- Bitcoin miners face unprofitability as hash price hits a record low recently

- Network hashrate dropped 8% as miners underclock machines to save power

- Miners pivot to AI and high-performance computing amid tough mining conditions

The crypto downturn has pushed a slew of Bitcoin miners to the brink of unprofitability, prompting operators to scale back the energy-hungry machines that keep the blockchain running.

A closely watched measure of mining revenue known as the hash price recently touched a record low, according to Hashrate Index. The median cost to mine - including overhead investment and financial expenses - remains above that level, meaning that total expenses are greater than revenue for most of the publicly-traded miners they track, according to industry publication and data provider TheMinerMag.

“As hash price falls, we have seen almost a 8% drop in network hashrate, this is a result of miners using firmware to underclock their machines to save power,” said Ethan Vera, chief operating officer at mining services provider Luxor Technology, which trades used rigs.

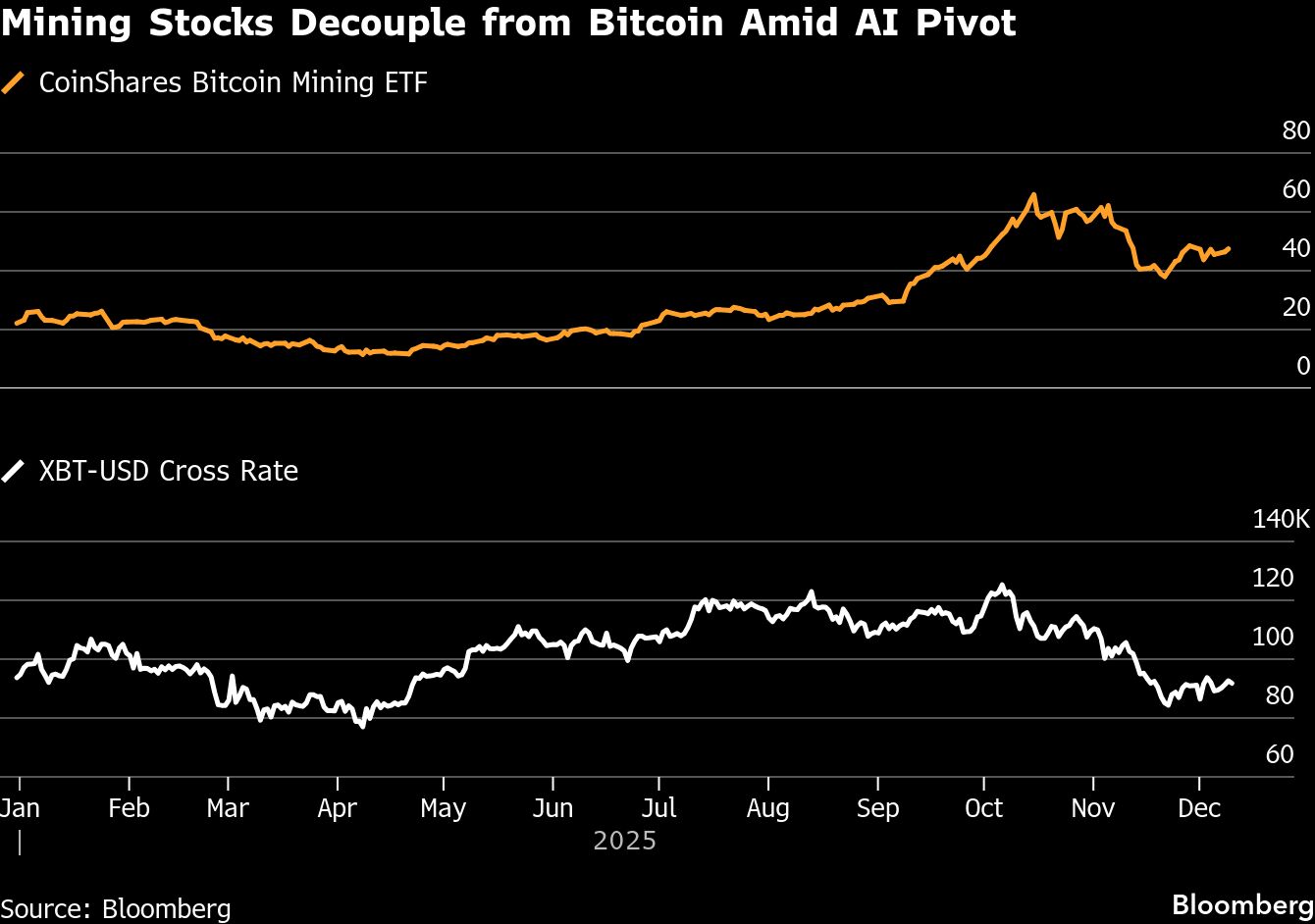

The downturn highlights the ultracompetitive business conditions resulting from a once-every-four-years event that cuts in half the so-called mining reward, which is the amount of Bitcoin released from the network to compensate companies for processing transactions. The last “halving” was in April 2024. It also validates the pivot by many of them toward hybrid models built around artificial intelligence and high-performance computing that have made the shares of the companies among the best market performers this year.

While a cohort of miner-turned AI infrastructure companies have drawn tens of billions of dollars to build out high-tier data centers, Bitcoin mining still remains their largest revenue stream. Core Scientific Inc. and Terawulf Inc. derived just about 21% and 14% of their third-quarter revenue from the high-performance compute services, respectively. IREN Ltd., which has seen its shares surge more than fourfold this year, gets just 3% of revenue from HPC, TheMinerMag estimates.

The break-even price for 14 publicly-traded miners has climbed about 20% from a mean of about $90,000 per Bitcoin in the third quarter, according to TheMinerMag. That would leave most miners in the red with the price of Bitcoin now lower, the firm estimated. Bitcoin's average price is around $104,000 so far in the fourth quarter, down from about $114,000 in the previous three months. Bitcoin traded at around $92,000 on Wednesday.

