Shares of Sonata Software Ltd. recorded their steepest fall on Wednesday in over four years after its consolidated net profit and revenue fell in the fourth quarter of financial year 2024. The IT services firm's profit dropped 23% to Rs 33.2 crore in the March quarter, according to an exchange filing. Analysts tracked by Bloomberg had a consensus estimate of Rs 128.3 crore.

Sonata Q4 FY24 Earnings Highlights (Consolidated, QoQ)

Revenue down 12% to Rs 2,192 crore versus Rs 2,493 crore (Bloomberg estimate: Rs 2,179 crore).

EBIT down 37% to Rs 110 crore vs Rs 174 crore (Bloomberg estimate: Rs 168.5 crore).

EBIT margin narrows to 5.03% vs 6.97% (Bloomberg estimate: 7.73%).

Net profit down 23% to Rs 33.2 crore vs Rs 43.1 crore (Bloomberg estimate: Rs 128.3 crore).

Board recommends a final dividend of Rs 4.4 per share.

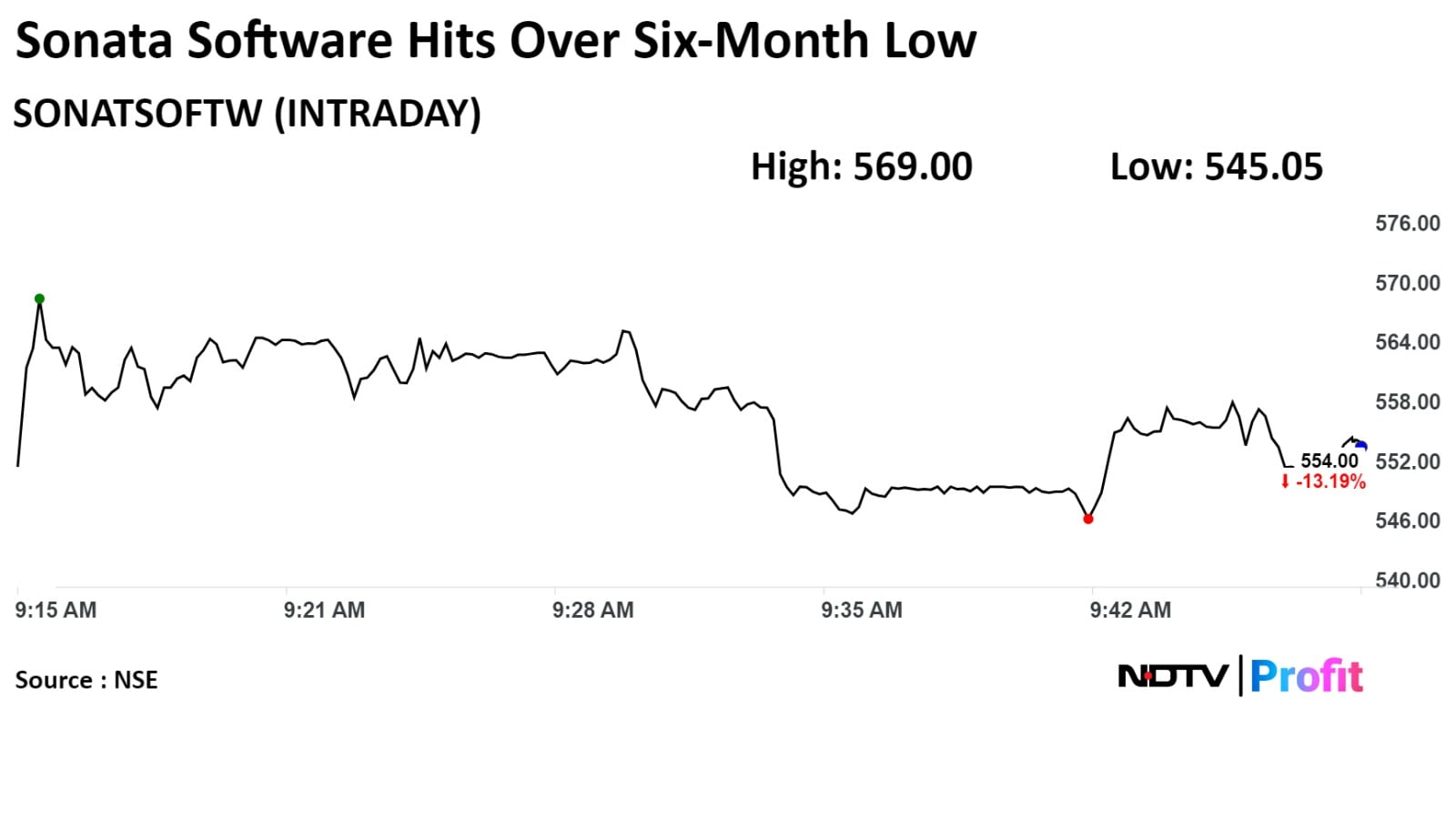

On the NSE, Sonata Software's stock fell as much as 14.6% during the day to Rs 545.05 apiece, the lowest since Oct. 26. It was trading 12.97% lower at Rs 555.05 apiece, compared to a 0.4% decline in the benchmark Nifty 50 at 10:08 a.m.

The share price has fallen 25.24% on a year-to-date basis and 14.3% in the last 12 months. The total traded volume so far in the day stood at 6.96 times its 30-day average. The relative strength index was at 17.91, indicating that the stock may be oversold.

Five out of the six analysts tracking the company have a 'buy' rating on the stock and one recommends 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 45.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.