Oil and Natural Gas Corp. jumped to an over-nine-year high on Tuesday after shareholders of Imperial Energy Ltd., its Cyprus unit, approved merging its five step-down subsidiaries with itself.

Imperial Energy Ltd., a subsidiary of ONGC Videsh Ltd., has a total of seven step-down subsidiary businesses in Cyprus and Russia. Out of the seven, five will be merged, ONGC said in an exchange filing on Monday.

The five businesses are Imperial Energy Cyprus Ltd., Imperial Energy Nord Ltd., Imperal Frac Servics Cyprus Ltd., Redcliffe Holdings Ltd., Biancus Holding Ltd., and San Agio Investment Ltd. with IEL.

The merger is due for approval from the competent court of Cyprus, the exchange filing said.

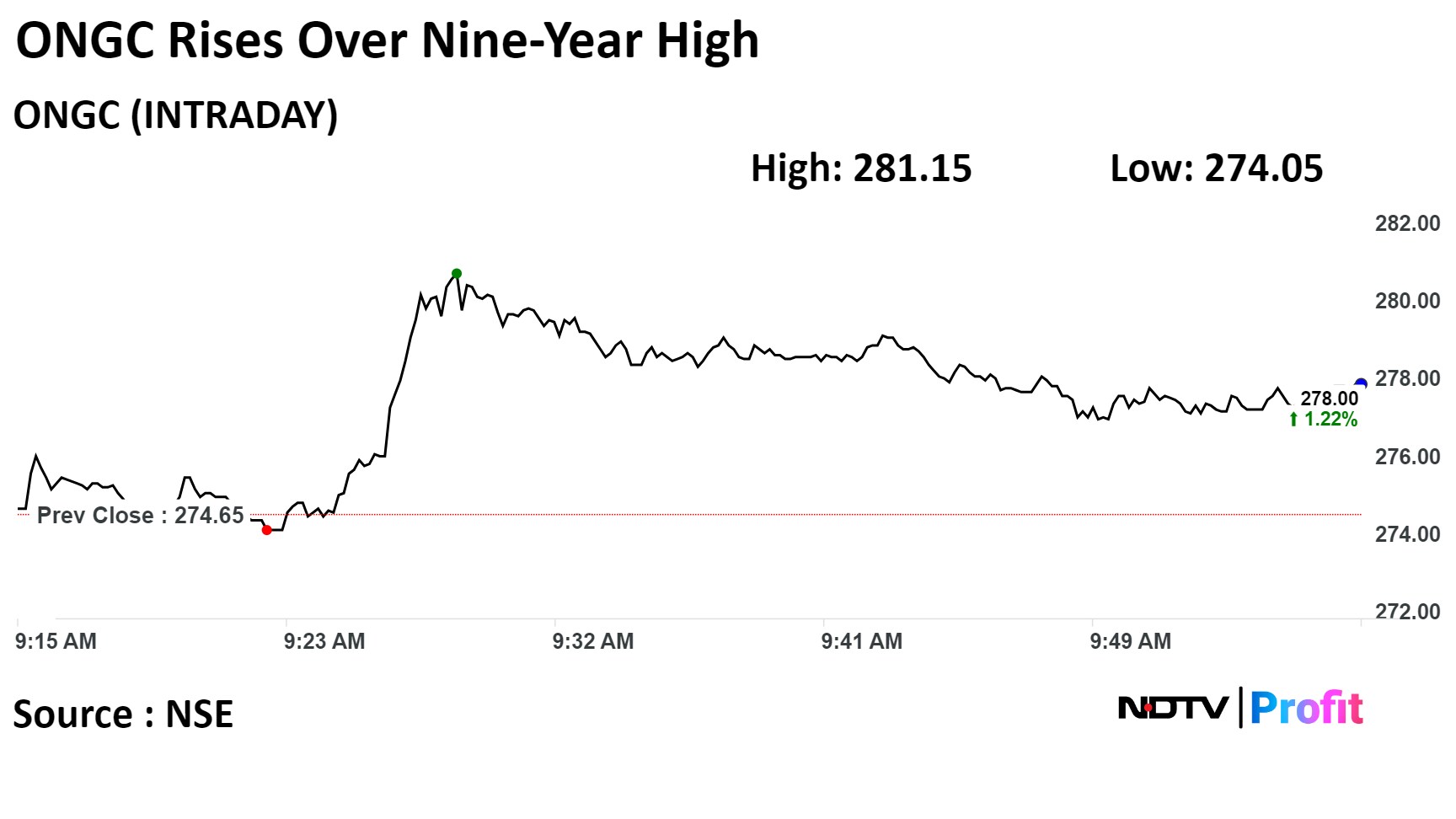

Shares of the company rose as much as 2.37% to Rs 281.15 apiece, the highest since Oct. 10, 2014. It was trading 0.98% higher at Rs 277.35 apiece as of 09:55 a.m. This compares to a 0.28% decline in the NSE Nifty 50 Index.

It has declined 79.14% in past 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 69.23.

Out of 28 analysts tracking the company, 16 maintain a 'buy' rating, six recommend a 'hold', and six suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 5.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.