Shares of Eicher Motors Ltd. jumped 6% on Wednesday to the highest in three weeks after UBS Research upgraded the automaker from 'neutral' to a 'buy' rating.

The brokerage has also raised the target price of the Royal Enfield maker to Rs 5,000 apiece from the earlier Rs 4,300 per share, implying a potential upside of 16%.

UBS expects that Royal Enfield's new 450cc liquid cooled engine platform, introduced with the new Himalayan 450, to address competition and growth concerns, especially with a strong launch pipeline in store. The brokerage added that new launches by rival companies did not ramp up volume meaningfully and are tracking well below guidance.

Competition has not breached Royal Enfield's qualitative edge and exports will deliver strong double-digit growth in the medium term, UBS said. It forecasted an 18% compound annual growth rate in Ebitda over financial years 2024–26 and said the stock was trading at a 17% discount to peers.

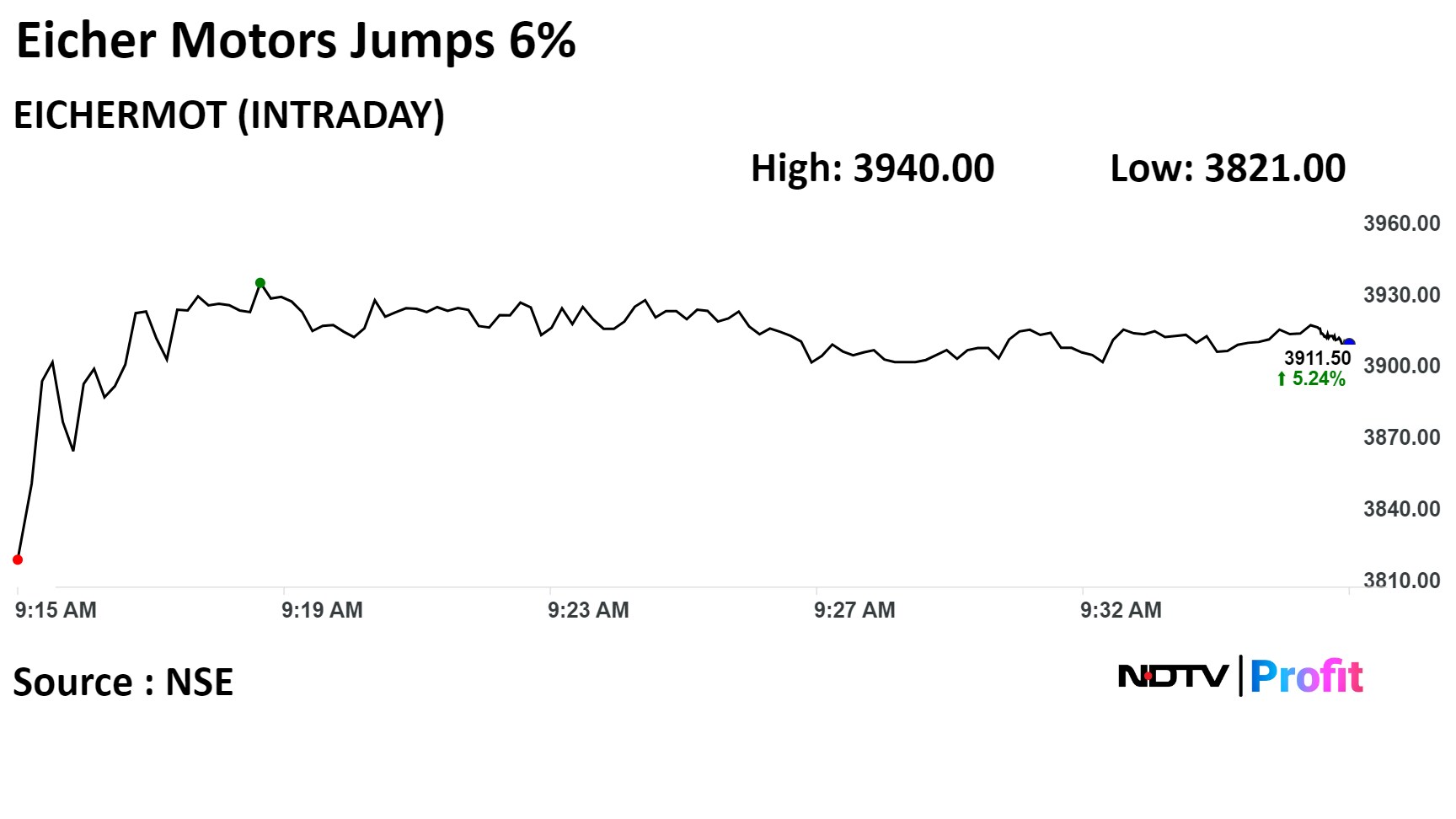

On the NSE, Eicher's stock rose as much as 6% during the day to Rs 3,940 apiece, the highest since Feb. 28. It was trading 5.04% higher at Rs 3,904 per share, compared to a 0.09% advance in the benchmark Nifty 50 as of 9:32 a.m.

The share price has risen 32.75% in the last 12 months. The total traded volume so far in the day stood at 24 times its 30-day average. The relative strength index was at 57.3.

Nineteen out of the 41 analysts tracking the company have a 'buy' rating on the stock, 11 recommend 'hold' and as many suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.