“Investors that are piling in or had piled in to these companies over the most recent months are mainly concerned about the AI business, with very little interest for their Bitcoin mining operations.” said Mike Colonnese, managing director of equity research at HC Wainwright & Co. “You will see some of the group unplug their mining machines and put up AI data centers. You are going to see a lot of that over the coming years.”

The decoupling between the stock prices and Bitcoin has deepened over the last several months with top miners converting existing computing facilities for minting digital tokens into data centers supporting AI applications. Core Scientific, Terawulf, IREN and Cipher Mining Inc. have signed multi-year contracts with hyperscalers such as Alphabet Inc.'s Google and Microsoft Corp., which are projected to generate billions of dollars in revenue.

“There has been a fundamental shift in Bitcoin mining as many major players exit the sector,” TheMinerMag's analyst Wolfie Zhao said.

Last month, Bitfarms Ltd. unveiled plan to unwind its Bitcoin mining business over the next few years as it focuses on building out AI data centers. Meanwhile, other firms that tended to be aggressive on operational expansion , have yet to announce new growth targets. The share of computing power to mine Bitcoin from US-listed miners has shrunk recently as private operators and miners outside the country ramp up production, Zhao said.

“It is the companies with smaller balance sheets and a lot of debt that will struggle the most.” Luxor's Vera said. “It is going to be a pretty grim Q4 for a lot of miners and it is even worse if you include their GPU businesses, which hasn't made any revenue yet.”

Bitcoin mining turned from a cottage industry to be a multibillion dollar sector amid the last crypto bull market in early 2021, when public companies rushed to buy expensive specialized computers, build data centers and secure large amounts of energy across the US. Miners have tapped into some of the same assets to kick start the construction of AI data centers whereas others have to build from scratch.

The AI boom has emerged as a way out for many firms with mining economics deteriorating drastically every four years because of the halving. More than 95% of the 21 million Bitcoin that will ever be created have been minted already. Miners will earn transaction fees instead of new Bitcoin once the finite amount is expected to be reach in the year 2140 or so.

“There is only a finite amount of Bitcoin to be mined,” Zhao said. “Unless Bitcoin prices go to the moon, AI demand seems to be a better bet since that is a much bigger pie to begin with.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.