Shares of JM Financial Ltd. hit a 20% lower circuit on Wednesday after the RBI barred JM Financial Products Ltd. from lending against shares, debentures with immediate effect.

This includes lending against initial public offer of shares as well as against subscriptions to debentures. The regulator has observed serious deficiencies in loans sanctioned for IPO financing, and as well as to non-convertible debentures, according to a release by RBI.

JM Financial Group said there are no material deficiencies in the loan-sanctioning process and claimed that there's no governance issues as well. The company also said it has not violated any applicable rule, according to a statement.

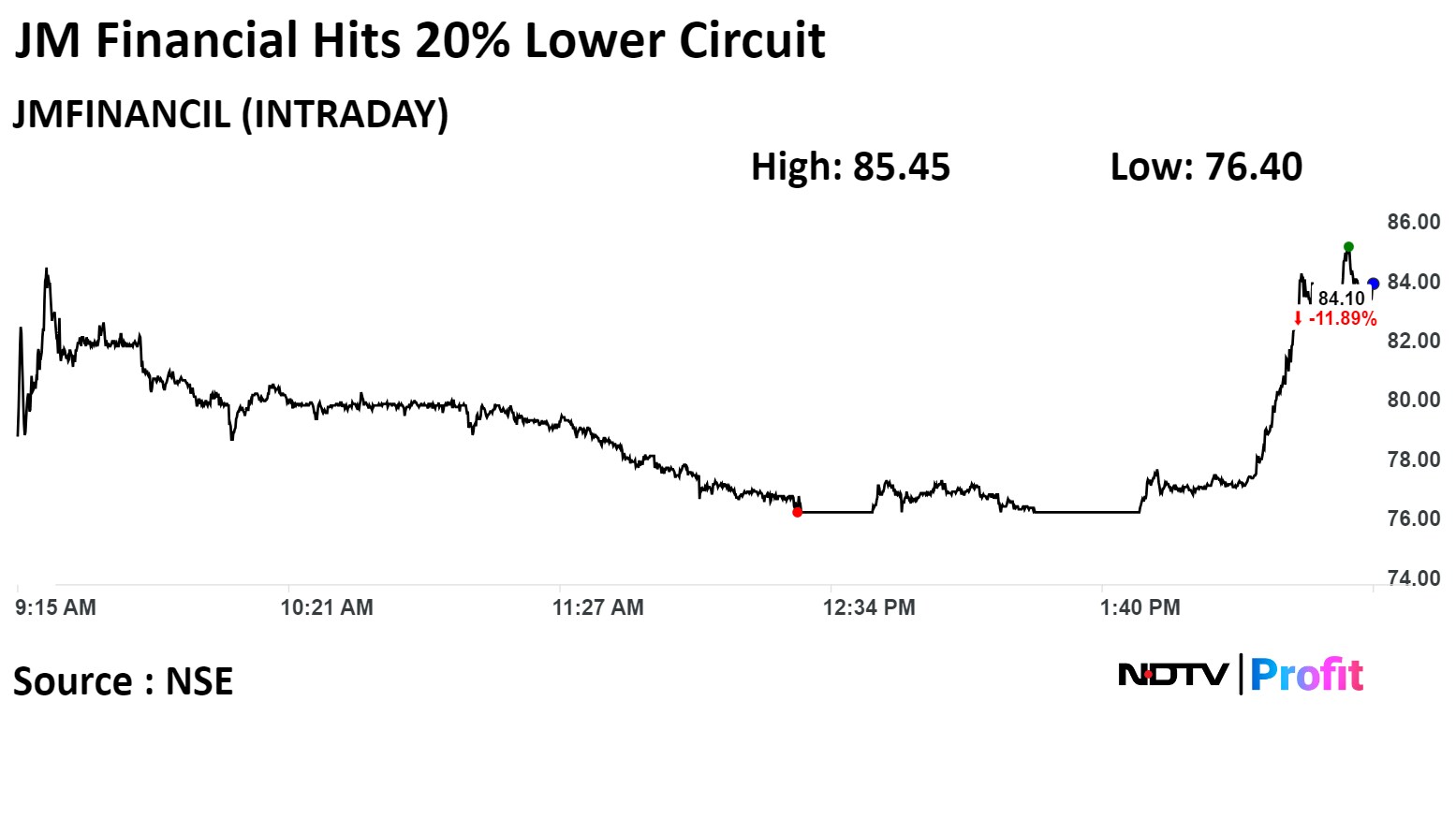

Shares of JM Financials fell as much as 19.96% during the day to hit the lower circuit of Rs 76.4 apiece on the NSE. The previous low was on seen on Aug. 31, 2023. This It was trading 12.72% lower at Rs 83.3 apiece, compared to a 0.4% advance in the benchmark Nifty 50 as of 2:39 p.m.

It has risen 29.09% in the last 12 months. The total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 25.9.

One analysts tracking the company has a 'buy' rating on the stock, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.