- Reserve Bank of India urges banks to reduce fees on debit cards and late payments

- Banks generate significant revenue from fees on retail lending and consumer products

- RBI focuses on fees affecting low-income customers without setting specific charge limits

India's central bank is pushing lenders to lower fees for some consumer products, according to people familiar with the matter, a drive that may jeopardize the billions of dollars banks in the country get from fees.

Reserve Bank of India officials have conveyed to banks in recent weeks that it wants a reduction in service charges — including those for debit cards, minimum balance violations and late payments, the people said, asking not to be identified discussing private interactions. The RBI, which regulates the lenders, didn't reply to requests for comment.

The move follows a renewed drive among India's banks in recent years into retail lending, part of a way to diversify after many were burnt during a cycle of souring corporate loans. Growth in areas such as personal loans, financing for cars and smaller businesses has made the retail market lucrative for banks, while at the same time it had caught the eye of a watchdog concerned about the pace of expansion.

The central bank is particularly mindful of fees that disproportionately impact low-income customers in the world's most populous country, the people said. The RBI hasn't prescribed any specific range on charges, they said, leaving it to the discretion of banks, they said.

There are no mandated thresholds on bank surcharges. Processing fees for retail and small business loans typically range from 0.5% to 2.5%, with some banks capping home loan charges at 25,000 rupees ($285), according to data compiled by BankBazaar, an online financial marketplace.

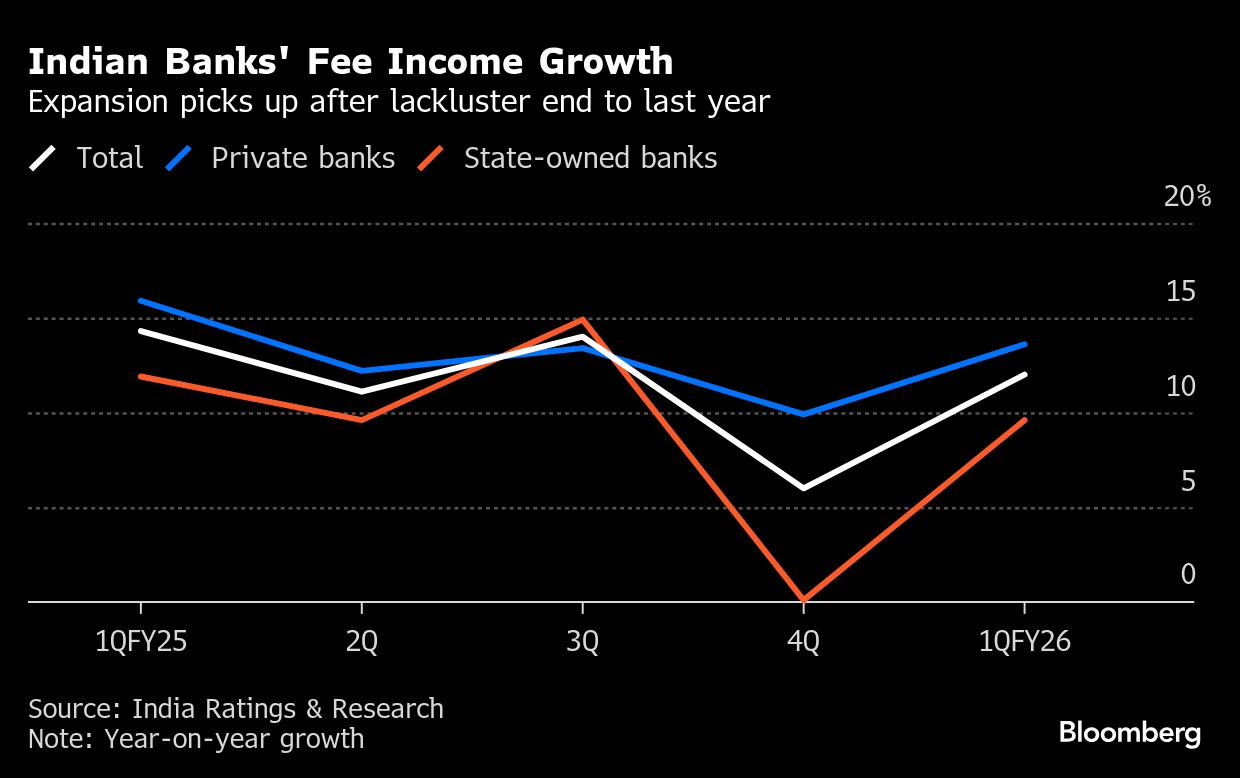

Fee income at Indian banks has shown early signs of rebounding this financial year following a period of slower growth. In the quarter that ended in June, the metric rose 12% to about 510.6 billion rupees from the prior year, and up from 6% in the previous three months, according to data from India Ratings & Research.

The Indian Banks' Association is also in discussions with banks over more than 100 retail products which could be in the RBI's sights, said the people. The wide disparity in fees paid by different customers for the same products has also attracted the central bank's attention, they said.

The industry lobby group didn't reply to requests for comment.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.