- Perpetual swaps enable 24-7 trading of stock derivatives using crypto collateral without ownership rights

- These derivatives mimic equity indices like Nasdaq 100, offering up to 100x leverage and no expiration

- US regulations currently prohibit these products, placing them in a legal grey area for domestic traders

A product born in crypto's most fevered era is being quietly rebuilt for the US stock market — trading 24-7, with no brokers and no closing bell.

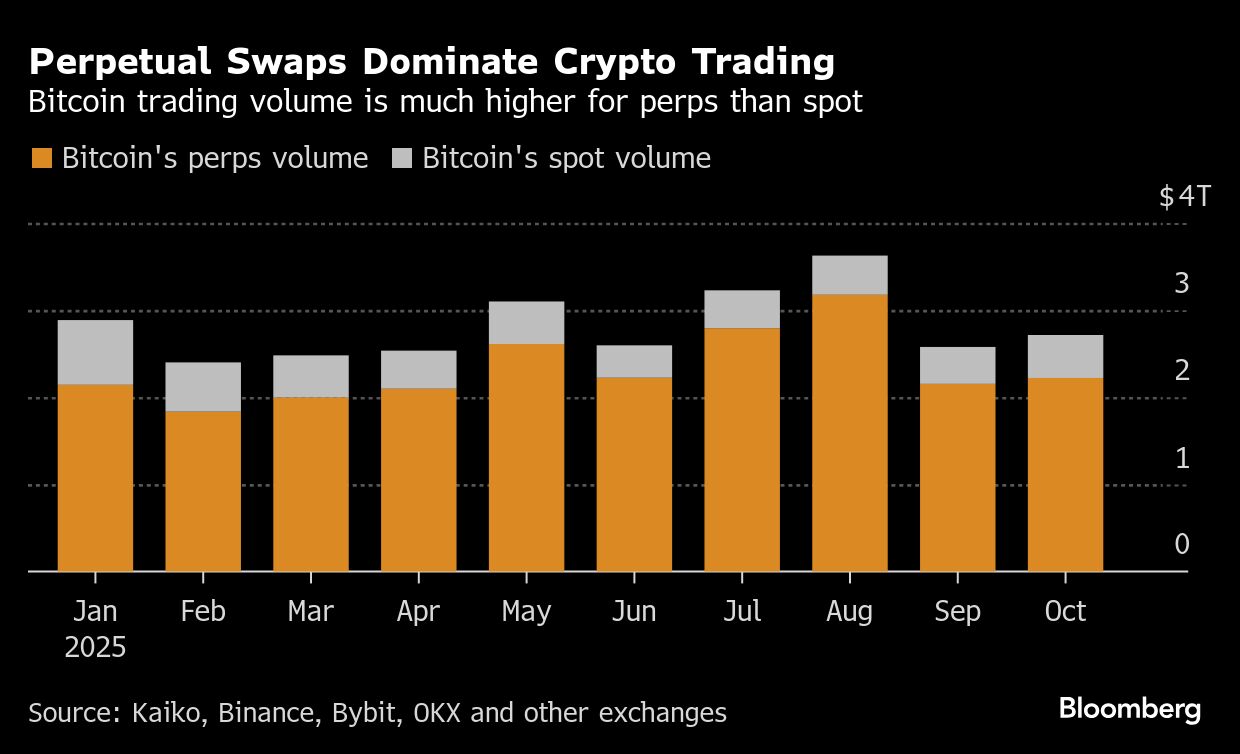

The perpetual swap, or perp, is a derivative that lets traders take long or short positions on a digital asset's price, without ever owning it. In crypto, perps have reshaped trading, becoming a multi-trillion-dollar engine of leverage and liquidity, where positions can run as high as 100-to-1 and never expire.

Now developers are extending that model to traditional assets and benchmarks, including Nasdaq 100, Tesla Inc., and Coinbase Global Inc., and more. Think of it as fantasy sports for equities: traders bet on where a stock or index will go, using crypto as collateral — bypassing Wall Street's investment ecosystem altogether.

The offerings, which are gaining momentum despite past blowups and regulatory strain, are technically off-limits to US users because no domestic framework currently permits them. On the Hyperliquid blockchain — known for its fast-growing namesake exchange — a Nasdaq-linked contract known as XYZ100 has already drawn as much as more than $60 million in open interest.

Wall Street is already paying attention. The likes of Jane Street are backing Vest Labs, which is building a venue for global equity perp trading.

