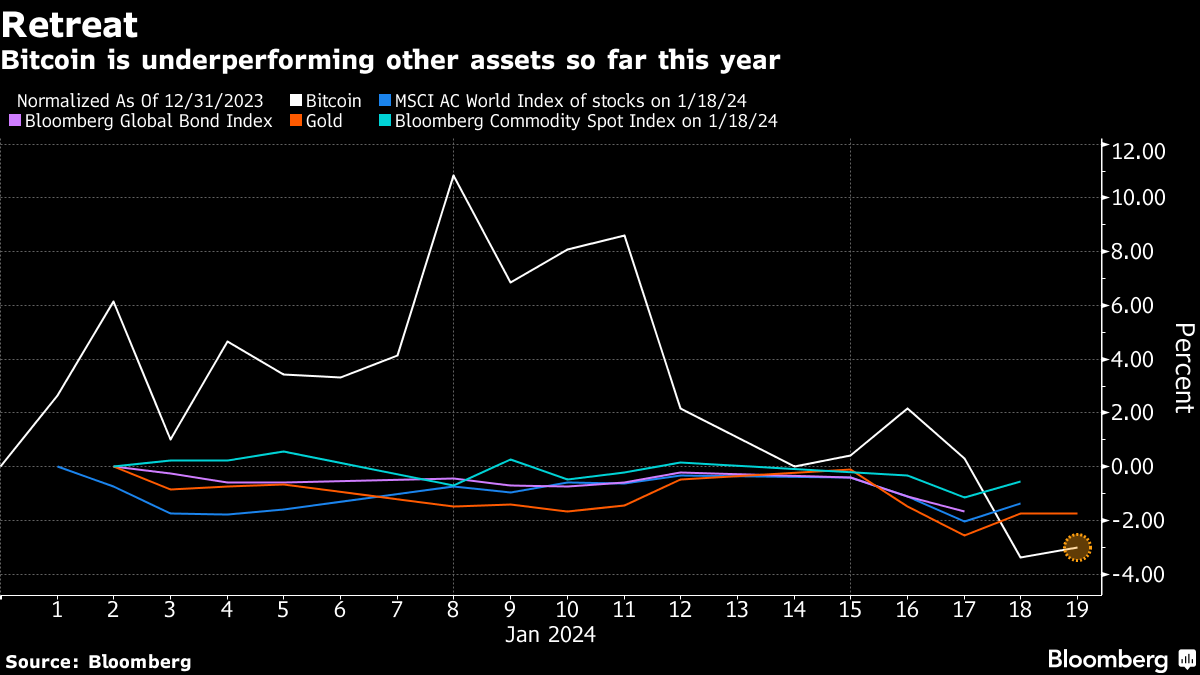

(Bloomberg) -- Bitcoin slid to the lowest since mid-December as the speculative demand for the token sparked by hype about new exchange-traded funds dissipates, leaving the cryptocurrency in the red since the start of 2024.

The largest digital asset briefly flirted with a drop below $40,000 before trading at $41,160 as of 6:30 a.m. Friday in Singapore, a decline of 3% in the past 24 hours. Smaller tokens like Ether, Solana and Polkadot also struggled.

Bitcoin surged 157% last year on optimism about the eventual Jan. 11 launch of the first US exchange-traded funds to directly hold the token. Digital assets also got a tailwind from bets on looser monetary policy. Traders are now assessing how much money the ETFs attract and paring expectations for interest-rate cuts.

Read more: What Are These New Bitcoin ETFs and How Do They Work?

“This type of correction after a significant run-up is normal for Bitcoin,” said Greg Moritz, co-founder at crypto hedge fund AltTab Capital.

Nine new spot Bitcoin ETFs went live last week, including from BlackRock Inc. and Fidelity Investments. The $25 billion Grayscale Bitcoin Trust converted from a closed-ended structure into an ETF.

BlackRock's iShares Bitcoin Trust has passed $1 billion in investor inflows. The equivalent figure for the Fidelity Wise Origin Bitcoin Fund is about $880 million. Grayscale's Bitcoin fund, which was created in 2013, has seen about $1.6 billion in outflows since it started trading as an ETF.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.