Shares of Tata Steel Ltd. declined to their lowest level in nearly two weeks on Thursday after its profit fell in the fourth quarter of fiscal 2024. The consolidated net profit of the company declined 64.6% year-on-year to Rs 555 crore during the January–March period, according to an exchange filing.

However, the company's Ebitda beats estimates of Jefferies and Motilal Oswal Financial Services Ltd. prompting them to maintain their ratings on the stock.

The steel maker's standalone Ebitda beat Motilal Oswal's estimates due to raw material costs, the brokerage said in a note on Thursday. In the fourth quarter, higher dispatches in domestic markets drove sales. Dispatches increased in auto-grade and special-grade steel, and higher volumes in the branded and retail segments also drove revenue.

Tata Steel's Ebitda also came 7% higher than Jefferies' estimates.

Tata Steel Q4 FY24 Result: Highlights (Consolidated, YoY)

Revenue down 6.8% to Rs 58,687 crore.

Ebitda down 8.6% to Rs 6,601 crore.

Margin at 11.2% versus 11.5%.

Net profit down 64.6% to Rs 555 crore.

Board recommends dividend of Rs 3.6 per share.

Board approved issue of NCDs worth up to Rs 3,000 crore on private placement basis.

Brokerages' Takes

Jefferies

Jefferies kept a 'buy' rating, with a target price of Rs 200 per share, implying 14.4% potential upside from Wednesday's close.

The company's Q4 numbers were weak but better than estimated, it noted.

Tata Steel's Ebitda rose 5% sequentially (down 9% YoY), 7% above the brokerage's estimates.

Ebitda loss narrowed sharply from $191 in Q3 to $40 in Q4

Q4 net debt was flattish QoQ.

Tata Steel plans to infuse $2.1 billion in the overseas holding company TSHP.

Existing debt of $565 million provided by Tata Steel to TSHP will be converted to equity.

Funds infused will be used to repay existing external debt at offshore entities and UK restructuring costs.

Motilal Oswal

Motilal Oswal remained 'neutral' on the stock and refrained from changing its target price.

The company's standalone revenue came above the brokerage's estimates as volumes improved, which was offset by muted realisation.

Its standalone Ebitda beat Motilal Oswal's estimates due to raw material costs.

Tata Steel's consolidated revenue decline is due to lower blended armour grade steel income, which was lower than Motilal Oswal's expectation.

The company incurred a capital expenditure of Rs 4,805 crore during the quarter.

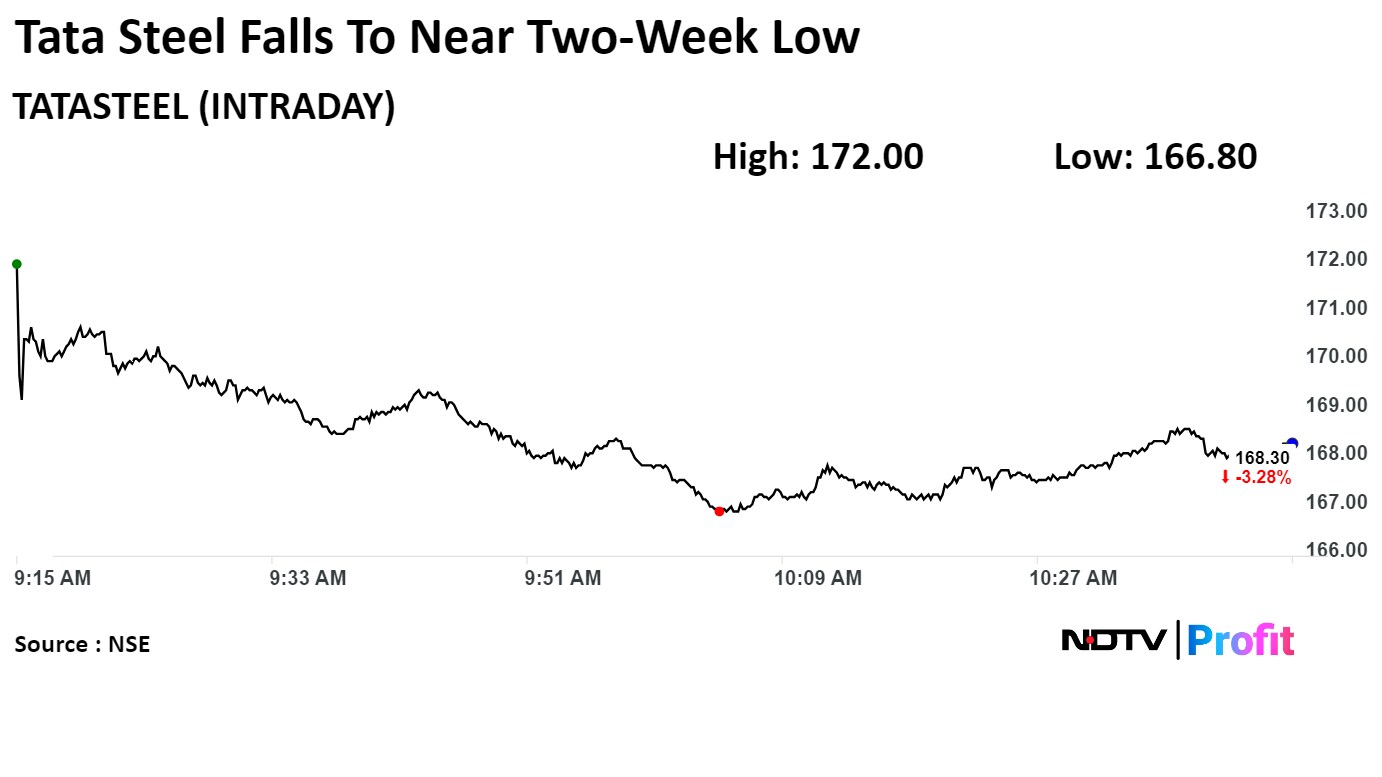

Shares of the company fell as much as 4.28%, the lowest level since May 17, before paring loss to trade 3.79% lower at Rs 167.65 apiece as of 11:07 a.m. This compares to a 0.50% decline in the NSE Nifty 50.

The stock has risen 56.94% in 12 months and 20.34% year-to-date. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 49.74.

Out of 32 analysts tracking the company, 17 maintain a 'buy' rating, eight recommend a 'hold,' and seven suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 11.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.