Shares of Novartis India Ltd. hit a 14-year high on Monday amid reports that Dr. Reddy's Laboratories Ltd. is in a race to acquire Novartis AG's stake in the India unit.

Dr. Reddy's stock also hit an all-time high following the reports. However, the Hyderabad-based pharmaceutical major has not commented on the matter yet.

Novartis has commenced the strategic review that will include an assessment of its 70.68% shareholding, a Novartis India spokesperson told NDTV Profit. "No decision has yet been taken regarding the eventual outcome. In the meantime, it is business as usual."

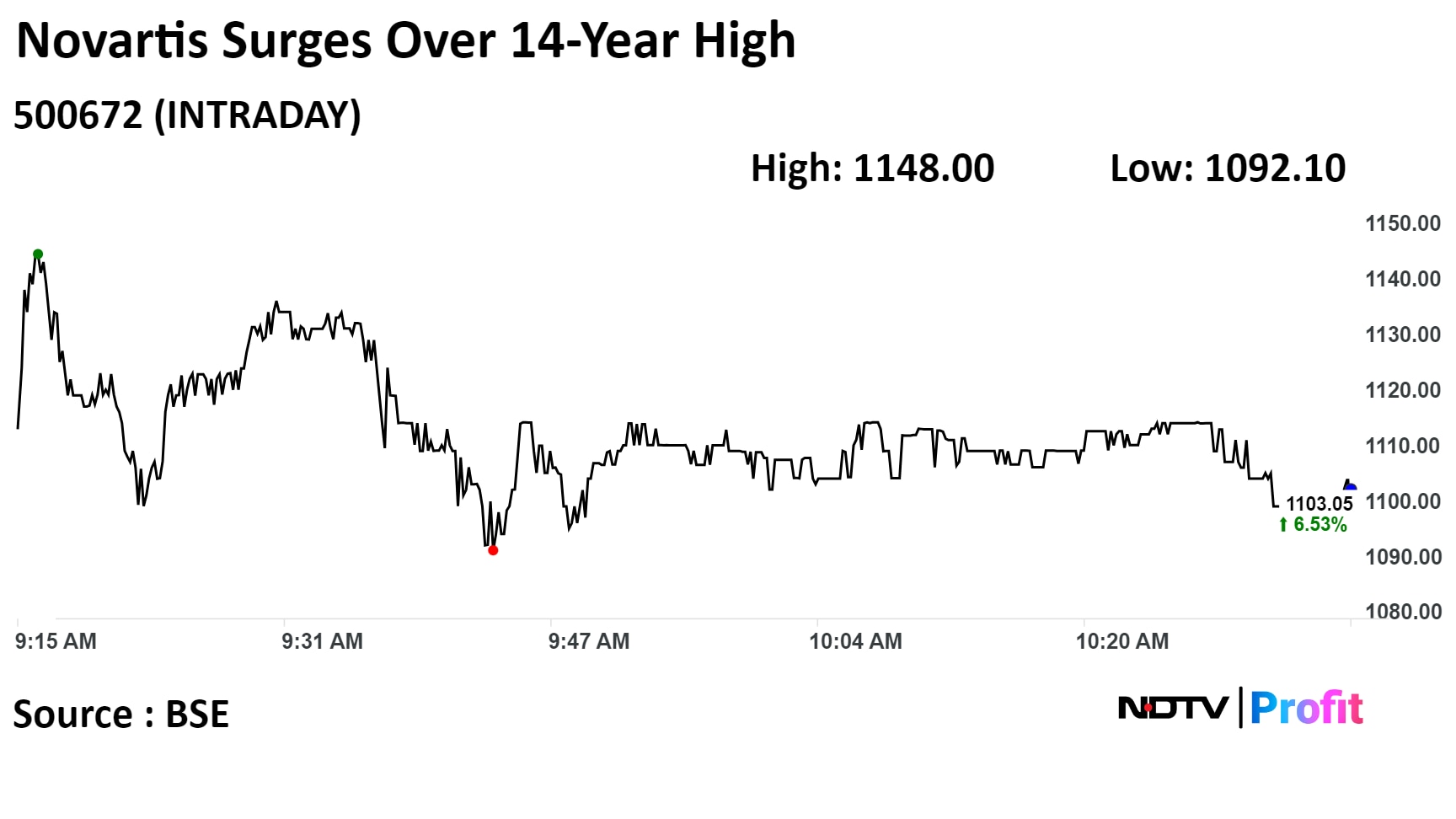

On the BSE, Novartis India's stock rose as much as 10.87% during the day to Rs 1,148 apiece, the highest since Feb. 11, 2000. It was trading 6.23% higher at Rs 1,110 per share, compared to a 0.15% advance in the benchmark Sensex at 10:35 a.m.

