CLSA Research expects Vodafone Idea Ltd.'s shares to fall 60% from the current market price, citing tumbling subscriber numbers and a potential financial crunch. The latest data from the telecom regulator reveals the cash-strapped telecom firm reported a loss of 10 lakh subscribers in February and a 1.7 crore loss over the past 12 months, while competitors gained subscribers.

The brokerage maintains its 'sell' call, with a target price of Rs 5 per share, according to a April 9 note. This would be the fifth-lowest target price for the telecom company, with the least been Rs 1.5 apiece given by Deutsche Bank. Goldman Sachs has a target price of Rs 2.2 per share, while JP Morgan and HSBC Research have a price target of Rs 3 apiece and Rs 5 per share, respectively.

Beyond the planned capital expenditure and 5G rollout, Vi faces a financial crunch in FY26CL. Annual spectrum and AGR payments of $4 billion per annum will fall due, unless the government converts debt principal to equity at the end of the moratorium, CLSA said in a report on April 9.

The company had earlier approved a fundraising of Rs 45,000 crore via equity and debt. Of the total amount approved, Rs 20,000 crore will be via equity or equity-linked instruments. The telecom major approved issuing shares worth Rs 2,075 crore to promoters.

A continued delay to its 5G rollout could trigger further subscriber share consolidation, as Reliance Jio and Bharti Airtel Ltd. continue to rapidly ramp up 5G, it said.

The brokerage will review once the planned fund raising is completed, it said.

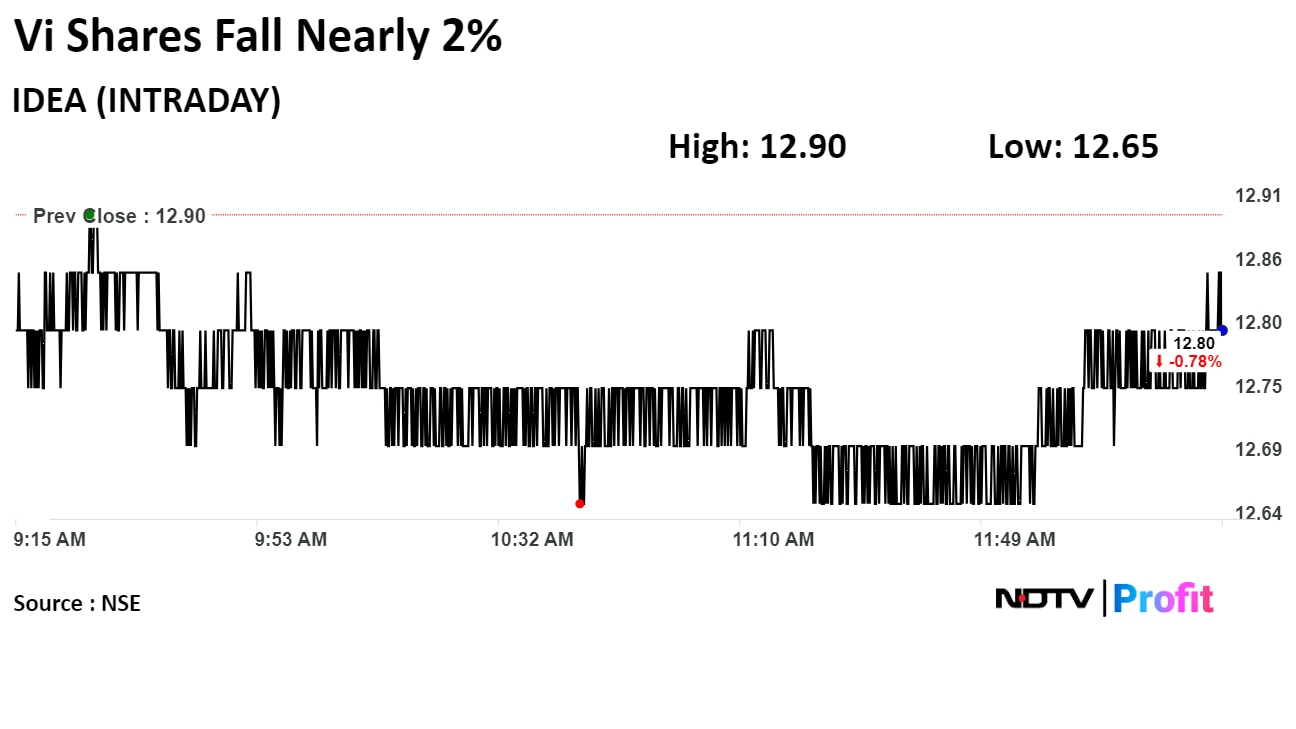

Shares of Vi fell as much as 1.94% so far in the day to Rs 12.65 apiece on the NSE. It was trading 1.09% lower at Rs 12.76 apiece, compared to a 0.24% advance in the benchmark Nifty 50 as of 12:25 a.m.

The stock has risen 107.4% in the last 12 months but has fallen 20% year-to-date. The relative strength index was at 40.4.

Three out of the 17 analysts tracking Vi have a 'hold' rating on the stock and 14 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 45%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.