Fast moving consumer goods (FMCG) companies have found some favour among investors following first quarter earnings.

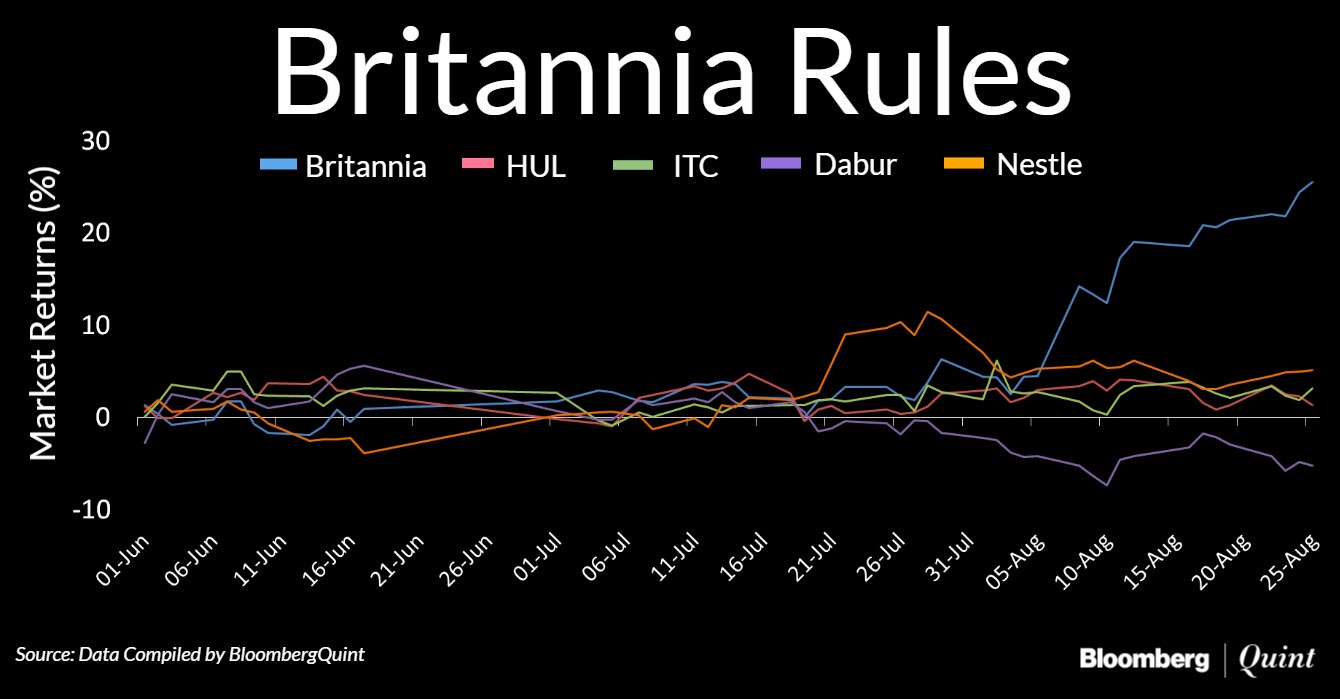

A comparison of the market returns of the top five FMCG companies after the first quarter of financial year 2016-17 shows that Britannia Industries has outperformed its peers in the last two months, rising almost 26 percent.

Analysts attribute the outperformance to better-than-industry volume growth and a stock re-rating. The re-rating has helped Britannia catch up with peers in terms of its forward price to earnings ratio.

Britannia currently trades at a forward price to earnings ratio of around 30 times, compared to the industry average of 34-36 times. Seventy-two percent of the analysts tracked by Bloomberg have a buy rating on the stock while the stock is currently trading above its consensus price target of around Rs 3,350.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.