Shares of One 97 Communications Ltd. jumped on Saturday, after the company's loss narrowed and revenue grew in the quarter ended December.

The Paytm operator's loss narrowed to Rs 221.7 crore, compared Rs 291.7 crore in the last quarter.

One97 Communications Q3 FY24 Highlights (Consolidated, QoQ)

Revenue up 13% to Rs 2,850.5 crore vs Rs 2,518.6 crore (Bloomberg estimate: Rs 2,727 crore).

Net loss narrowed to Rs 221.7 crore vs Rs 291.7 crore (Bloomberg estimate: Net loss of Rs 285.2 crore).

Ebitda loss narrowed to Rs 219 crore vs Rs 231 crore.

CLSA upgraded Paytm's rating from 'outperform' to 'buy' and raised the stock's target price to Rs 960 from Rs 925. The bulk of the BNPL business loss was offset by new revenue streams and cost reduction, among other factors, the brokerage said.

The company's core Ebitda of Rs 220 crore was ahead of the brokerage's Rs 160 crore estimates.

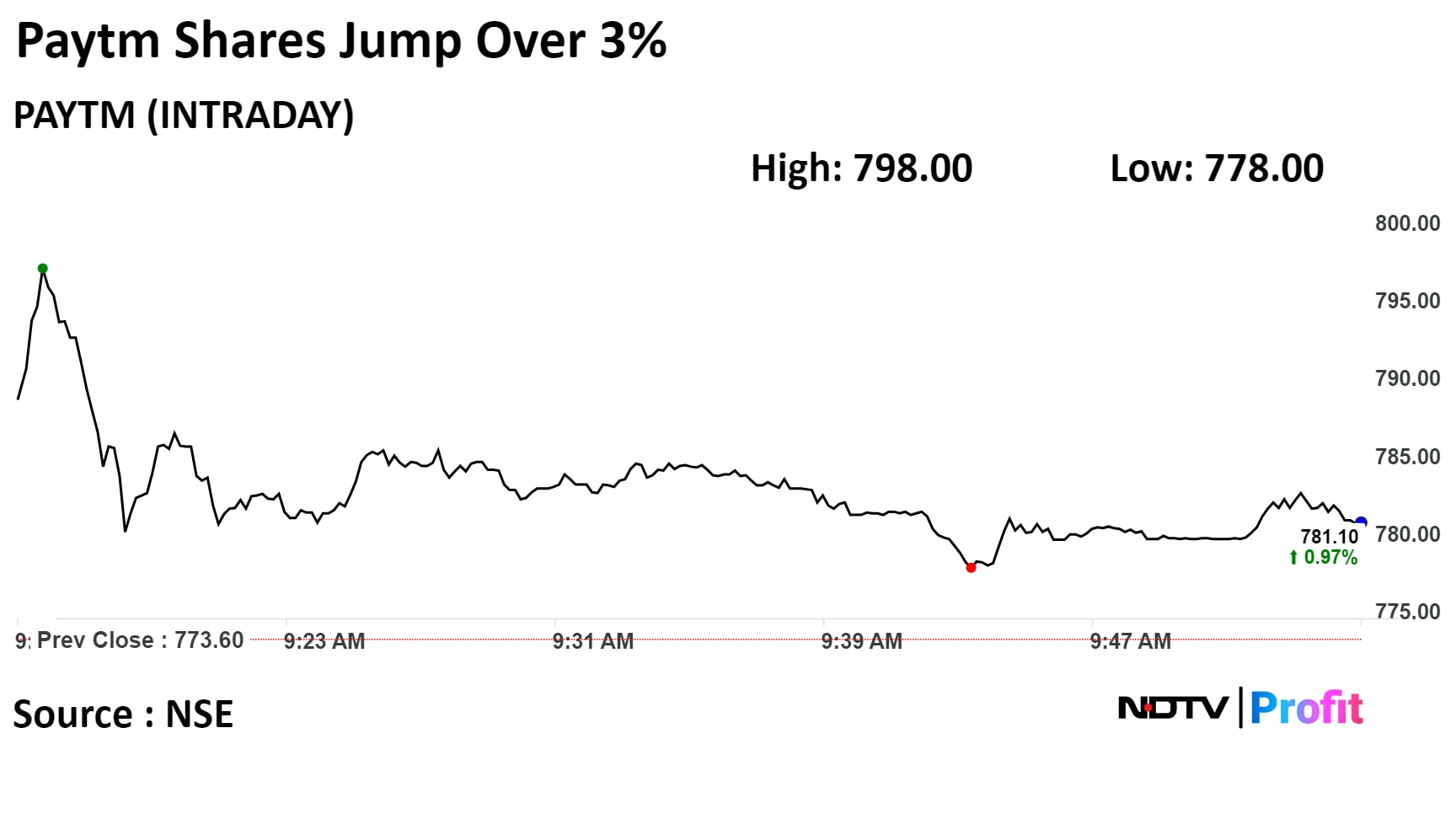

Shares of the company rose as much as 3.15%, the highest since Dec. 6 2023, before paring gains to trade 0.99% higher at 10:16 a.m. This compares to a 0.9% advance in the NSE Nifty 50.

The stock has risen 41.83% in the last 12 months. The relative strength index was at 69.64.

Of the 16 analysts tracking the company, 11 maintain a 'buy' rating and five recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.