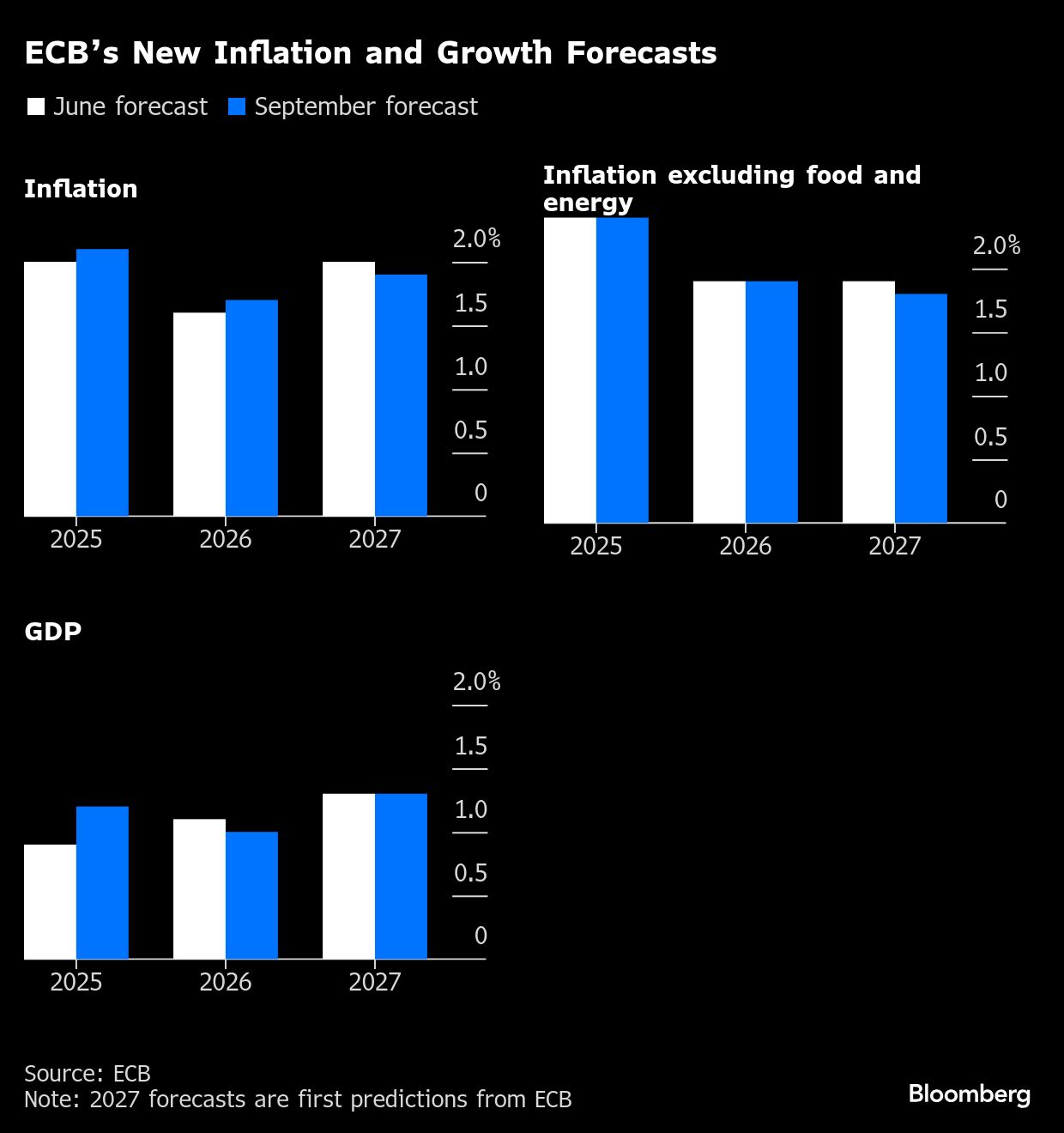

Christine Lagarde suggested the European Central Bank has circled in on its inflation target and expects the economy to pick up in 2026.

“Inflation remains close to our 2% target,” the ECB president said Monday, adding that underlying price pressures are also on track and that “wage growth will moderate further.”

Addressing told European Union lawmakers in Strasbourg, she said that “sluggish export performance, driven by higher tariffs, a stronger euro and increased global competition, is expected to hold growth back for the remainder of the year.”

“However, the effect these headwinds have on growth should fade next year,” she said. “Survey indicators suggest that services continue to grow, signaling some positive underlying momentum in the economy.”

Most policymakers including Lagarde herself have indicated some reluctance to lower borrowing costs further from the current 2% deposit rate, with inflation hovering around the 2% target, risks seen as quite contained in both directions and the economy so far resilient to shocks ranging from trade to wars.

“When I look at my inflation outlook, at the balance of risks, when I look at the underlying inflation, when I look at the transmission, we are in a good place, as I have said repeatedly,” the ECB president said. “So the disinflationary process is over, we are in a good place, and we intend to stay in that good place and to do what is required to stay in that good place.”

Lagarde reiterated the official ECB line that officials will take their decision based on data as they arrive and don't precommit to any future moves.

Vice President Luis de Guindos and Chief Economist Philip Lane argued earlier on Monday that there's no need to cut rates further at this time. Still, the latter described the potential choice for policymakers to being between staying on hold and continuing to ease.

Bank of France Governor Francois Villeroy de Galhau has insisted that another rate reduction can't be ruled out. Fresh political turmoil in France after the unexpected resignation of Prime Minister Sebastien Lecornu on Monday is adding to economic headwinds.

Turning to the euro, Lagarde doubled down on the chance raise the common currency's global position at a time of geopolitical shifts and heightened policy uncertainty.

“In this changing landscape, there is a unique opportunity to create conditions to strengthen the euro's role on the global stage,” she said, adding that this “would bring tangible benefits.”

US protectionism and President Donald Trump's defiance of international cooperation is feeding doubts about the dollar as a safe-haven currency. European officials have identified such concerns as a chance for their own currency. In May, Lagarde talked about a “global euro moment,” but not much has happened since to strengthen Europe's foundation.

Villeroy has been among those pushing to increase the global role of the euro, including by increasing the issuance of safe assets. Efforts to introduce a digital version of the European currency could also increase its appeal.

“The euro can be more than the currency of a continent and a symbol of unity — it can become a global anchor of trust,” Lagarde said. “But vision alone is not enough. Europe needs bold reforms to turn this vision into reality. Now is no longer the time to just discuss reforms; now is the time to implement them.”

Joint Debt

Lagarde also raised the prospect of common EU debt, a suggestion raised in Mario Draghi's 2024 report on increasing European competitiveness.

“Additional steps like joint financing of public goods – such as defense – would help establish a safe and liquid pool of EU public debt,” she said.

Common borrowing by the EU's 27 members was among the main recommendations put forward by Draghi, though it remains a controversial topic, with nations including Germany broadly opposed.

“The time has come to put words into action,” she said, referring to the package of proposals in the Draghi report.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.