Shares of Gland Pharma Ltd. fell nearly 7% on Tuesday to its lowest level in over two weeks. The drop came after 9.3 million shares, or 5.66% stake of the company, changed hands in a large trade. The trade happened at Rs 1,743.95 apiece, according to data from Cogencis. The buyers and sellers were not known immediately.

On Monday, NDTV Profit had reported that Nicomac Machinery Pvt. and RP Advisory Services Pvt. plan to exit the company by selling up to a 4.9% stake via block trade.

According to the terms seen by NDTV Profit, the base offer size is for 72.44 lakh shares (4.4%), worth Rs 1,249.7 crore on the lower end of the price range. There is an option to upsize for 8.76 lakh shares (0.53%). The floor price is at Rs 1,725 apiece, a discount of 7.34% from Monday's closing price.

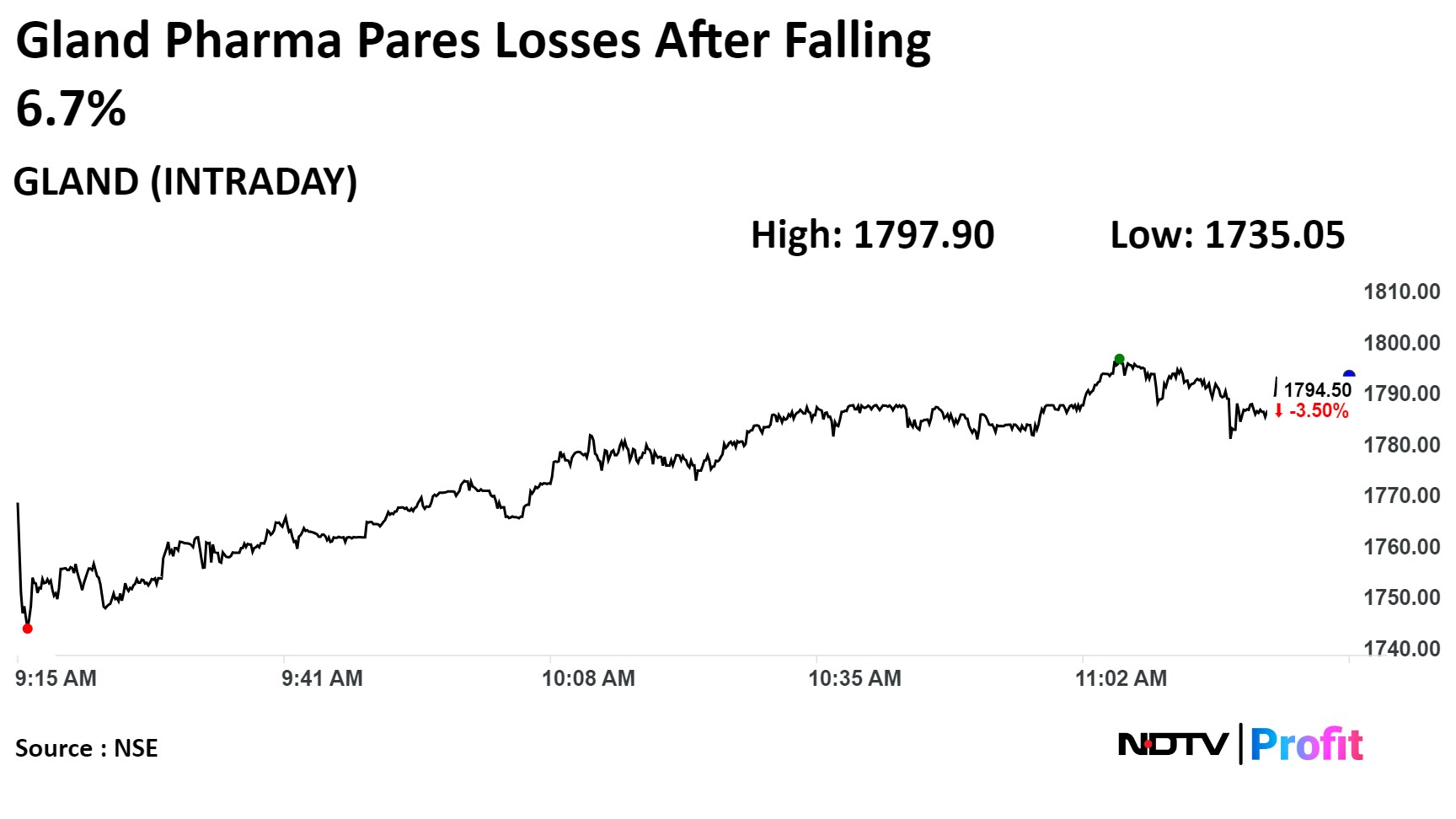

On the NSE, Gland Pharma's stock fell as much as 6.7% during the day to Rs 1,735.05 apiece, the lowest since March 21. It was trading 3.54% lower at Rs 1,792 per share, compared to a 0.3% advance in the benchmark Nifty as of 11:31 a.m.

The share price has risen 32.02% in the last 12 months and fallen 7.3% on a year-to-date basis. The total traded volume so far in the day stood at 74.34 times its 30-day average. The relative strength index was at 48.95.

Eleven out of the 19 analysts tracking the company have a 'buy' rating on the stock, two recommend 'hold' and six suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.