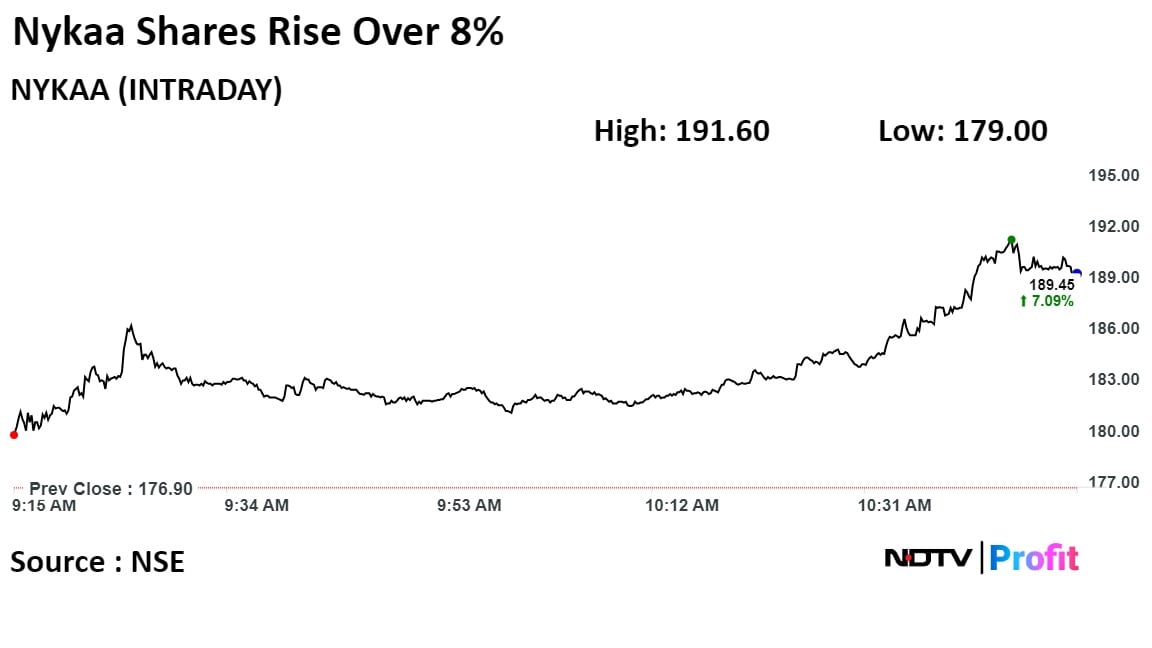

Shares of Nykaa parent FSN E-Commerce Ventures Ltd. jumped over 8% on Tuesday to the highest in over a year after HSBC Global Research hiked its target price.

The brokerage maintains a 'buy' rating on the stock while raising the target price to Rs 250 from Rs 240, implying an upside of 44.2%.

Nykaa is well-positioned to capture long-term value in beauty and personal care with its scale and leadership, the brokerage said in a note.

HSBC expects the BPC e-commerce market to grow at a 20–30% compound annual growth rate over the coming decade, with double-digit growth.

Nykaa's pan-India network, growing portfolio of skin and beauty products, and loyal customer base are among the other reasons for HSBC's positive outlook. It also pointed out that, while industry growth was muted in the third quarter of this financial year, Nykaa reported strong growth.

The company expects the BPC vertical's gross merchandise value growth to be in the mid-twenties and the net sales value growth to be around 20% in the third quarter.

In its business update on Monday, it said that Nykaa Fashion saw strong growth in the December quarter, with the GMV growth expected to be around 40% and the NSV growth expected to be in the low-thirties.

On the NSE, shares of Nykaa rose as much as 8.31% during the day to Rs 191.60 apiece, the highest since Nov. 11, 2022. It was trading 7.97% higher at Rs 191 apiece, compared to a 0.83% advance in the benchmark Nifty 50 as of 10:48 a.m.

The share price has risen 24.16% in the last 12 months. The total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was at 71.15, indicating the stock may be overbought.

Fourteen out of 24 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and as many suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 19.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.