The shares of KPIT Technologies Ltd. surged over 7% on Wednesday after its third-quarter profit jumped, meeting analysts' estimates.

The company's consolidated net profit jumped 10.85% sequentially to Rs 156.75 crore in the quarter ended December, according to an exchange filing. A Bloomberg poll of analysts estimates pegged a net profit of Rs 149.4 crore.

KPIT Technologies Q3 Results Highlights (Consolidated, QoQ)

Revenue up 4.82% at Rs 1,257 crore (Bloomberg estimate: Rs 1,243.2 crore).

EBIT up 8.70% at Rs 208.54 crore (Bloomberg estimate: Rs 202.2 crore).

EBIT margin up 59 basis points at 16.59% (Bloomberg estimate: 16.3%).

Net profit up 10.85% at Rs 156.75 crore (Bloomberg estimate: Rs 149.4 crore).

“Basis our performance so far, robust pipeline and the consistency of demand driven by new technology investments by our strategic clients, we are confident of meeting our upward revised outlook for the year,” Kishor Patil, chief executive officer at KPIT Technologies, said in a statement accompanying the earnings.

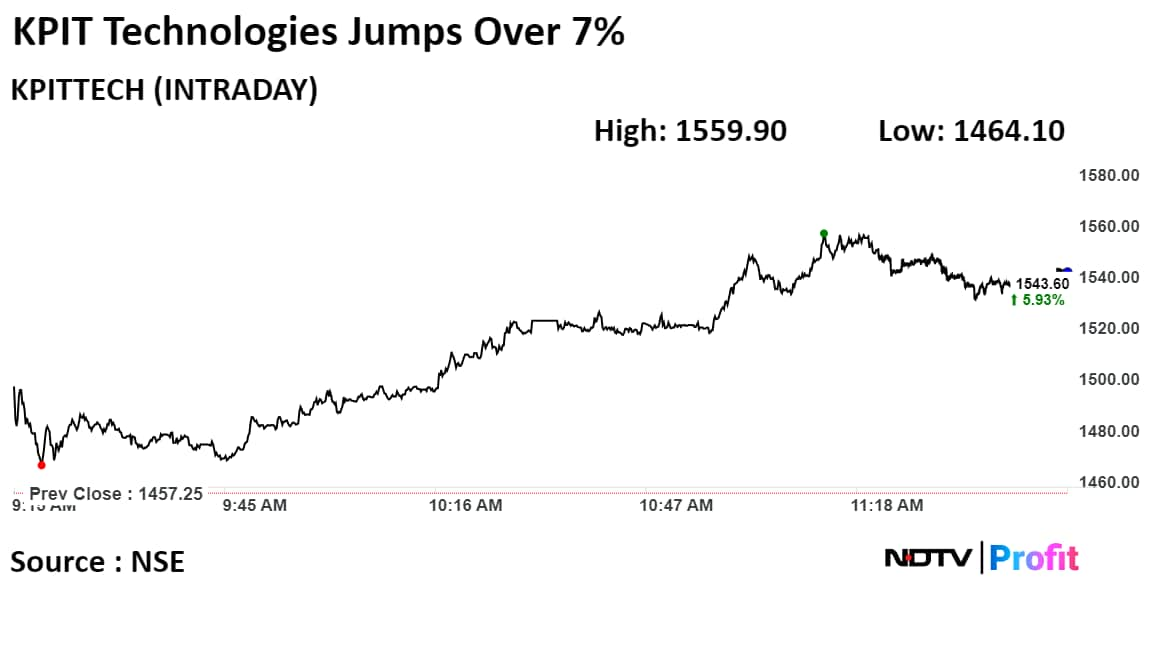

Shares of the company surged 7.04% to 1,559.90 apiece, the highest level since Jan. 23. It pared gains to trade 5.66% higher at Rs 1,539.70 apiece, as of 11:45 a.m. This compares to a 0.85% advance in the NSE Nifty 50 Index.

It has risen 101.82% in the last 12 months. Total traded volume so far in the day stood at 4 times its 30-day average. The relative strength index was at 56.

Out of 15 analysts tracking the company, 10 maintain a 'buy' rating, one recommends a 'hold,' and four suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 103.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.