Shares of Life Insurance Corp. surged over 7% to a 52-week high on Friday after the Union government has granted a one-time exemption for achieving a minimum 25% public shareholding by May 2032.

The Department of Economic Affairs cited "public interest" for its decision to grant the exemption for 10 years, the state-run insurer said in its exchange filing on Thursday.

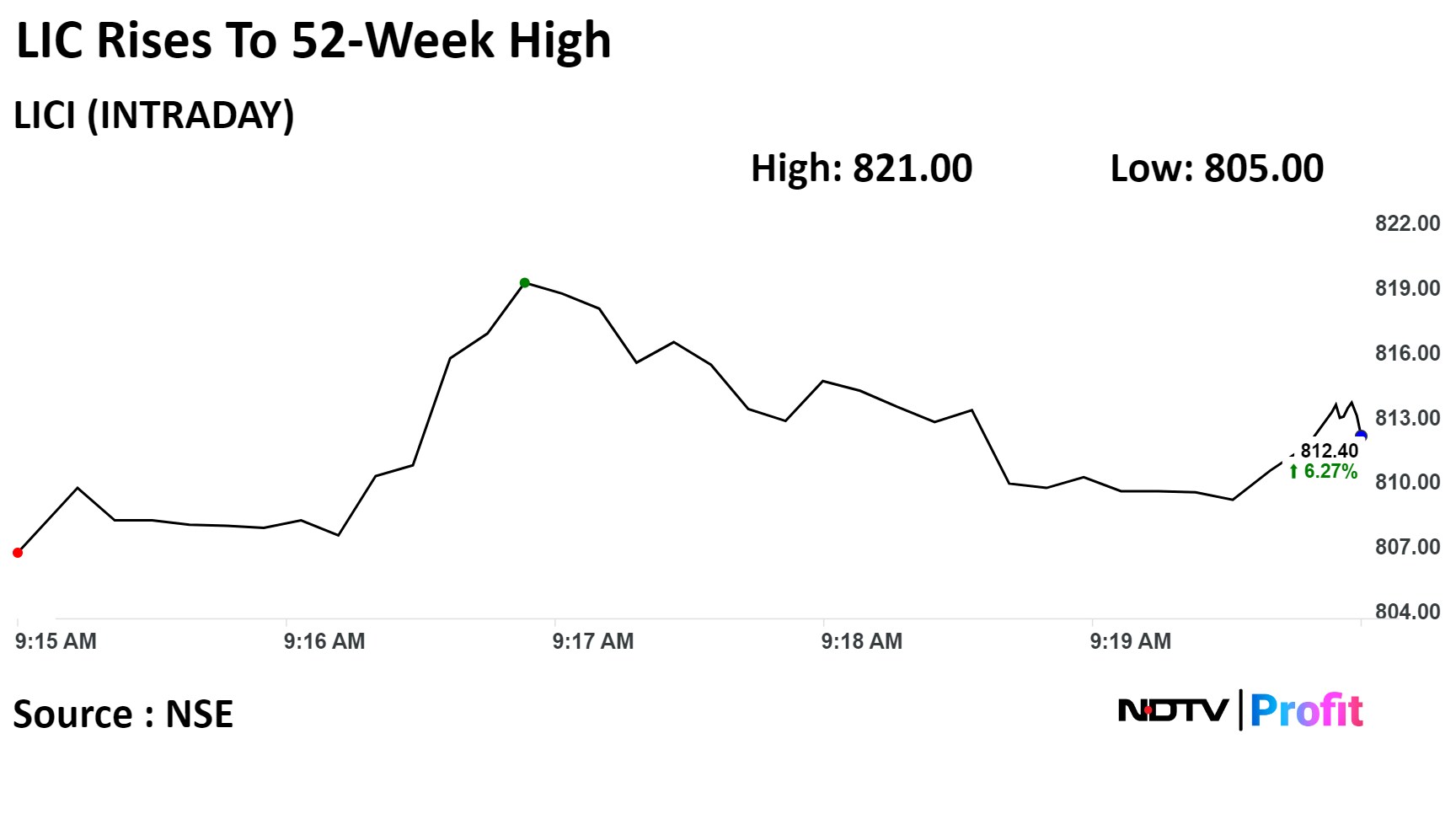

On the NSE, LIC's stock rose as much as 7.39% during the day to Rs 821 apiece. It was trading 6.25% higher at Rs 812.30 apiece as of 09:20 a.m. compared to a 0.05% advance in the benchmark Nifty 50.

The stock rose the most in a single day since Dec 4.

It has risen 11.67% on a year-to-date basis. The relative strength index was at 60.93.

Out of 19 analysts tracking the company, 14 have a 'buy' rating on the stock, four recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 8.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.