Shares of Reliance Industries Ltd. surged nearly as much as 6%, the most in about 22 months, to hit an all-time high on Monday as crude prices rose amid escalating tensions in the Middle East.

Reliance's added over 100 points to the NSE Nifty 50, recording the biggest intraday gain since May 20, 2022. It has added Rs 84,000 crore to investor wealth.

Prices of crude oil surged to an eight-week high amid escalating tensions in the Middle East. Brent prices soared past $83 a barrel. Higher prices are expected to benefit the upstream or exploration vertical of Reliance and peers including Oil and Natural Gas Corp.

According to Rahul Kalantri, vice president of commodities at Mehta Equities Ltd. oil prices also received a boost from the International Energy Agency's revised global demand outlook for 2024 and 2025.

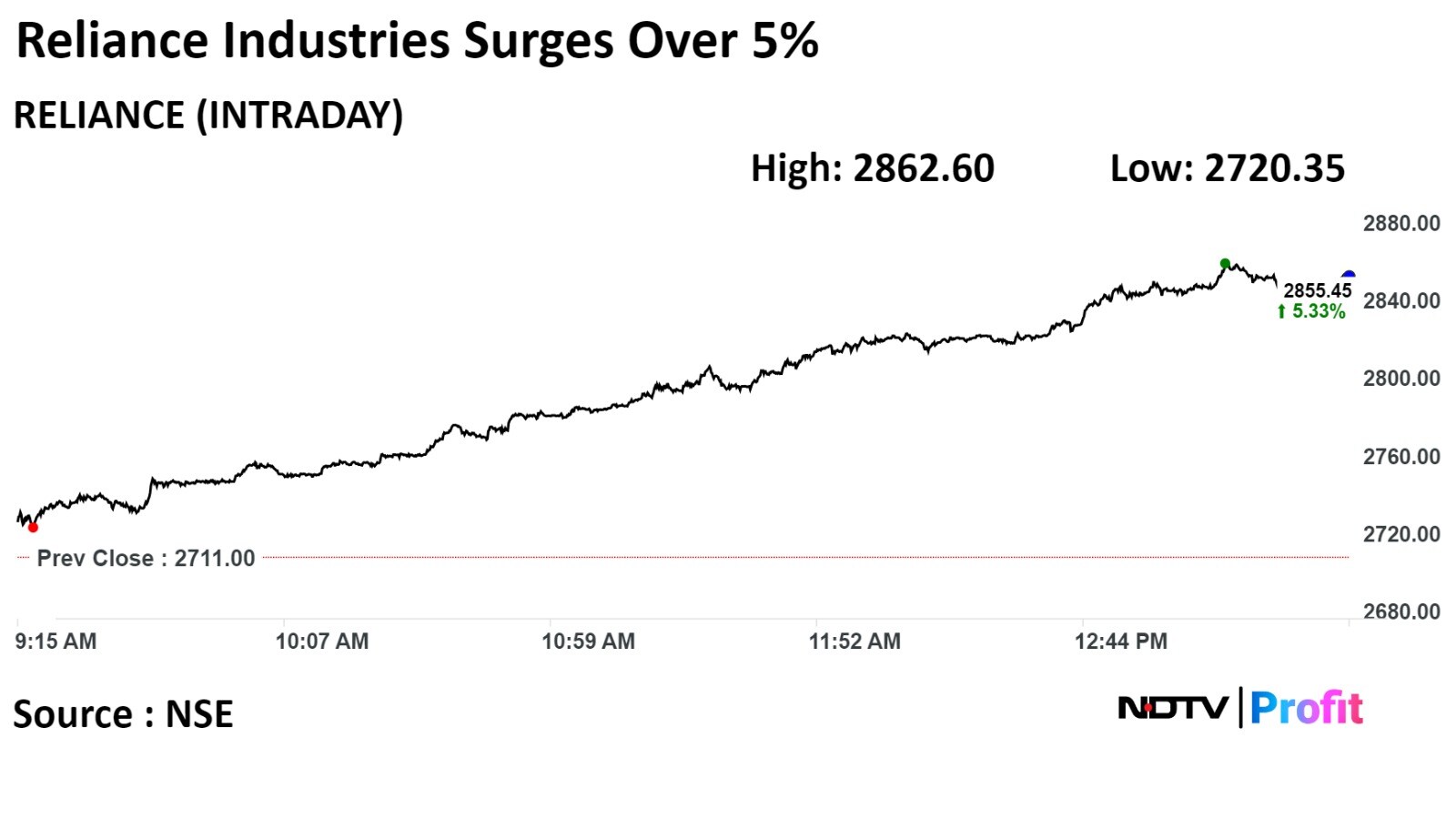

RIL's stock rose as much as 5.78%, the most since May 20, 2022, during the day to Rs 2,862.60 apiece on the NSE. It was trading 5.33% higher at Rs 2,850.30 per share, compared to a 1.52% advance in the benchmark Nifty 50 at 1:33 p.m.

The share price has risen 9.36% in the last 12 months. The total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 73, implying the stock is overbought.

Twenty-eight out of the 35 analysts tracking Reliance Industries have a 'buy' rating on the stock, five recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.7%.

The BSE Oil and Gas index rose over 3%, with ONGC, RIL and Hindustan Petroleum Corp. gaining the most.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.