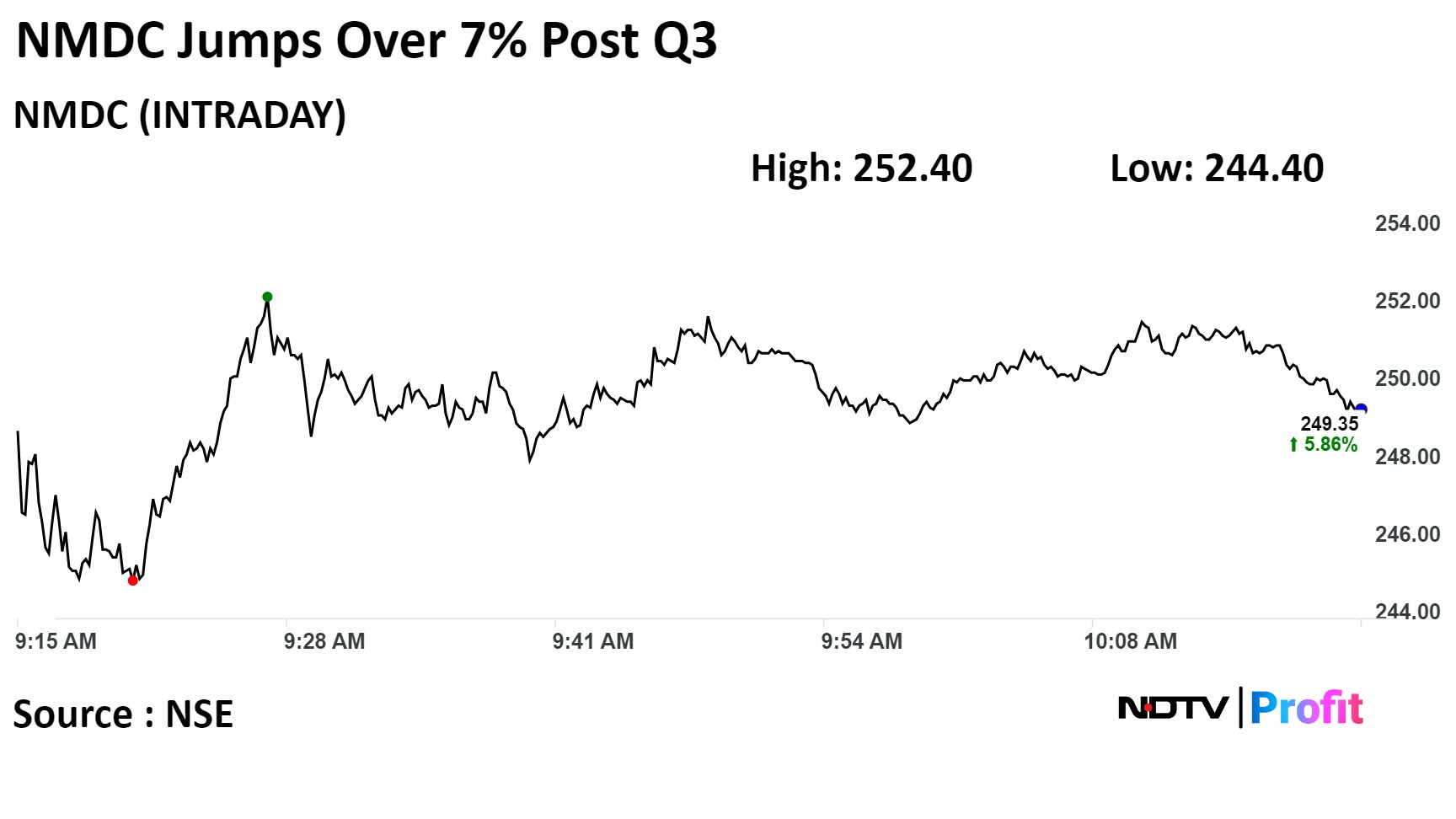

Shares of NMDC Ltd. surged over 7% on Thursday after its third-quarter profit jumped over 60% meeting analysts' estimates.

Adding to this, the company is also undertaking capex programe to increase its mining capacity, according to Motilal Oswal Financial Services.

The company's consolidated net profit jumped 62.67% to Rs 1,483.93 crore in the quarter ended December, according to an exchange filing. This compare to Rs 1,558.97 crore estimate tracked by Bloomberg.

NMDC Q3 FY24 (Consolidated, YoY)

Revenue up 45.42% at Rs 5,409.9 crore. (Bloomberg estimate: Rs 5,361.43 crore)

Ebitda up 75.97% at Rs 2,007.17 crore. (Bloomberg estimate: Rs 1,933.13 crore).

Margin expands 643 bps to 37.1%. (Bloomberg estimate: 36.10%).

Net profit up 62.67% at Rs 1,483.93 crore. (Bloomberg estimate: Rs 1,558.97 crore)

NMDC recorded the second best ever quarterly production at 12.2 million tonne, up 15% year-on-year and 38% sequentially, according to Motilal Oswal Financial Services. Production from Chhattisgarh mines was up 12% YoY at 8.5mt and production from Karnataka mines stood at 3.7mt (Production at Donimalai mine was up 44% YoY).

NMDC is undertaking numerous capex programs, which will eventually increase its mining capacity to 70-75mt from its current 50mt, the research firm said.

Shares of the company rose as much as 7.15% the most since Sept. 4, 2023. It is trading 5.84% higher at Rs 249.30. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has fallen 110.74% in the past 12 months. Total traded volume so far in the day stood at 8.3 times its 30-day average. The relative strength index was at 67.59 indicating it was underbought.

Out of 22 analysts tracking the company, 17 maintain a 'buy' rating, two recommend a 'hold,' and three suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 25.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.