The share price has risen 85.45% in the past 12 months. The total traded volume so far in the day stood at 17 times its 30-day average. The relative strength index was at 77.33.

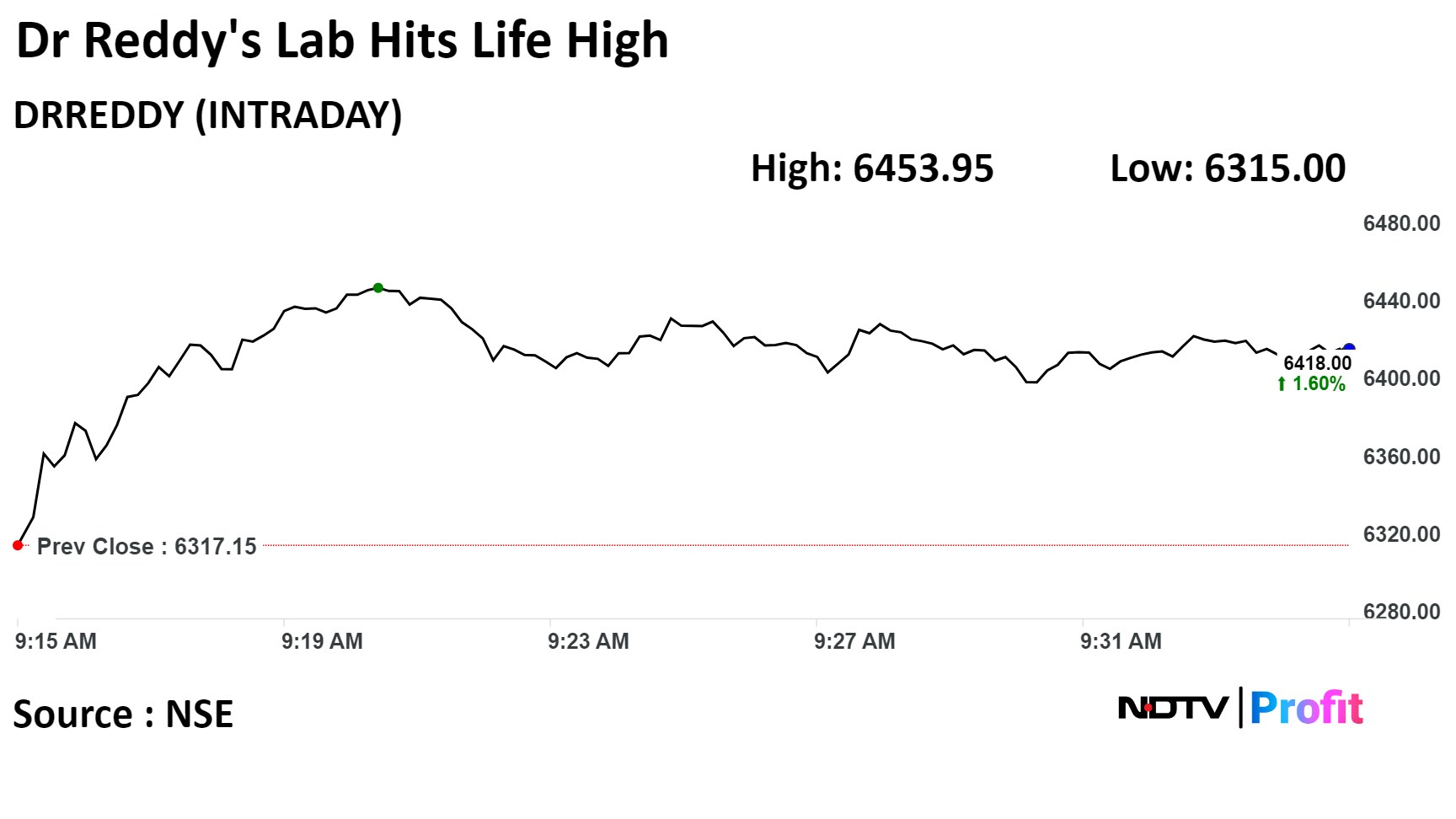

Shares of Dr. Reddy's rose as much as 2.17% to Rs 6,453.95 apiece on the NSE. It was trading 1.36% higher at Rs 6,403.30 per share, compared to a 0.22% advance in the benchmark Nifty 50 at 10:54 a.m.

The share price has risen 43.42% in the past 12 months. The total traded volume so far in the day stood at 18.9 times its 30-day average. The relative strength index was at 72.80.

Seventeen out of 42 analysts tracking Dr. Reddy's have a 'buy' rating on the stock, 11 recommend a 'hold' and 14 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 8.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.