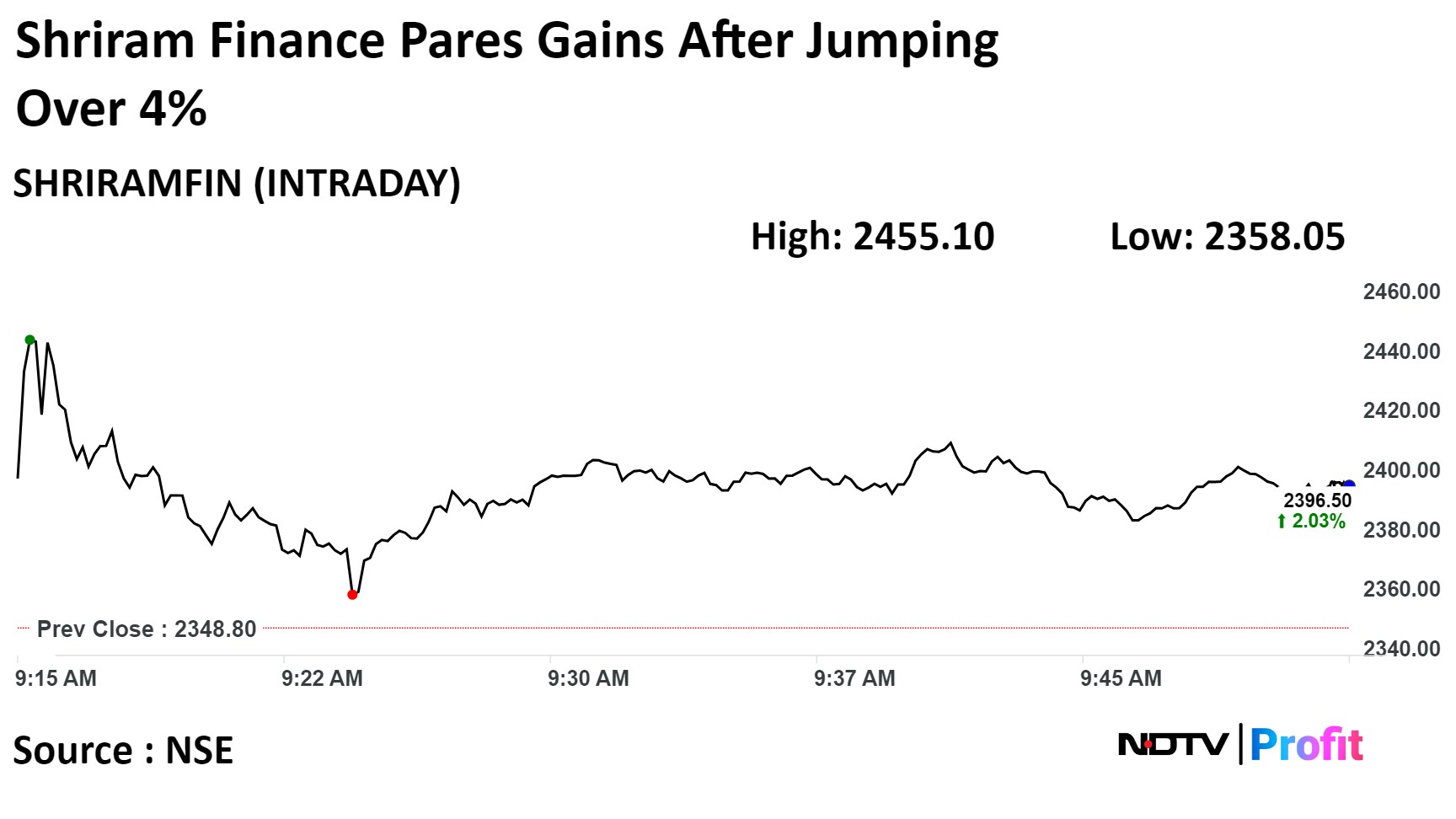

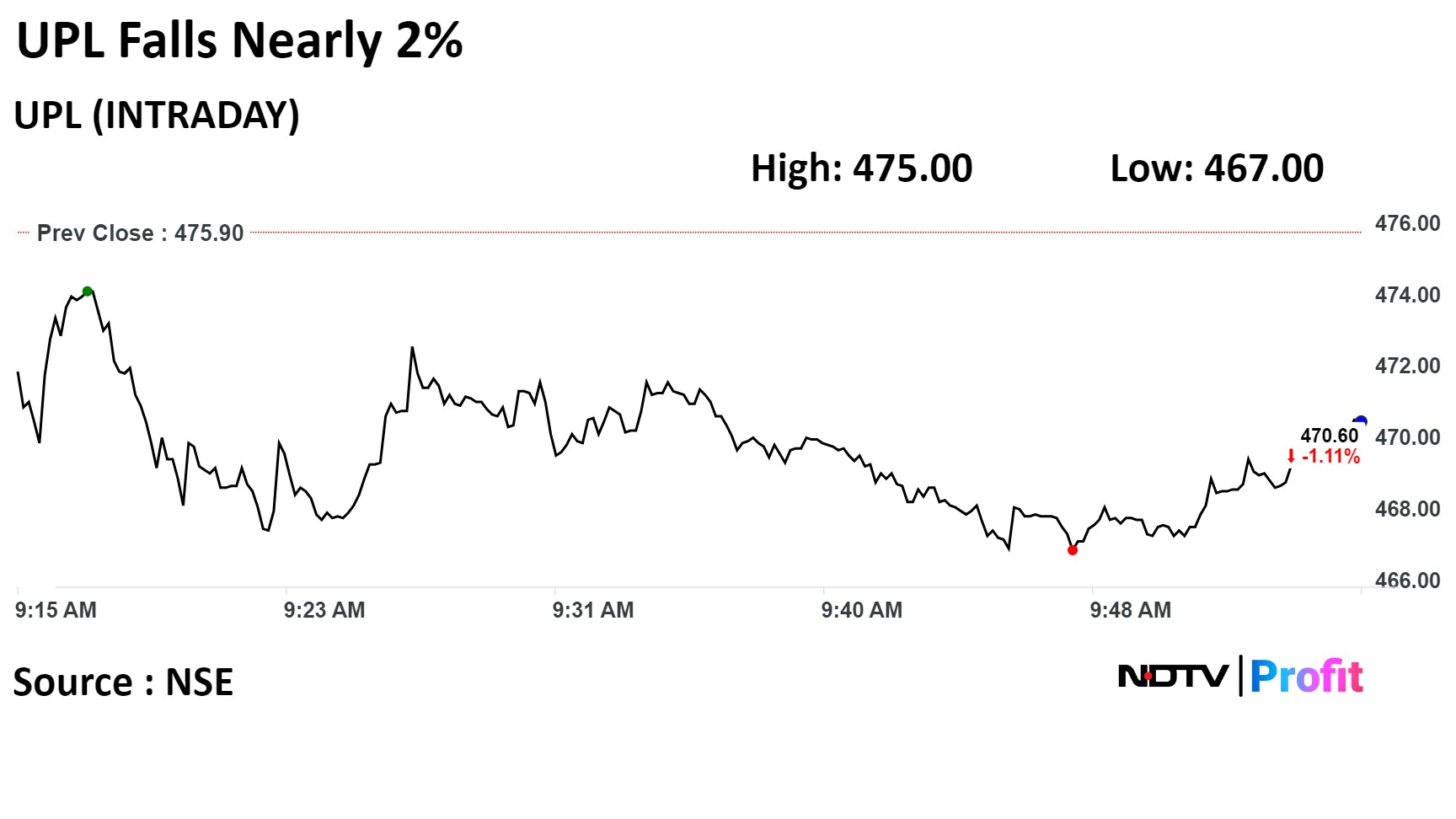

Shares of Shriram Finance Ltd. snapped a two-day loss and jumped over 4% on Thursday after the NSE announced that the non-banking finance company would replace UPL Ltd. in the Nifty 50.

The National Stock Exchange made the announcement after its periodic review on Wednesday. The changes will be effective on March 28.

UPL Ltd. fell for the third consecutive session, declining 4.42% in the last three days.

Shares of Shriram Finance rose as much as 4.53% during the day to Rs 2,455.10 apiece on the NSE. It was trading 1.12% higher at Rs 2,375 per share, compared to a 0.26% decline in the benchmark Nifty 50 at 10:30 a.m.

The stock has risen 98.7% in the last 12 months. Total traded volume so far in the day stood at 0.90 times its 30-day average. The relative strength index was at 52.82.

Of the 37 analysts tracking the company, 35 maintain a 'buy' rating, one suggests 'hold' and another recommends 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 12%.

Shares of UPL fell 1.87% during the day to Rs 467 apiece on the NSE. It was trading 1.23% lower at Rs 470.05 per share, compared to a 0.32% decline in the Nifty 50 at 10:35 a.m.

The stock has fallen 32.28% in the last 12 months. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 31.9.

Of the 32 analysts tracking the company, 18 maintain a 'buy' rating, seven recommend 'hold' and as many suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 19.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.