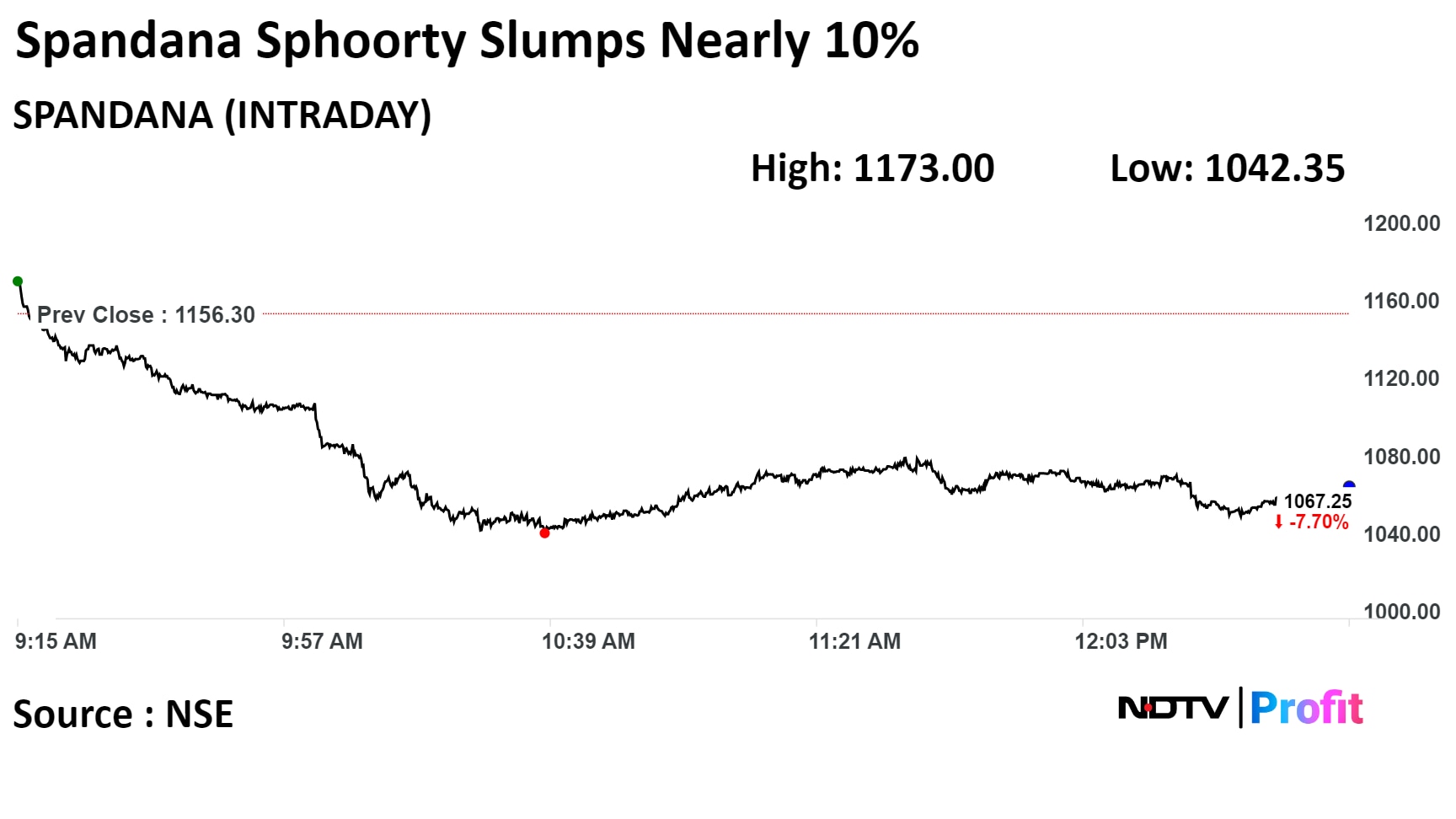

Shares of Spandana Sphoorty Financial Ltd. slumped nearly 10% on Tuesday after its third-quarter profit missed analysts' estimates.

The financial services provider's net profit rose 70.7% year-on-year to Rs 118.3 crore in the quarter ended December, according to an exchange filing. Analysts polled by Bloomberg estimated the net profit at Rs 133.45 crore.

Spandana Sphoorty Financial Q3 FY24 (Standalone, YoY)

Revenue rose 73.8% to Rs 591.2 crore. (Bloomberg estimate: Rs 399.70 crore).

Net profit up 70.7% at Rs 118.3 crore. (Bloomberg estimate: Rs 133.45 crore).

Cost to income ratio at 42.9% vs 44.7%.

The financial services provider witnessed a 38 basis point fall in its yield on quarter due to interest reversal at a time when NPAs have risen and the cost of funds remains stagnant, InCred Equities said.

"This resulted in an 84 basis point dip in margins sequentially. We expect the pressure on margins to stay in Q4 amid Project Parivartan's implementation, but normalised margins are likely in FY25," the brokerage said.

Shares of the company declined 9.85%, the lowest since Dec. 27, 2023, before paring loss to trade 7.99% lower as of 1:00 p.m. This compares to a 0.95% decline in the NSE Nifty 50.

The stock has risen 84.54% in 12 months. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 42.76.

All eight analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 22.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.