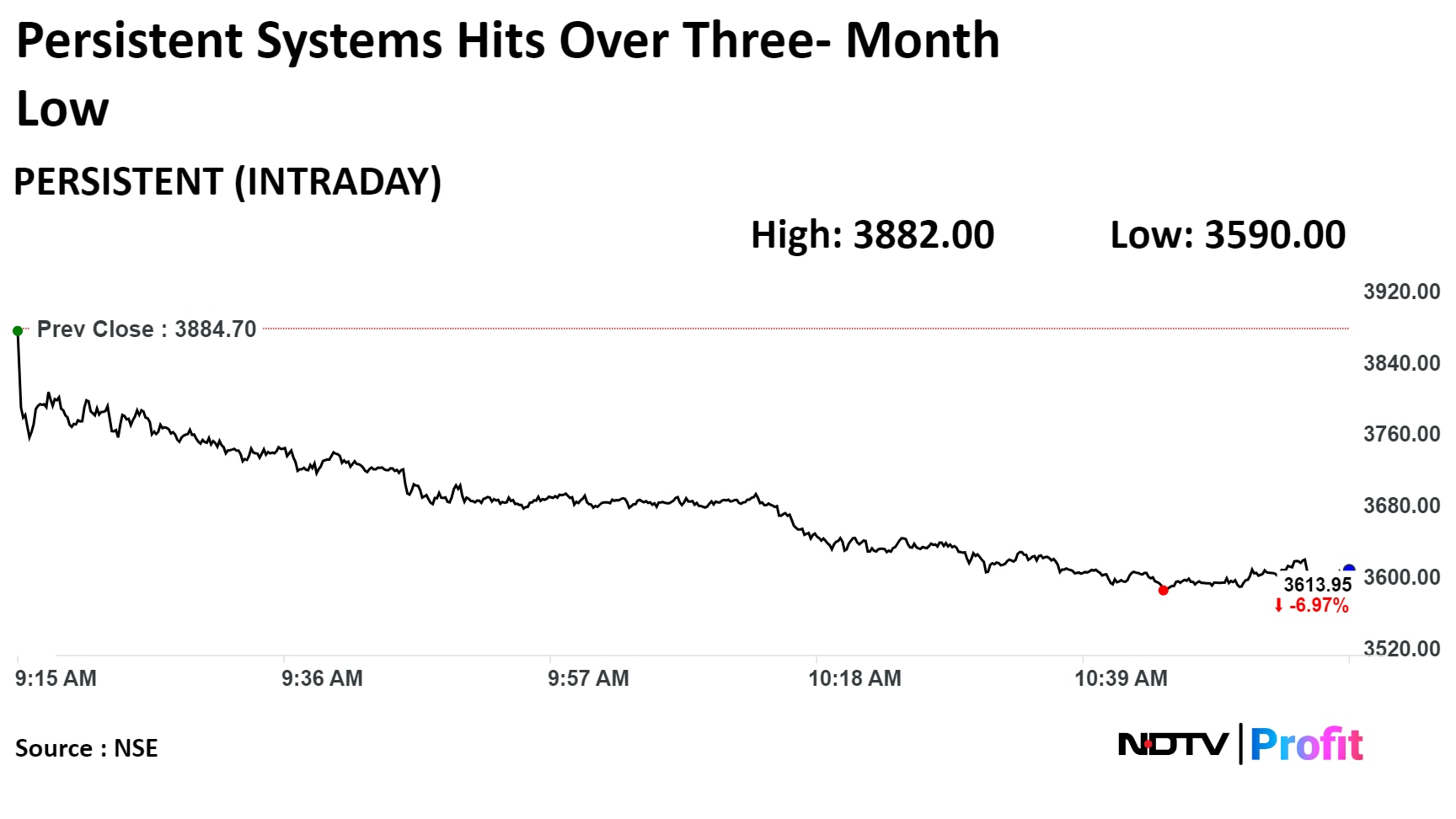

Shares of Persistent Systems fell over 7% to their lowest in over three months on Monday, even as it reported an inline fourth-quarter net profit. A brokerage note after the results said the stock was trading at a higher valuation than its peers.

The company's net profit rose 10.20% to Rs 315.32 crore in the quarter ended March 2024, according to an exchange filing. A Bloomberg poll of analysts estimates the net profit at Rs 303 crore.

Persistent Systems (Consolidated, QoQ)

Revenue up 3.69% at Rs 2,590.52 crore (Bloomberg estimate: Rs 2,563 crore)

EBIT up 3.12% at Rs 374.44 crore

EBIT margin down 8 bps at 14.45%

Net profit up 10.20% at Rs 315.32 crore (Bloomberg estimate: Rs 303 crore)

The company's management said in its post-earnings conference call that its goal is to maintain margins at current levels, given the uncertain macro environment.

They also said that the attrition rate has come down to comfortable levels. The attrition rate for the reporting quarter stood at 11.5%, compared to 11.9% in the previous quarter, according to the company's investor presentation.

"Deal win momentum moderated in Q4 FY24 after a record deal win in Q3, with TCV of $448 million, down 14% QoQ due to muted renewal," said DART Research in a note.

The fourth quarter performance was beat on both the top and bottom lines, but was a miss on operating margin owing to high sub-con costs, it said.

"The ACV data trend reflects a gradual decline in growth momentum in the near term," the brokerage said, adding that the stock currently trades at 39.5 times its price to earnings on FY26E EPS, which looks a bit stretched as compared to its peers. "Thus, we maintain a negative view on the stock."

Shares of the company fell as much as 7.59% to Rs 3,590 apiece, the highest level since Jan. 3. It pared losses to trade 7.10% lower at Rs 3,509 apiece as of 11:02 a.m. This compares to a 0.6% advance in the NSE Nifty 50 Index.

The stock has risen 52.3% in the last 12 months and fallen 2.37% year-to-date. Total traded volume on the NSE so far in the day stood at 2.44 times its 30-day average. The relative strength index was at 27.41, indicating that the stock may be oversold.

Out of 38 analysts tracking the company, 15 maintain a 'buy' rating, 12 recommend a 'hold,' and 11 suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.