The Reserve Bank of India is open to a flexible movement in the Indian rupee, and is not looking to control any levels of the domestic currency, sources told NDTV Profit on Tuesday.

The central bank has adequate reserves to control any excessive volatility, the persons privy to the development said.

The RBI, at present, is in a wait-and-watch mode ahead of Donald Trump taking charge of the US presidency, they added. Trump, who has promised wide-ranging import tariffs that may adversely impact global trade, will take charge of the White House on Jan. 20.

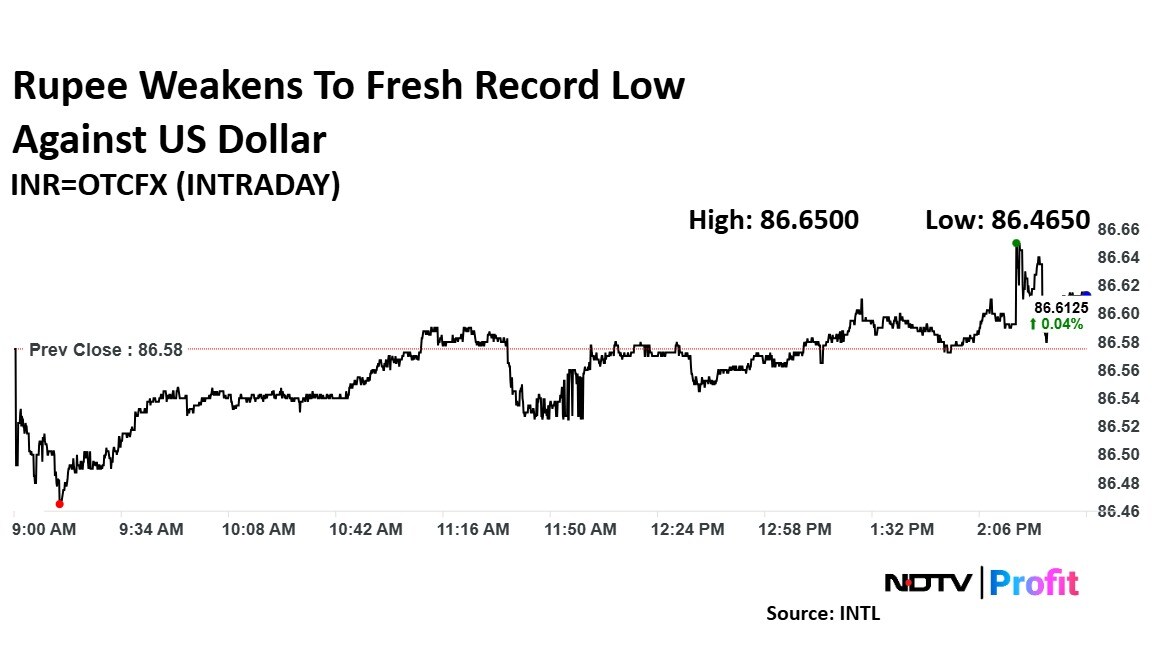

The news of RBI mulling over a flexible stance on the rupee came amid the local unit plunging to a new record low. The rupee weakened by 15 paise to a record low of 86.7 against the US dollar, and has slided by over 70 paise over the last two days.

Notably, the RBI witnessed a change in leadership last month with Shaktikanta Das demitting office after a six-year tenure. He was replaced with Sanjay Malhotra, a career bureaucrat who last served as the revenue secretary before taking charge as the central bank's governor.

The downward movement in rupee was seen among the areas of concern as the new RBI governor took charge.

The rupee is expected to touch 87 against the US dollar by the middle of 2025, but there can be an “overshoot” due to global developments, said Sonal Varma, the managing director and chief economist (India and Asia ex-Japan), while speaking to NDTV Profit.

According to Varma, the RBI has taken a shift in its foreign exchange management policy, letting the rupee to weaken.

“There seems to be some shift in the RBI's FX (foreign exchange) management strategy. So compared to the very heavy FX intervention, they are allowing the currency to weaken a bit more, which in our view is the right strategy,” she said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.