HSBC Global Research has raised the target price of Titan Co. on the back of solid jewellery momentum and aggressive network expansion. The brokerage also attributed the bullish stance to the large opportunities available with the lab-grown diamonds. It has reiterated a 'buy' rating with a raised target price of Rs 4,300 from Rs 4,200 apiece earlier, implying a potential upside of 15% from the previous day's close.

Solid jewellery momentum continues and Titan appears on track to grow its jewellery business by a compound annual growth rate of 20% for the next five years, HSBC said in a report on April 8. "The appeal for gold as a store of value continues to aid this tailwind."

Titan is also building several new growth options and is well-supported by aggressive network expansion. New growth options will be from its international jewellery foray, strong CaratLane business and the expansion of Taneira, according to HSBC.

Lab-grown diamonds will be a new large-scale opportunity for Titan on its consumer positioning, principles of trust, exchange value and quality standards, the note said.

Titan remains a key compounding story of India consumers for HSBC with earnings potentially set to double over the next four years and new businesses scaling up.

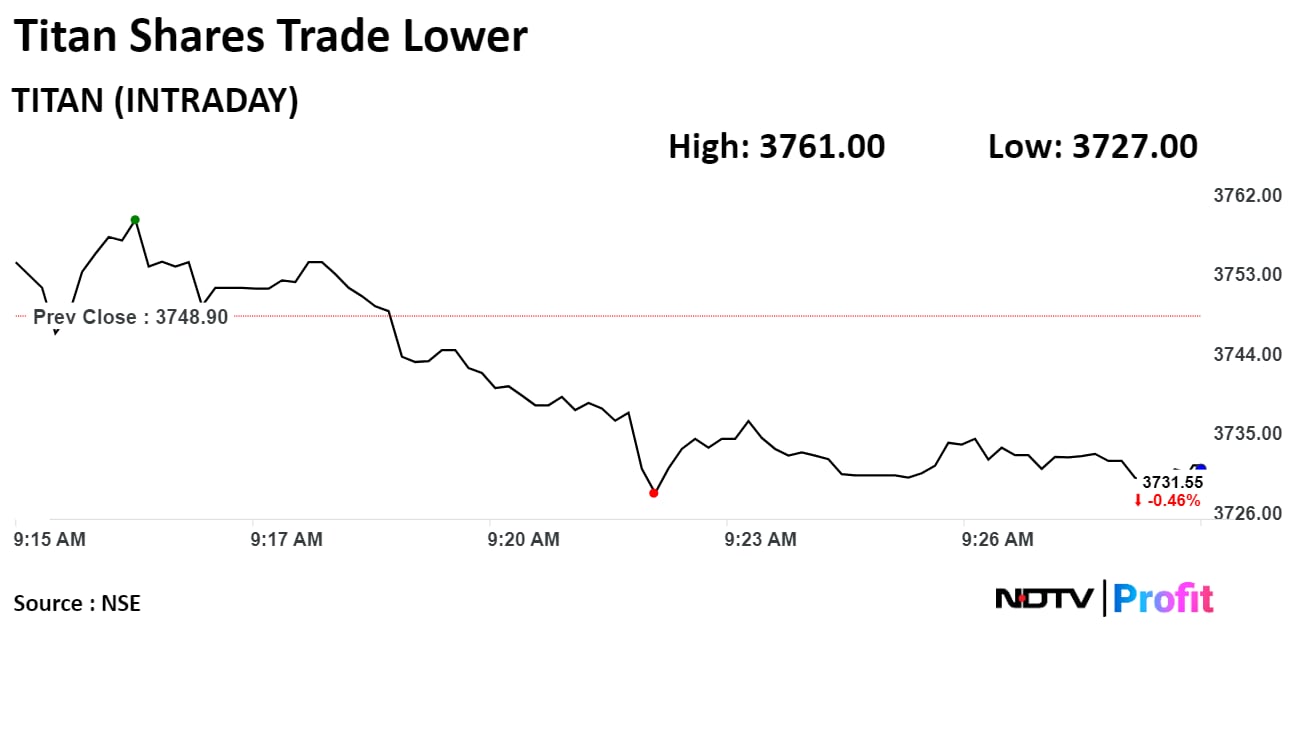

Titan's stock fell as much as 0.58% during the day to Rs 3,727 apiece on the NSE. It was trading 0.43% lower at Rs 3,732.65 per share, compared to a 0.16% advance in the benchmark Nifty 50 as of 9:28 a.m.

The share price has risen 44.47% in the last 12 months. The relative strength index was at 53.

Twenty-three out of the 33 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and four suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.