Brokerages raised Tata Motors Ltd.'s target price and earning estimates due to solid delivery on growth and deleveraging amid India's capex-led economic cycle.

The company's net profit surged 138% year-on-year to Rs 7,025 crore in the quarter ended December 2023, according to an exchange filing. Bloomberg's poll of analysts' estimates pegged the net profit at Rs 4,557 crore.

Jefferies and Macquarie have the stock as their top pick in the Indian four-wheeler original equipment manufacturers list despite demand concerns.

However, Nuvama downgraded the stock's rating to 'hold', but raised the target price to Rs 960 apiece from Rs 910 apiece earlier, due to limited upside potential and a moderating volume outlook.

Tata Motors Q3 Earnings Highlights (Consolidated, YoY)

Revenue rose 25% to Rs 1.11 lakh crore (Bloomberg estimate: Rs 1,08,517 crore).

Ebitda increased 59% to Rs 15,333 crore (Bloomberg estimate: Rs 14,778 crore).

Margin expanded to 13.86% versus 10.89% (Bloomberg estimate: 13.6%).

Net profit up 138% to Rs 7,025 crore (Bloomberg estimate: Rs 4,557 crore).

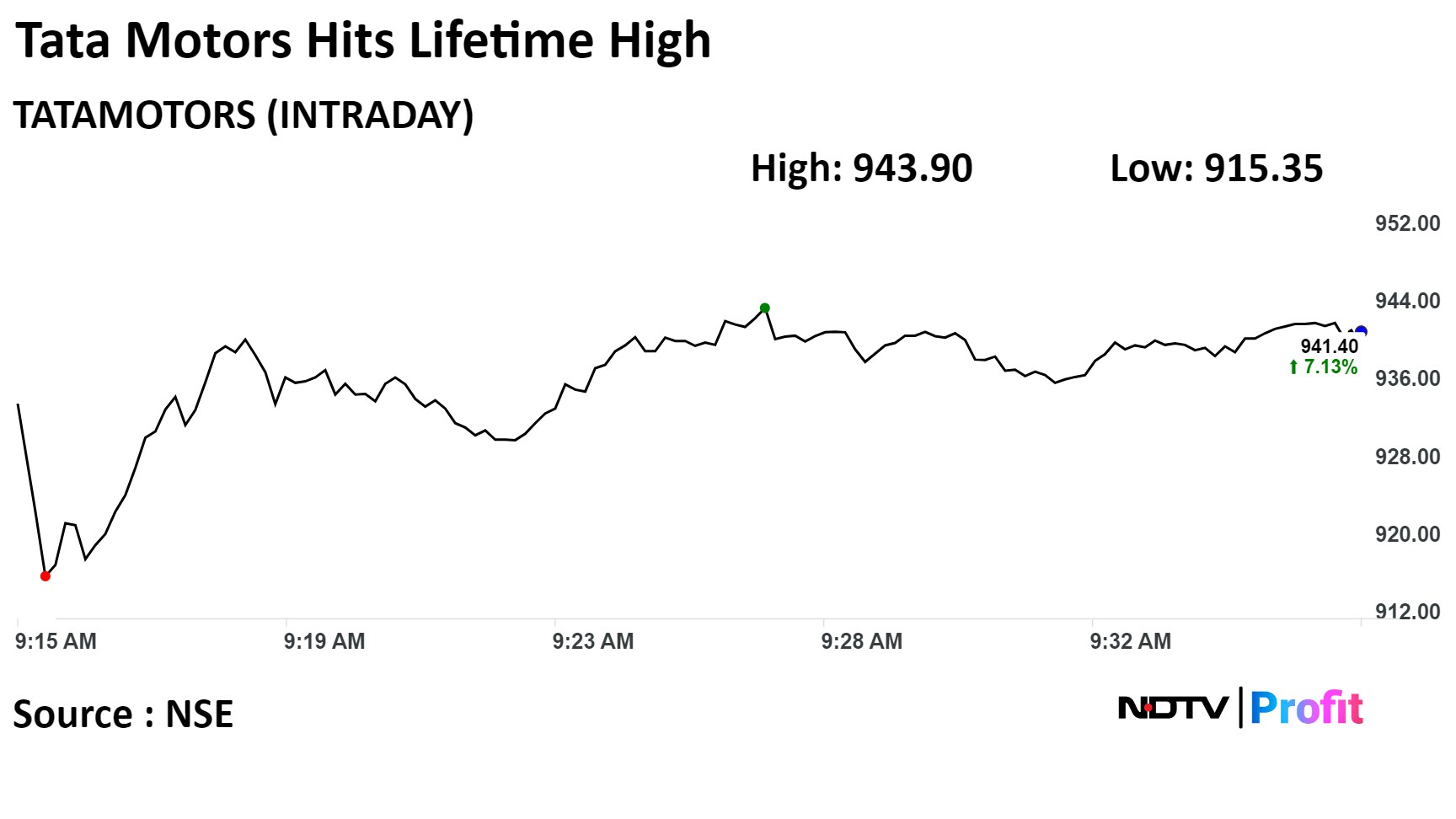

Shares of the company surged as much as 7.41% to a record high of Rs 943.90 apiece. It pared gains to trade 6.92% higher at Rs 939.55 apiece as of 9:35 a.m. This compares to a 0.09% decline in the NSE Nifty 50 Index.

It has risen 112.78% in the past 12 months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 83, indicating that the stock may be overbought.

Out of 34 analysts tracking the company, 27 maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.4%.

Here's what brokerages say:

Jefferies

Jefferies rates Tata Motors a 'buy' and raises price target to Rs 1,100 from the earlier Rs 950.

It raises FY24–26 earnings per share by 7–11% on the back of lower India CV volumes but highest estimate for JLR.

The brokerage expects FY26 Ebitda to be 2.3 times of FY23.

It also expects the EPS to rise to a new high of Rs 82.

The brokerage said it remains preferred buy among four-wheeler OEMs.

"JLR is seeing some headwinds from increasing customer acquisition cost and Red Sea issues but is benefiting from the ramp-up of recently expanded RR/RR-Sport capacity and easing chip acquisition costs," the brokerage said.

Jefferies said that while it is positive on India's capex led economy cycle, it has cut the truck industry growth and it also sees demand concerns in PVs.

