Shares of L&T Technology Services Ltd. snapped a two-day losing streak on Wednesday after its third-quarter profit rose in line with analysts' estimates.

The company's net profit rose 6.6% year-on-year to Rs 336.8 crore in the quarter ended December, according to an exchange filing. The analysts polled by Bloomberg estimated net profit at around Rs 331.2 crore.

LTTS Q3 Results: Key Highlights (Consolidated, QoQ)

Revenue up 1.5% at Rs 2,421.8 crore. (Bloomberg estimate: Rs 2,451 crore).

EBIT up 2.4% at Rs 416.2 crore. (Bloomberg estimate: Rs 421.2 crore).

EBIT margin at 17.18% vs 17.02% (Bloomberg estimate: 17.2%).

Net profit up 6.6% at Rs 336.8 crore. (Bloomberg estimate: Rs 331.2 crore).

"We keep our FY24/FY25 EPS estimates broadly unchanged after the 3QFY24 results," said brokerage Motilal Oswal in a report. It reaffirmed its 'buy' call on the stock with a target price of Rs 6,220 apiece, citing a better outlook for the ER&D services industry compared to the broader IT services universe and the growing penetration of outsourced ER&D services.

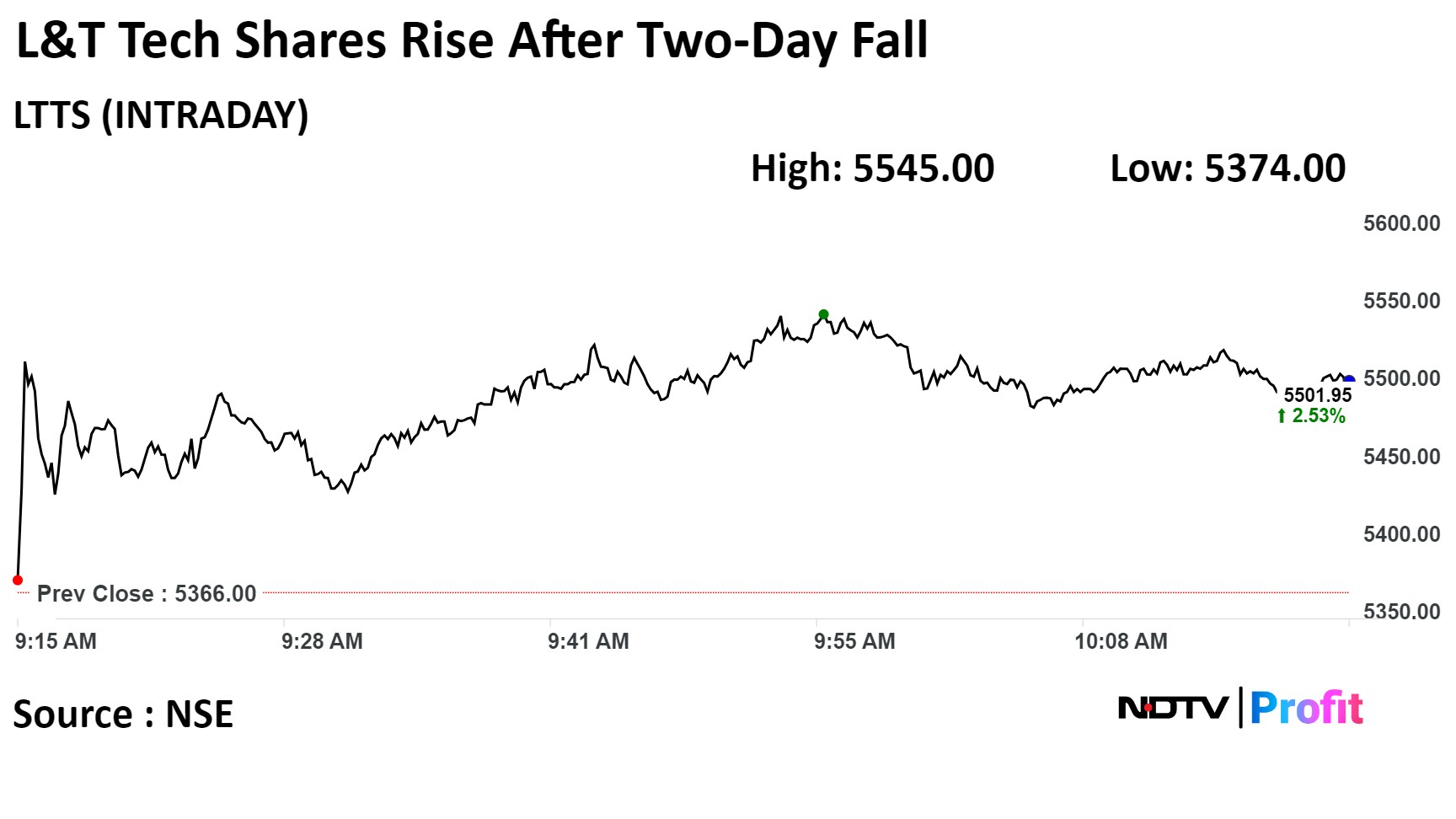

Shares of the company rose as much as 3.65% to Rs 5,545 apiece, its highest level since Monday. At 10:28 a.m., the stock pared gains to trade 2.9% higher at Rs 5,505. This compares to a 1.14% advance in the NSE Nifty 50 Index.

It has risen by 61.22% in the last twelve months. Total traded volume so far in the day stood at five times its 30-day average. The relative strength index was at 67.18.

Out of 29 analysts tracking the company, seven maintain a 'buy' rating, seven recommend a 'hold,' and 15 suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 12.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.