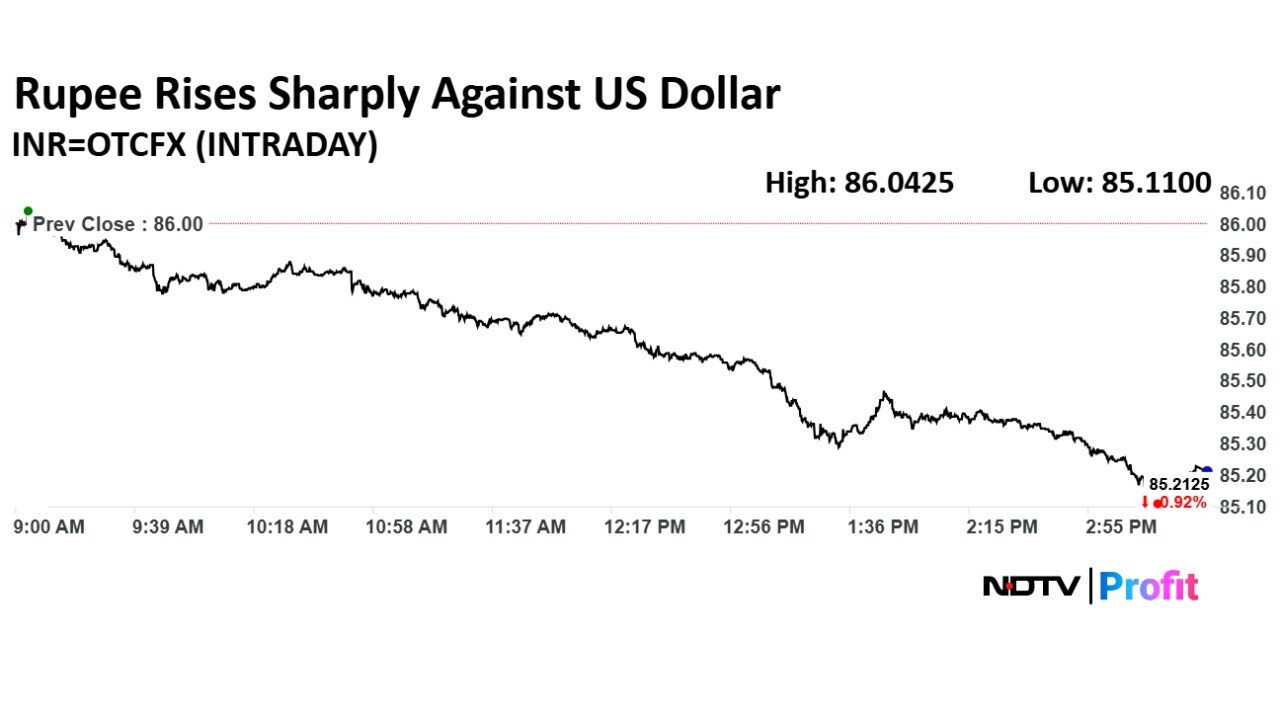

The Indian rupee strengthened by 79 paise to close at 85.22 against the US dollar on Friday, recovering from its previous close of 86.01 on Thursday. This significant appreciation comes amid various global and domestic economic factors influencing the currency markets.

Amit Pabari, managing director of CR Forex Advisors, provided insights into the factors affecting the rupee's performance. "FIIs continue their sell-off due to a narrowing bond yield differential, now at a two-decade low of just 164 basis points between Indian and US 10-year bonds," he explained.

Adding to the pressure, expectations of a record Reserve Bank of India surplus transfer to the government have pushed domestic bond yields lower, further compressing the yield differential that previously supported the rupee. "Additionally, speculation of an RBI rate cut in the upcoming MPC meeting, fueled by softening food and energy prices, is also weighing on short-term rupee sentiment, even though such a move may bolster growth in the longer term," Pabari noted.

On a positive note, India's economic indicators continue to show strength. "India Services PMI jumped to 61.2 in May—the fastest pace in 14 months. Manufacturing PMI ticked up to 58.3, both exceeding expectations and suggesting robust domestic momentum that could act as a tailwind for the currency," Pabari highlighted.

Moreover, the US House recently passed a sweeping tax-and-spend bill that adds $3.8 trillion to the US debt over the next decade, exacerbating fiscal concerns. "According to the CBO, the poorest 10% of Americans stand to lose while the top 10% gain, exposing policy divides that could affect global investor sentiment toward the dollar," Pabari added.

While the majority of Asian currencies have appreciated against the dollar, this trend might further support the rupee. "Despite its recent strength, the Dollar Index is showing signs of fatigue as mounting US fiscal concerns weigh on sentiment, potentially declining towards the 99.00 level, and possibly further to 98.50, which could provide relief to Asian currencies and offer near-term support to the Indian rupee," Pabari concluded.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.