While the management is cautions of demand in India, Jefferies said it has a strong pipeline of launches in this year.

Macquarie Equity Research

Rates Tata Motors as 'outperform' and raises price target to Rs 1,028 from the earlier Rs 921 due to solid delivery on growth and deleveraging.

"TTMT is our top pick in the India Mobility space," Macquarie said in its note.

The brokerage raised FY24 and FY25 Ebitda by 3% each on better margins for JLR and the domestic CV business.

Macquarie said the margins have improved across segments.

While the JLR margins improved 150 basis points quarter-on-quarter to 8.7%, helped by superior products and geographical mix, CV margins improved on better product mix and cost optimization.

The domestic margins have improved on steady volume and stable commodity prices noted the brokerage.

Nuvama Research

Downgrades to 'hold' due to limited upside potential and a moderating volume outlook. However, it increased target price to Rs 960 apiece from Rs 910 apiece earlier.

Raises FY24–26E Ebitda by 7–8% on the back of better margins.

JLR mix could turn adverse post a benign third quarter model mix and favorable geographic mix.

Freight costs can increase and delay in dispatches due to Red Sea route disruption.

Expects employee expenses to increase 11% in the next two years on the back of the conclusion of wage agreement.

JLR volume growth and India CV business growth could lower to low single-digits, increasing the costs amidst greater market spends in global as well as domestic markets.

Launch of EVs in JLR/India CV to keep up the pressure on margins in initial years.

Key risks include luxury-car demand contraction, lower-than expected growth in India, failure of new launches in EVs, spike in commodity prices and adverse currency movements.

Emkay

Maintains 'add' rating with an updated target price of Rs 925 from Rs 900 earlier.

Raises FY24/25/26 EPS by 3%/5%/8% on the back of strong Q3 earnings and lower JLR tax rate assumption.

Believes that the strong mix and healthy profitability would help meet the deleveraging target.

Expects upcoming model launches to aid outperformance amid weakening industry outlook.

Expects domestic CVs to peak in FY24, with margin expectations remaining resilient on pricing discipline.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.