Shares of Kirloskar Oil Engines Ltd. jumped to hit their lifetime high on Thursday after its profit for the quarter ended March jumped 86.04%.

The company reported a net profit of Rs 147 crore in the fourth quarter, compared with Rs 78.91 crore same quarter a year earlier, according to an exchange filing.

Kirloskar Oil Engines (Consolidated, YoY)

Revenue up 19.95% at Rs 1,660 crore.

Ebitda up 59.36% at Rs 302.69 crore.

Margin up 450 bps at 18.23%.

Net profit up 86.04% at Rs 147 crore.

Board recommends final dividend of Rs 3.5 per share.

The company said it has achieved its highest-ever quarterly and yearly revenue figures, surpassing Rs 500 crore in international sales for the first time.

"From a business perspective, our CPCB IV+ products have experienced good traction, alongside the encouraging response for the newly introduced Optiprime range," the company said. "Our B2B segment growth was backed by strong demand in key sectors such as construction, infrastructure, and railways. Meanwhile, our efforts focused on enhancing profitability in the B2C segment have yielded substantial improvements in segment PBIT compared to the previous year."

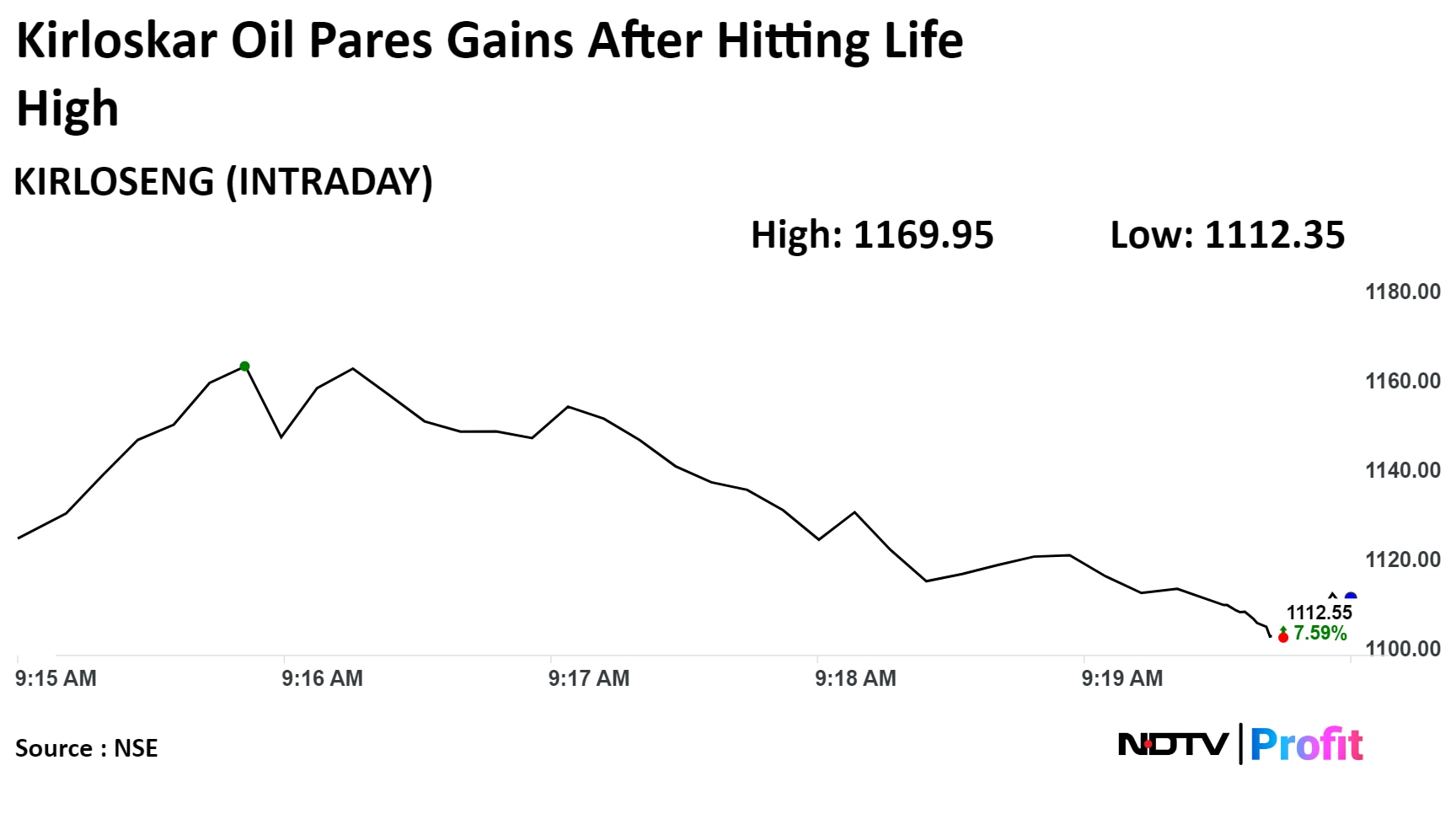

Shares of the company rose as much as 13.14% to hit a record high of Rs 1,169.95 apiece. It pared gains to trade 6% higher at Rs 1,095.10 apiece as of 9:31 a.m. This compares to a 0.26% decline in the NSE Nifty 50 Index.

The stock has risen 6.14% on a year-to-date basis and 67.8% in the last 12 months. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 79.84, indicating that the stock may be overbought.

All the three analysts tracking the company have a 'buy' rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies a downside of 13.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.