The Indian rupee closed weaker against the US dollar on Thursday after one-day of strengthening, amid a rise in dollar index and crude oil prices.

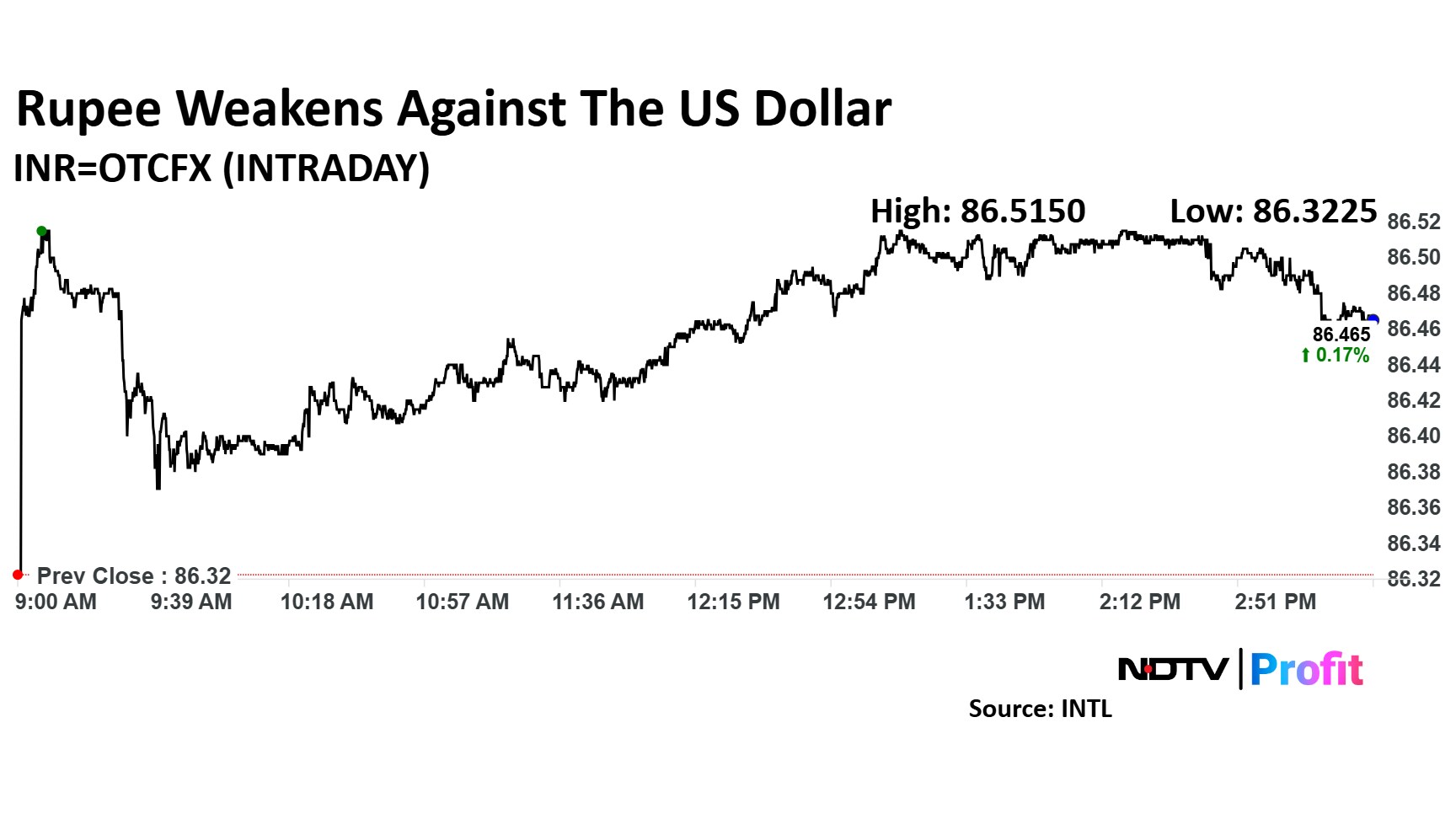

The domestic currency weakened by 14 paise to close at 86.47, against the US dollar, according to Bloomberg. It had closed at 86.33 on Wednesday.

At 3:04 p.m., the dollar index, which tracks the greenback's strength against six major currencies, was 0.15% higher at 108.33.

"Domestically, the Indian rupee traded within a narrow range but stayed elevated amid the uncertainty surrounding upcoming central bank meetings," said Amit Pabari, managing director of CR Forex Advisors. "Additionally, the Reserve Bank of India's proactive liquidity measures, including VRR auctions, have stabilised the market but may further pressure the rupee."

However, strong data points and expectations of lower borrowing costs for debt refinancing have left markets cautious ahead of the Jan. 28–29 Federal Reserve meeting, he added. "Moreover, trade tensions have eased slightly, with Trump announcing a 10% tariff on Chinese goods starting February 1 and a 25% tariff expected on imports from Mexico and Canada."

Traders now look forward to the outcome of US Federal Reserve's meeting due next week and they also assess Trump government's potential decision to impose 10% duty on China products.

"Conflicting White House statements regarding additional levies on Chinese imports create choppy market conditions," said Kunal Sodhani of Shinhan Bank. "Investors expect no immediate rate cuts from Fed in the first half of the year."

For USDINR, 86.25 acts as a support, while 86.60 a resistance, according to him.

"Indian rupee, which gained almost up to 86.32 yesterday, due to inflows from Vedanta and bond market inflows, is expected to open weaker at 86.47 this morning," said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors. The wide range is expected to be 86.20/60 for the day, he said.

March futures contract of both WTI crude and brent crude rose over 0.2% to $75.59 a barrel and $79.18 a barrel, respectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.