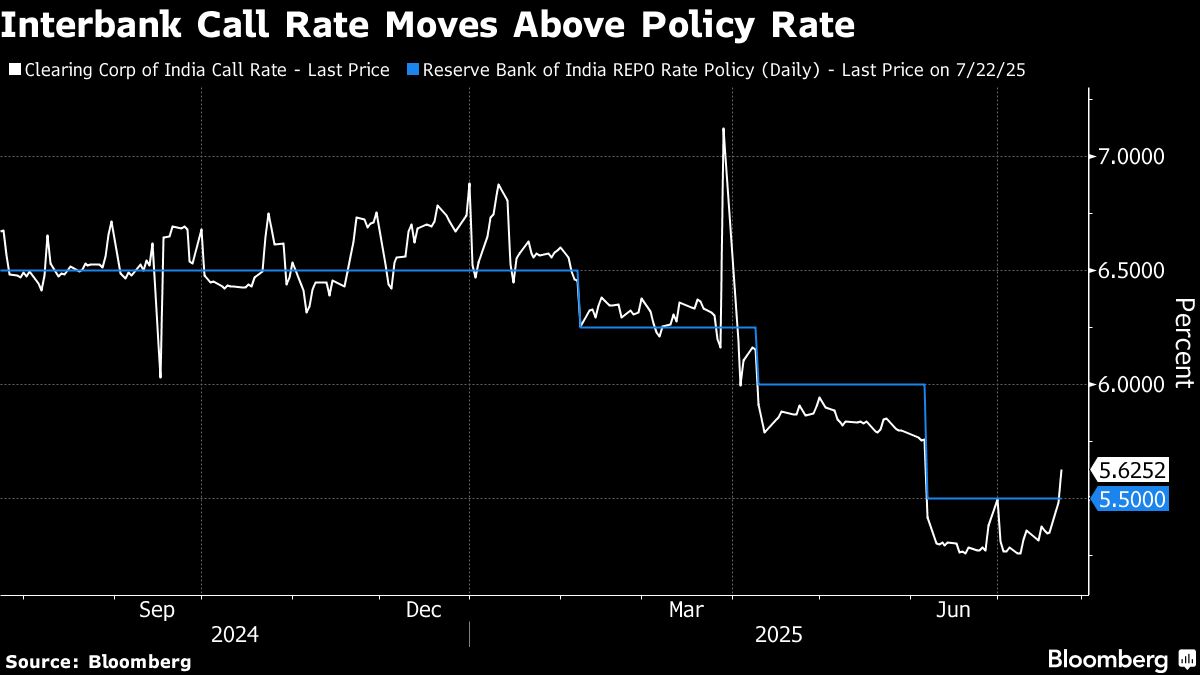

- Weighted average call rate rose to 5.81%, exceeding the RBI policy rate of 5.5% on Wednesday

- Tri-party repo rates increased to 5.73%, continuing a sharp rise from the previous day

- Monthly GST outflows caused banks to reduce participation in RBI's variable rate reverse repo auction

India's overnight rates have risen above the central bank's key policy rate, driven by monthly tax outflows, which could result in weakened participation at the central bank's next liquidity absorption auction.

The weighted average call rate — a key gauge the Reserve Bank of India uses to guide monetary policy — climbed to 5.81% on Wednesday, surging above the policy rate of 5.5%. Rates in the secured lending market also jumped, with the tri-party repo — a common funding instrument — trading at 5.73% on Wednesday. That extends a sharp rise on Tuesday, when the call rate settled above the key rate for the first time since March.

“It seems that banks tendered very aggressively at the last variable rate reverse repurchase operation and once the GST outflows hit the system, they were left with a situation they did not envisage,” said Abhishek Upadhyay, an economist at ICICI Securities Primary Dealership Ltd. “Banks will be much more circumspect about parking money at the next VRRR auction,” he said, referring to the RBI's cash withdrawal steps.

The latest spike adds to several instances in recent years where funding rates have diverged from the RBI's policy rate. These fluctuations often stem from temporary shortages or surpluses of cash, which are harder to manage in the age of digital banking where customers can move funds around the clock. The central bank is crafting a new model for managing banking system cash, as it aims to ensure stability in funding markets.

Read More: RBI's Liquidity Framework Report Likely End-July, Governor Says

The current episode has been amplified by around two trillion rupees parked with the RBI until Friday through a seven-day variable rate reverse repurchase auction, according to DBS Bank Ltd. In such auctions, the central bank soaks up cash from banks in exchange for securities.

Surplus liquidity, measured by excess cash banks park with the RBI, was at 2.2 trillion rupees ($26 billion) as on July 22, lower than 3.9 trillion rupees on Friday, according to a Bloomberg Economics index.

Bond traders plan to seek more clarity from the central bank on the level of surplus liquidity it considers appropriate, following its recent cash-draining operations, Bloomberg News reported Tuesday, citing people familiar with the matter. The RBI's next policy meeting is due on Aug. 6.

“The RBI will likely continue to offer the VRRR auction, though likely reduce the size,” said Nathan Sribalasundaram, a rates strategist at Nomura Holdings Inc. “Banks are likely to be a little more cautious this time around.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.