Shares of Quess Corp. Ltd. surged over 16% after it approved spinning off the business services provider's diversified verticals into three independent entities to unlock value.

The company will demerge into Quess Corp Ltd., Digitide Solutions Ltd., and Bluspring Enterprises Ltd., according to an exchange filing.

Once the demerger is effective, all shareholders will receive one additional share for each of the new companies for every share held in Quess Corp. The demerger process is expected to take between 12 and 15 months to achieve regulatory clearances, it said.

The company said that this helps the management to focus and develop capital allocation plans relevant to each business and create value for its shareholders.

According to the plan:

Quess Corp. will remain in workforce management.

Digitide Solutions will handle business process management, insurtech and human resource outsourcing businesses.

Bluspring Enterprises will work in facility management, industrial services and investments.

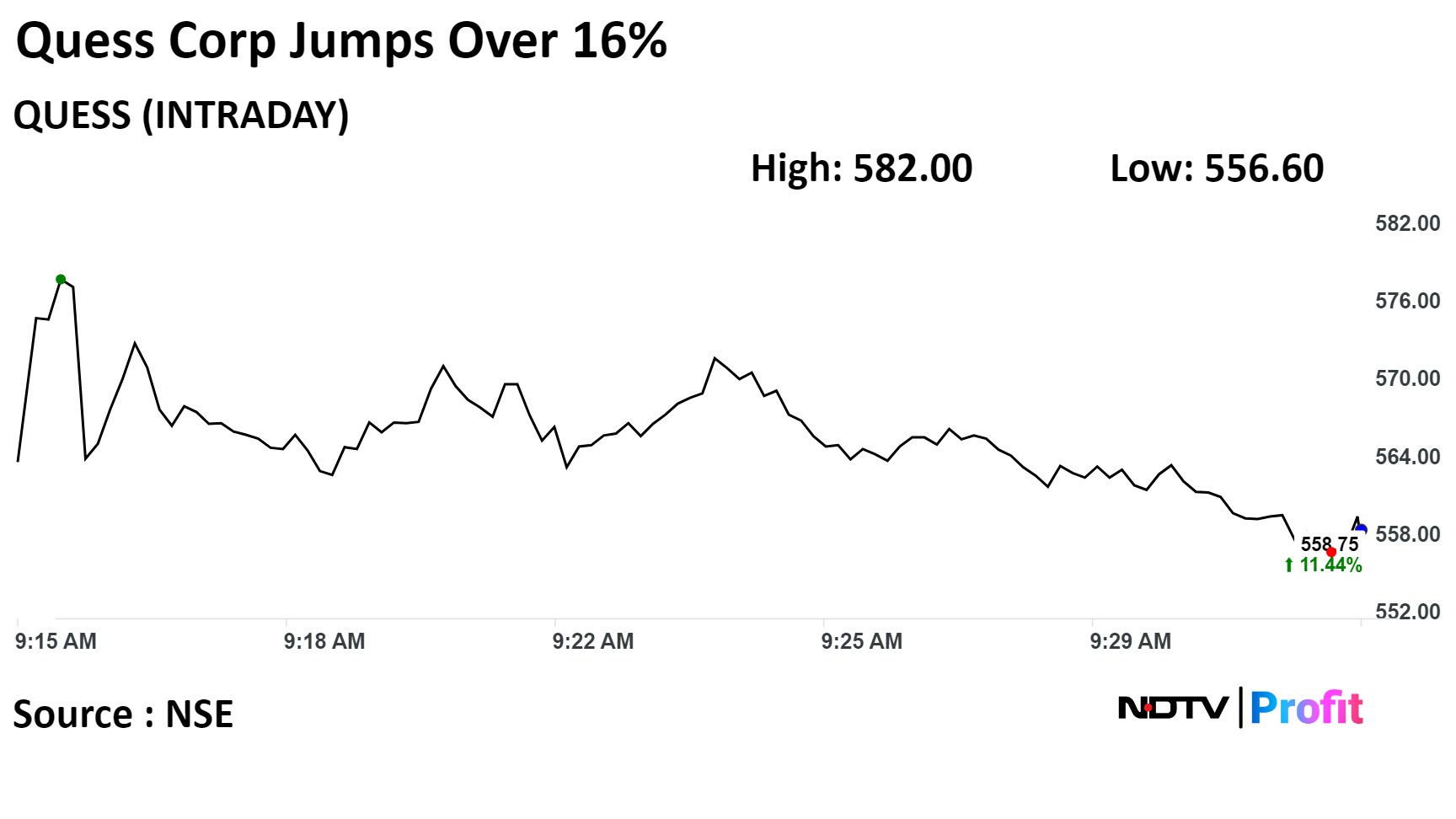

Quess Corp stock jumped 16.07% during the day to Rs 582 apiece on the NSE, the highest jump since June. 11, 2021. It was trading 13.21% higher at Rs 567.65 apiece, compared to a 19% advance in the benchmark Nifty 50 as of 9:25 a.m.

The stock has risen 51.23% in the past 12 months. The total traded volume so far in the day stood at 193 times its 30-day average. The relative strength index was at 73, indicating that stock may be overbought.

Five out of the seven analysts tracking have a 'buy' rating on the stock, one recommends a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies an upside potential of 1.4%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.