India's central bank considers recent weakness in the rupee as driven by speculative attacks and is prepared to continue its market intervention until the currency settles at a stronger level, a person familiar with the matter said.

The Reserve Bank of India (RBI) is selling dollars in both onshore and offshore markets after what it saw as speculative attacks by global fund managers on the rupee, the person familiar with the central bank's thinking said.

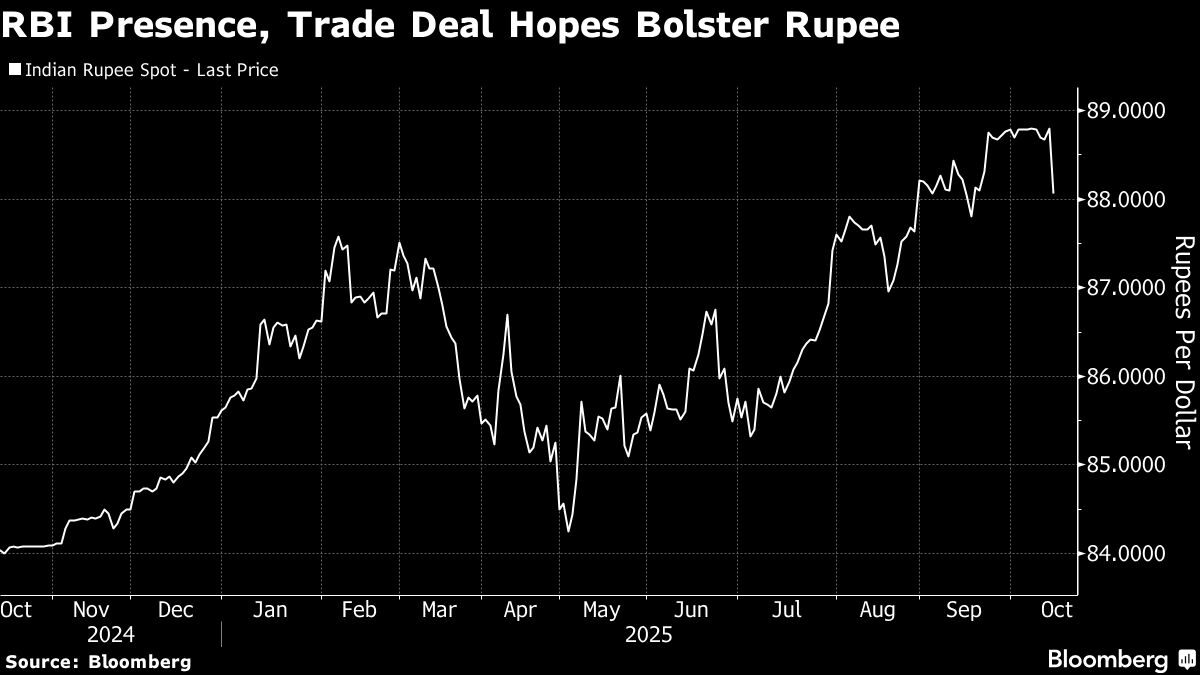

The RBI was alarmed to see the rupee nearing the 89 a dollar level in recent trading sessions, the person said, asking not to be identified when discussing internal matters. The central bank is unwilling to let the currency breach its record low of 88.8050 per dollar level anytime soon, the person said.

The currency rallied to 88.09 from 88.35 earlier in the session following the Bloomberg News report. It closed at 88.07, up 0.8% from the previous close. The gains were the most in nearly four months.

“Instead of having to expend reserves to maintain rupee at that level, the RBI may have taken an approach of crushing the speculative longs for once, making its stance clear,” said Abhishek Goenka, founder and chief executive of IFA Global.

The RBI will continue to intervene until it is satisfied that speculative positions have been unwound, the person said. A spokesman for the central bank didn't immediately respond to a request for further information.

The rupee has been hovering near record lows for weeks. On Wednesday, it surged almost 1% after the central bank went on the offensive following weeks of defending the currency, sparking speculation of a likely policy rethink.

The heavy intervention echoed a move in early February, when the authority sold billions of dollars, catching speculators betting against the rupee offguard. The rupee has largely flatlined over the past three weeks, with traders suggesting the RBI has been quietly acting to prevent it from sliding past the 89 to a dollar level.

If the rupee were to breach 89 to the dollar, that would take the currency into 90 territory, which is a psychological and technical level, the person said. RBI can't allow that to happen as the depreciation is owing to speculative attacks, and not because of economic fundamentals, the person said.

The currency's recent slide was owing to trade uncertainties between India and the US, but the central bank views this movement as overdone, the person said.

Even so, the central bank's active support brought back chatter about a possible shift in its currency management approach. Under Governor Sanjay Malhotra, the monetary authority has so far allowed the currency greater flexibility. His predecessor, Shaktikanta Das, had kept a tight grip on the rupee for nearly two years, curbing volatility relative to peers.

Wednesday's gain was partly fueled by optimism that New Delhi could conclude trade negotiations by next month, while a softer dollar on expectations of US Federal Reserve rate cuts gave the rupee an added boost.

There's growing optimism that India and the US are close to resolving their trade impasse sparked by President Donald Trump's 50% tariffs on Indian exports. Trump and Prime Minister Narendra Modi have spoken twice in recent weeks, and negotiators have resumed talks. An Indian team is in the US this week seeking to finalize a deal as early as next month, Bloomberg News reported Monday.

Despite the tariff uncertainty, the government is confident the economy will still expand more than 6.5% in the current fiscal year. Inflation is also under control, dropping below the 2% lower band of the RBI's target range this week, while the current account deficit at just about 1% of gross domestic product.

A clear sign that the rupee is under speculative attack is that emerging-market peers with weaker fundamentals — such as higher inflation and slower growth of 3%-4% — have more stable currencies, the person familiar with the matter said.

The RBI views the recent moves as market participants trying to test its resolve, the person said, noting that the central bank has ample firepower to defend any attack on the currency. India's $700 billion in foreign exchange reserves are the world's fourth largest.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.