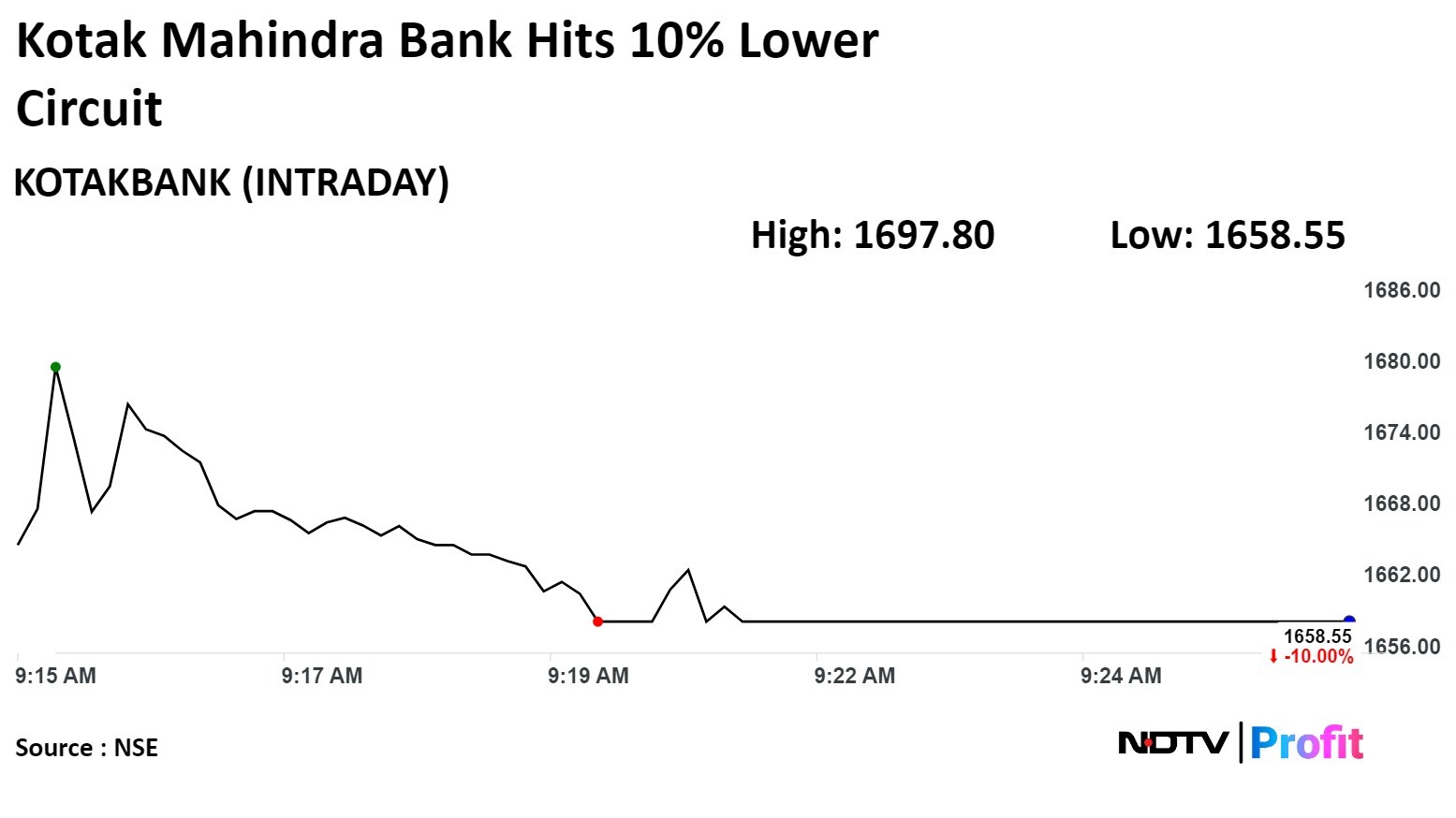

Shares of Kotak Mahindra Bank hit a 10% lower circuit on Thursday after the Reserve Bank of India's recent crackdown. The stock further fell over 13% intraday to over three-year low following the revised lower circuit limit by the exchanges.

The RBI directed India's third-largest private lender by market capitalisation to cease and desist the issue of fresh credit cards and the onboarding of new customers through its online and mobile banking channels with immediate effect.

Brokerages, meanwhile, have slashed their target price for Kotak Mahindra Bank Ltd. as the private lender's growth and interest margins could be adversely impacted due to this action.

As of 9:24 a.m., Kotak Mahindra Bank lost over Rs 36,600 crore in market capitalisation. The private lender also has about 1.63 million shares trade hands in a bunch, according to Bloomberg.

Kotak Mahindra's stock fell as much as 13.07% during the day to Rs 1,602 apiece on the NSE. It was trading 9.64% lower at Rs 1,665.1 apiece, compared to a 0.2% advance in the benchmark Nifty 50 as of 10:15 a.m.

It has fallen 11.82% in the last 12 months. The total traded volume so far in the day stood at 46 times its 30-day average. The relative strength index was at 33.

Twenty five out of the 44 analysts tracking the company have a 'buy' rating on the stock, 15 recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 2.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.