Expectations are set for two things from this week's Federal Reserve meeting: Officials will lower rates by a quarter percentage point and Chair Jerome Powell will offer little guidance as a growing divide among policymakers blurs the path ahead.

Powell signaled earlier this month the Federal Open Market Committee remained focused on threats to the labor market. Then, a delayed inflation report published last week came in softer than expected, likely keeping the Fed's inflation hawks at bay for now.

“The labor data continues to play a larger role in the debate,” said Krishna Guha, head of global policy and central bank strategy at Evercore ISI. As long as officials are comfortable with inflation expectations and the level of price pressures from wages and services, he said, Powell can stay focused on employment and “moving the Fed back to a neutral policy stance.”

The central bank's rate decision will be published at 2 p.m. Wednesday in Washington, alongside a statement from the committee. Powell will hold a press conference 30 minutes later. The committee won't release new forecasts, nor rate projections, at this meeting.

Federal funds futures indicate investors see a quarter-point cut as nearly a certainty.

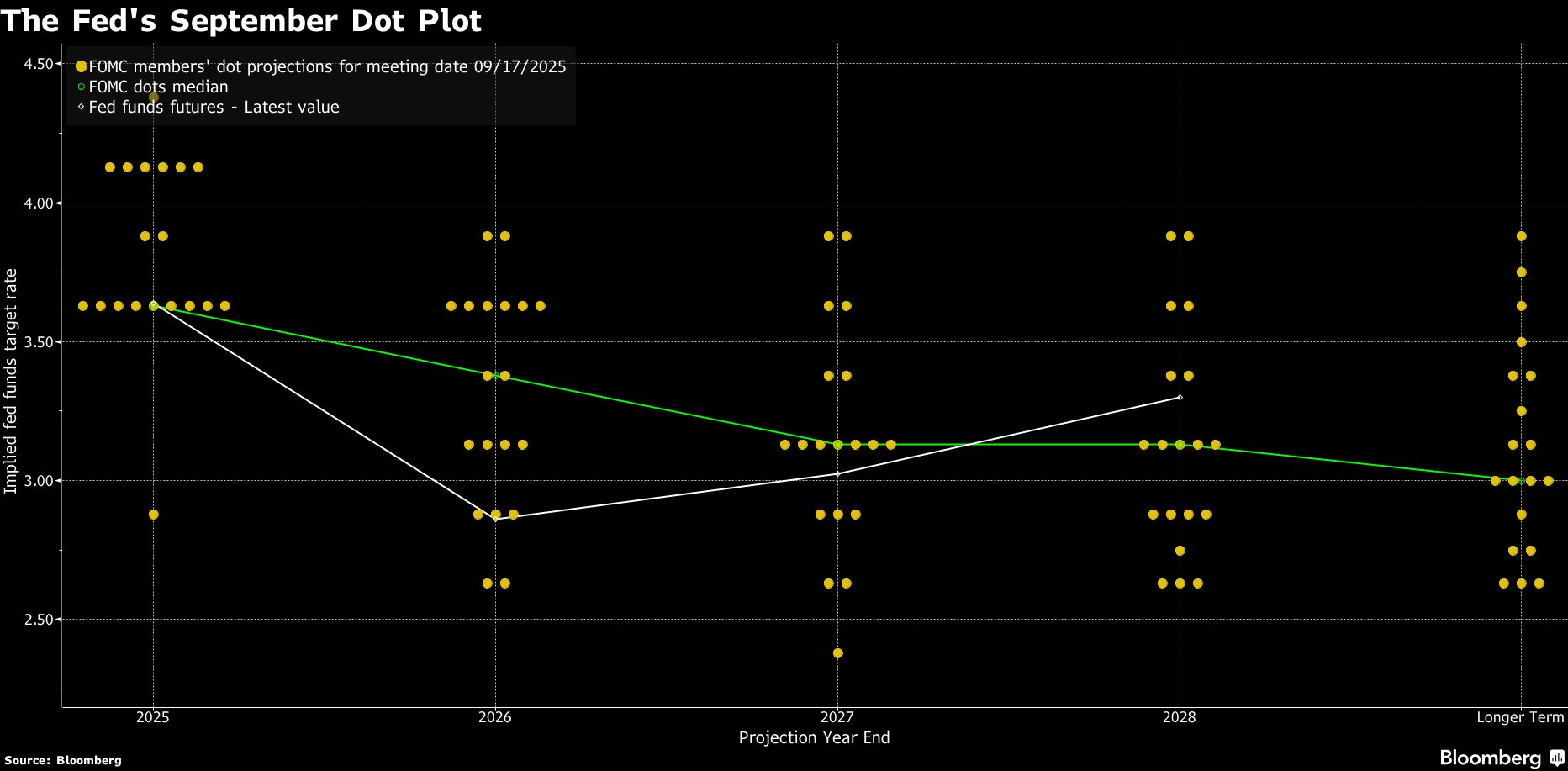

The high likelihood of a rate cut, however, doesn't mean policymakers are anywhere near united in how they view the outlook for rates. A large minority, while acknowledging risks to the job market, have continued to voice concerns about inflation.

The consumer price index rose by less than expected in September, but the core measure — which is considered a better guide to inflation's underlying trend — rose by 3% year over year, a full percentage point above target.

Some officials also point to stubbornly high price increases in segments of the economy, like services, that should be less affected by tariffs. Moreover, recent threats of new levies against China and Canada have introduced new uncertainties about prices and the economic outlook.

As a result, the committee could prove even more divided now than it was in September, when nine members favored no more than one additional cut this year.

Against that backdrop, analysts expect Powell to avoid offering clear guidance on what to expect at upcoming meetings. The lack of official economic data — due to the ongoing government shutdown — will only make him more cautious.

“The hope is that eventually the incoming data helps to bridge the gap between the two camps,” said Matthew Luzzetti, chief US economist at Deutsche Bank Securities Inc. But as long as the divide persists, he added, Powell will provide “very little signal about December or beyond.”

Fed Governor Stephen Miran, appointed by President Donald Trump to a seat that reopens in February, has signaled he will dissent again in favor of a half-point reduction. Among the remaining voters, Kansas City Fed President Jeff Schmid is seen as a potential dissenter in favor of leaving rates unchanged.

Balance Sheet

Fed watchers also see a growing chance the committee will halt the runoff of Treasury securities from its $6.6 trillion balance sheet at this meeting. Officials have for many months been seeking to shrink their portfolio as much as possible without draining too much liquidity from overnight funding markets.

Powell said earlier this month the central bank may reach that level in the coming months, but money markets have been showing signs of stress in recent weeks.

“Right now, we're playing a bit with that line between volatility and stress,” said Guneet Dhingra, head of US rates at BNP Paribas. “The risk-management aspect of this, I think, is very clearly suggesting that they need to seriously consider ending” the runoff.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.