Bitcoin and Ether are both trading within a whisker of all-time highs as investors pile into the two largest cryptocurrencies, with a recent wave of demand tilting in favor of the latter.

As of early morning in New York, Bitcoin traded above $120,600 on Wednesday, leaving it about 2% below its July peak. Ether, meanwhile, has shaken off a prolonged spell of underperformance, and is now just 3% shy of its 2021 bull market record. The second-largest token has led a surge that pushed total crypto market capitalization to a record $4.2 trillion, according to data compiled by CoinGecko.

The rally in Ether has been fueled by record inflows into funds directly investing in the token and a growing number of so-called Ether-focused treasury firms — public companies modeled after Michael Saylor's Bitcoin accumulation strategy. These entities have collectively absorbed nearly $17 billion worth of Ether, according to data compiled by StrategicEthReserve.xyz.

180 Life Sciences Corp., which conducts business under the name ETHZilla, is extending share price gains on Wednesday, rising more than 50% in premarket trading. The biotechnology turned Ethereum treasury company, backed by billionaire Peter Thiel, rose more than 200% on Tuesday after announcing that it holds 82,186 Ether tokens.

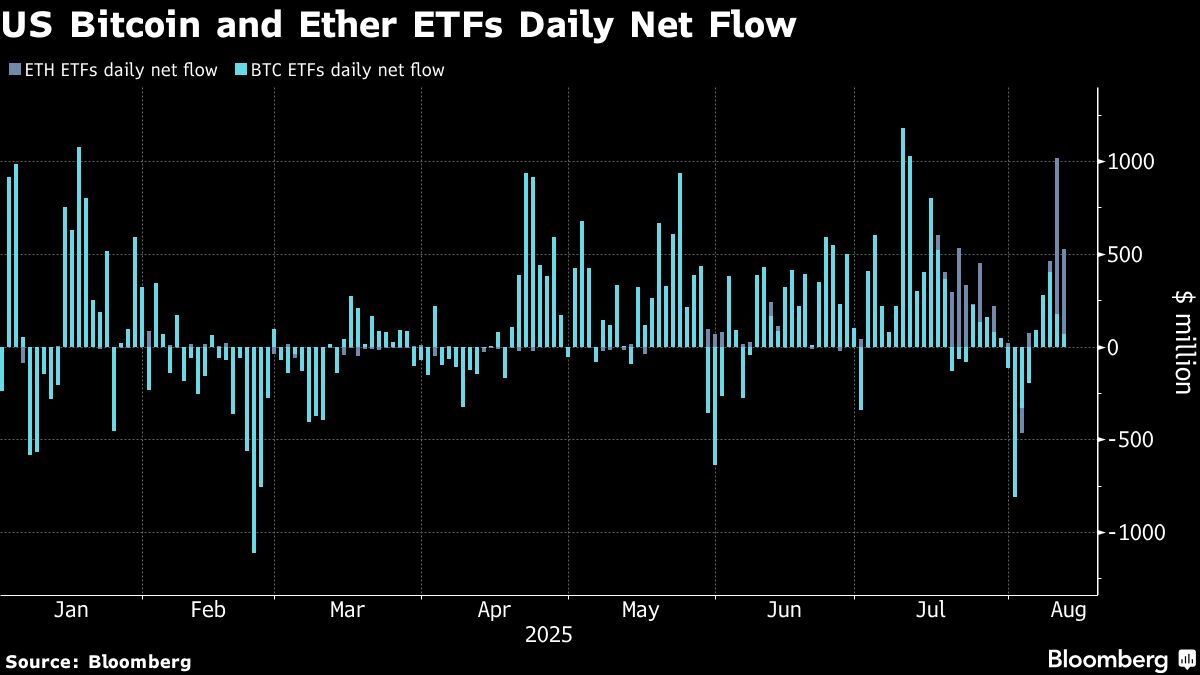

In August, US spot Ether ETFs have attracted more than $1.7 billion in net inflows, while Bitcoin funds saw $436 million in outflows, according to data compiled by Bloomberg. On Tuesday, for the first time since their launch, the nine US spot Ether ETFs posted more trading activity than their dozen Bitcoin counterparts. Open interest in Ether futures across exchanges also climbed to a record $66 billion, Coinglass data show.

“The July passage of the US GENIUS Act, which clears the way for mainstream adoption of stablecoins, is a pivotal change,” Geoff Kendrick, global head of digital assets research at Standard Chartered wrote in a Wednesday report. “Stablecoins account for 40% of all blockchain fees today, and more than 50% of stablecoins sit on Ethereum. The GENIUS Act should indirectly boost Ethereum's layer one activity as increased stablecoin liquidity leads to more decentralized finance (DeFi) activity, where ETH dominates.”

Standard Chartered now sees Ether hitting $7,500 by the end of 2025, up from a previous $4,000 target.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.