Crypto exchanges “are realizing that equities are much better tradable asset at least in the current economy,” said Justin Ma, CEO of Vest Labs. “I really want this to be a venue for 24-7 price discovery for US companies as well as something that's fully accessible for investors all around the world.”

The experiment captures two defining forces in today's markets: unstoppable retail speculation, and crypto's drive to rebuild finance in its own image. While big institutions cautiously pilot the likes of tokenized Treasuries, digital-asset developers are reviving the experiments that defined the industry's early boom — from perpetual swaps to prediction markets — with bets that are fast-moving, lightly regulated, and wired for volatility.

Here's how it works: A trader posts crypto collateral — typically the USDC stablecoin — and opens a long or short position on, say, the Nasdaq 100. They're not buying actual shares; they're entering a smart contract that tracks the index's price using external data feeds. If the trade goes their way, they earn the difference. If it moves against them, their position is typically auto-liquidated once their margin runs out. A dynamic fee — the funding rate — balances demand between longs and shorts, so the price of the perp stays tethered to the real-world asset.

Platforms can lean on price oracles and market makers to model stock moves when markets close – a fragile but functional, for now, setup.

“Perps were uniquely suited for nascent, speculative crypto markets as the structure allowed for outsized leverage with an objective, fair and self‑regulating funding mechanism in continuous 24-7 markets,” said Darius Sit, founder of crypto investment firm QCP.

It echoes a broader race toward 24-7 markets. Traditional markets are inching that way. Cboe has proposed longer option sessions, and brokerages already offer extended access on alternative venues. The crypto version goes further: nonstop stock bets without Wall Street's machinery.

Whether these contracts truly track the stocks is debatable. Whether they grant rights — dividends, votes, ownership — is not. They don't.

Risky Business

When markets close, the funding rate becomes the pulse: bullish weekends push it positive and prices drift up; fear flips it. It works, mostly, while markets are open. After-hours is murkier. Ostium, one of the perps platforms for equity and other assets, pauses trading when stocks stop; Others, such as the ones on Hyperliquid, don't. They model underlying equity prices while exchanges sleep, keeping liquidity alive but risking distortion.

“This structure enables perpetual-futures protocols to serve as natural venues for price discovery when primary markets are offline,” said Wyatt Raich, a former BlackRock executive, who is starting a new equity derivatives platform.

Kaledora Fontana Kiernan-Linn, co-founder of Ostium, said letting markets run while stocks are closed creates risks that outweigh the benefits, citing examples like sudden tariff announcements or surprise earnings-related announcements.

“You can get wicked out on the weekend of someone's moves of a massive order,” she said. “You might suddenly have all of your position being completely eroded by funding, like unpredictable things can happen when no one else can hedge.”

For many traders, though, that volatility is the point. US rules cap equity margin at roughly three-times leverage. Perps offer 10X, 50X, even 100X, with commensurate risk.

“One of the biggest trends in retail financial products in the US is the rise of demand for leverage,” said Tom Schmidt, general partner at venture capital firm Dragonfly. “The DTCC effectively limits leverage on US equities through traditional margin lending to 3X, but there's clearly demand for more than that.”

There's just one problem: they're not legal in the US. Perps sit in a legal no‑man's‑land. They behave like futures, mimic securities, and run on crypto infrastructure.

Michael Marcantonio, head of decentralized finance at Galaxy Digital, calls it “the holy trinity of regulation.” Such contracts, he noted, would be overseen by the Securities and Exchange Commission, the Commodity Futures Trading Commission and the Derivatives Clearing Organizations. And under current US law, approved futures must have a defined expiration date. That's why these products still block US users — though most run directly on blockchains, meaning anyone determined enough can still find a way in.

Precedent is discouraging. In 2021, the SEC subpoenaed Terra's Do Kwon over Mirror Protocol's synthetic stocks. Still, there are signs of openness. In September this year, the SEC and CFTC proposed a joint pilot for novel market structures. And under the crypto-friendly Trump administration, hopes have risen that US access to these products may follow. Coinbase has already introduced regulated Bitcoin and Ether perps for US traders.

“The SEC continues to be deliberate in their efforts to find a path to the US market for innovative products,” said Ryne Miller, a partner at Lowenstein Sandler and former general counsel at FTX US, who adds that incoming CFTC chair Michael Selig may also look for ways in.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.