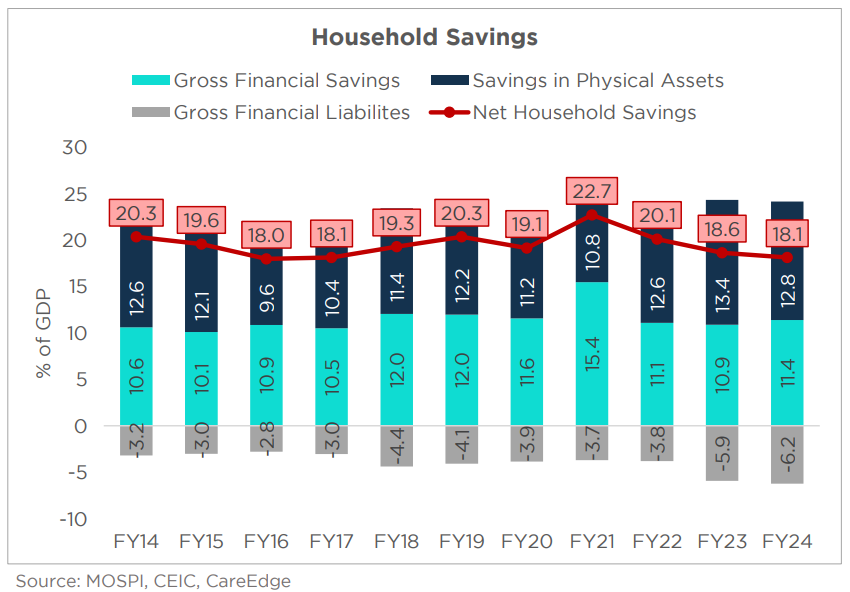

Indian households are now saving their lowest in nearly seven years, while their debt has doubled in the last 10 years. Consumer confidence among Indians living in rural areas, though, is at its highest since March 2024.

According to a report by CareEdge Ratings, net household savings is at 18.1% of gross domestic product in fiscal 2024, lowest since FY17. This is the third consecutive year when household savings have fallen. Financial savings at 11.4% are at their highest since FY21.

Financial liabilities, due to higher debt, have risen to 6.2% in FY24, compared to 3.2% in FY14.

The trend is characteristic of a developed economy and is currently not particularly alarming, said Rajani Sinha, chief economist at CareEdge.

The Reserve Bank of India has taken measures to contain household liabilities and ensure no financial bubble, but, this trend is here to stay, according to Sinha. The current generation of Indians like to indulge in discretionary spending such as holidays or gadgets, she explained. As such, while the trend will likely continue, it is likely driven by a small section of the population, and what needs to be watched out for is the lack of real wage growth, she cautioned.

That said,key consumption drivers and monitorables remain factors like rural demand.

Data collated by CareEdge shows that rural household confidence remained firmly in the optimistic range, while urban confidence was still pessimistic. This is because rural household income seems to be growing faster than inflation. Favourable agricultural prospects, easing food inflation and upbeat rural wage growth have aided the rural demand scenario.

The simple average wage rate for all rural occupations (men) increased by 6.1% year-on-year in February, consistently outpacing the rural inflation for four consecutive months.

In terms of future expectations, rural and urban consumers were optimistic, with rural confidence remaining higher, the data showed.

"Going ahead, RBI policy rate cuts, lower tax burden and continued easing of price pressures remain key tailwinds for the broad-based demand recovery," the CareEdge report said.

On June 6, the monetary policy committee voted to bring down the benchmark repo rate by 50 basis points to 5.25%. RBI Governor Sanjay Malhotra, however, noted that room for future rate cuts remains limited.

Overall investment scenario in the country remained positive, with centre's capital expenditure rising to Rs 10.5 lakh crore in fiscal 2025, higher than the previously estimated Rs 10.2 lakh crore.

"Investment announcements continued to be driven by the private sector, while the government led the investment completions," the report said.

Last week, Adani Group announced a $100-billion capex plan over the next six years, the highest by any corporate in India. The spending would be across three key areas, including energy and infrastructure, construction materials and mining and metals.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.