Shares of Honasa Consumer Ltd. the owner of Mamaearth and The Derma Co., surged over 9% on Monday on nearly threefold jump in its third-quarter profit.

The company's consolidated net profit rose 264.78% year-on-year to Rs 25.9 crore in the quarter ended December, according to an exchange filing.

Honasa Consumer Q3 FY24 (Consolidated, YoY)

Revenue up 27.76% at Rs 488.2 crore.

Ebitda up 191.52% at Rs 34.4 crore.

Margin expands 395 bps to 7.04%.

Net profit up 264.78% at Rs 25.9 crore.

"A larger sort of driver for a margin expansion has been efficiency and ENP, which has optimised by almost 200 basis points from a year-on-year basis. I think that continues to be the biggest lever in terms of margin unlocking as we look ahead," Chief Financial Officer Ramanpreet Sohi told NDTV Profit.

He further added that they have more levers to unlock 100 to 150 bps in the operating margins on a year-on-year basis. This is because as Mamaearth moves offline, it is getting more profitable, and Sohi sees that helping with the margins.

As The Derma Co., the second-largest brand, turns profitable and Mamaearth's offline presence increases, the company expects the younger brands to soon be able to balance the offline and online business.

Commenting on the rural demand, he said, "I think we see, at least in the near term and to a certain extent in the medium term, some level of pressure coming on the consumer demand."

He also said that there has been a general slowdown in general trade outlets.

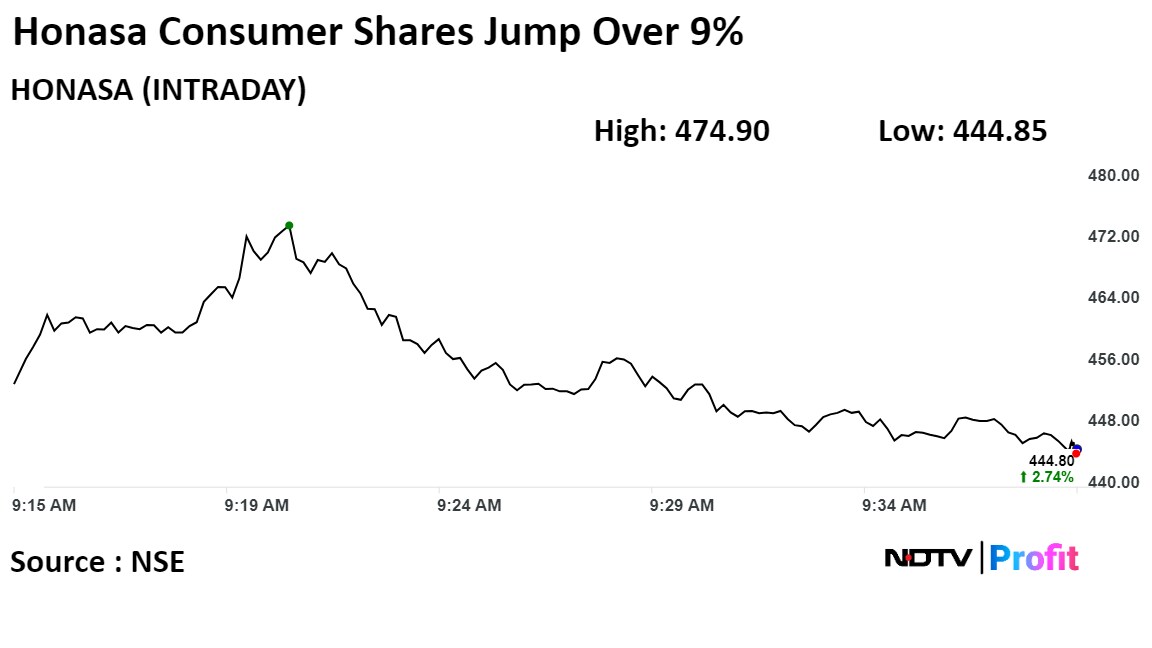

Shares of the company surged 9.69% to Rs 474.90 apiece, the highest level since Jan. 31. It pared gains to trade 3.81% higher at Rs 449.45 apiece as of 9:34 a.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has risen 33.33% in the last 12 months. Total traded volume so far in the day stood at 25 times its 30-day average. The relative strength index was at 49.

Out of three analysts tracking the company, two maintain a 'buy' rating, and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.