Shares of consumption sector companies such as Hindustan Unilever Ltd., Colgate Palmolve India Ltd. and Dabur India Ltd. after the Goods and Services Tax Council slashed rates on an array of food items, including packaged namkeens, instant noodles, chocolates, and coffee, from either 12% or 18% to a uniform 5%.

This tax rationalisation is expected to directly enhance the affordability of daily essentials and stimulate consumer demand, particularly in rural and semi-urban markets.

Goldman Sachs and UBS believe the GST cut will be a major positive catalyst for the FMCG sector, predicting an overall boost to consumption, a potential shift of market share from unbranded to branded products, and accelerated volume growth for companies.

Following this optimistic outlook, analysts at Morgan Stanley and UBS have identified specific stocks as clear beneficiaries, highlighting companies like Britannia, Nestle India, Dabur, Colgate, and Hindustan Unilever as poised for significant gains.

HUL, Nestle Share Price

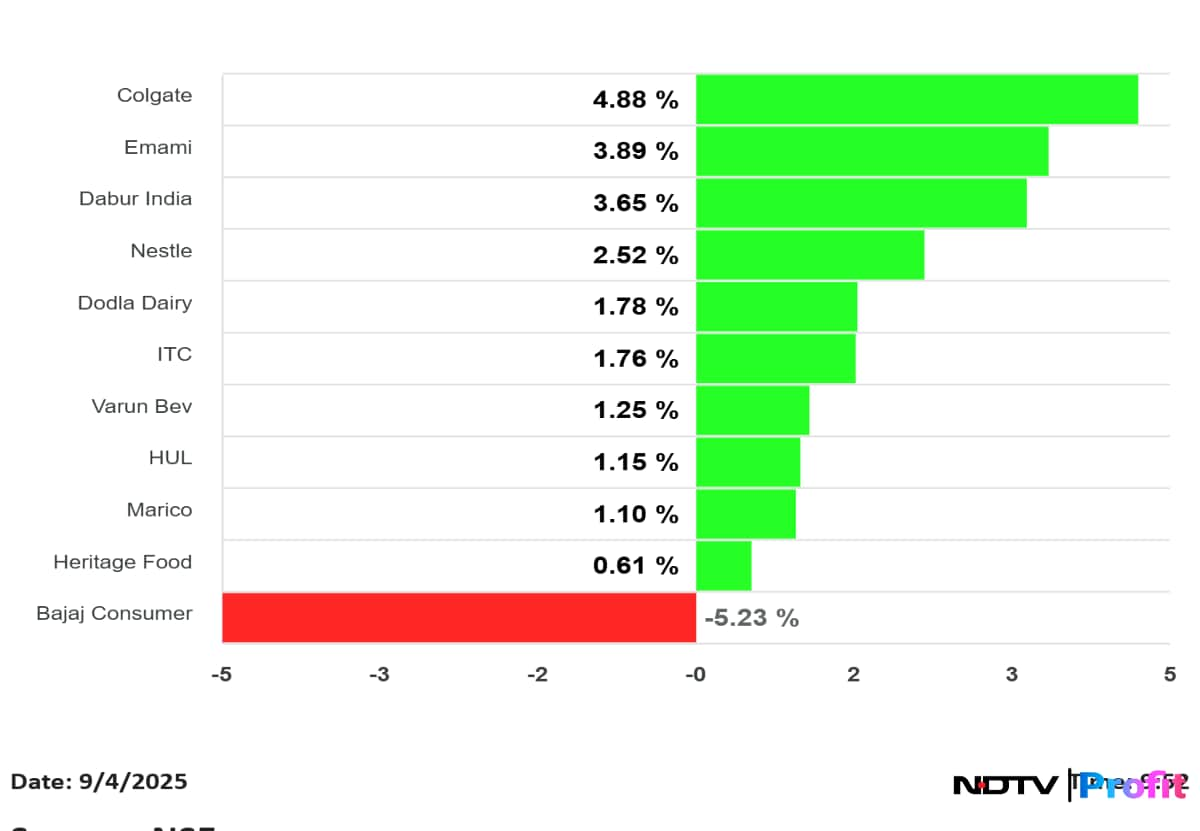

Majority of the FMCG players are trading in the green with names like Emami, Colgate and Dabur leading gains. FMCG giants like Nestle and HUL have also marked gains of over 2% during trade so far. The only player trading in red was Bajaj Consumer.

While the sentiments in the broader sector is upbeat, Jefferies has noted that for a stock like ITC, which has a significant cigarette business, the market is awaiting clarity on the future of the compensation cess.

This could be a key factor influencing its stock performance. Despite the uncertainty, the shares of ITC are also trading higher in trade so far.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.