Shares of Avenue Supermarts Ltd. rose to a 17-month high on Tuesday after ICICI Securities raised target prices and ratings on the stock, citing that the operator of DMart will outperform Nestle in the medium term.

The brokerage raised the rating to 'add' from 'hold' and hiked the target price to Rs 4,800 apiece from Rs 4,100 per share.

Palatable valuations, known problems with limited downside business risk, revenue outperformance and healthy margins will drive this outperformance, it said.

"Despite a lower contribution from the margin-accretive apparel segment, the net profit margin for DMart remained stable at 5.6% in nine months of this fiscal, in the range of medium-term guidance of 5-6%," the brokerage said.

This was driven by premiumisation in the non-food segment and improvements in distribution efficiency, with a higher share of products being directly distributed by DMart from its own distribution centre, ICICI Securities said.

The valuation premium that DMart used to command earlier has significantly decreased over the last two years, the brokerage noted. The one-year forward P/E multiple for DMart used to trade at around a 50% premium to Nestle during FY23. It has now been reduced to around 8%, it said.

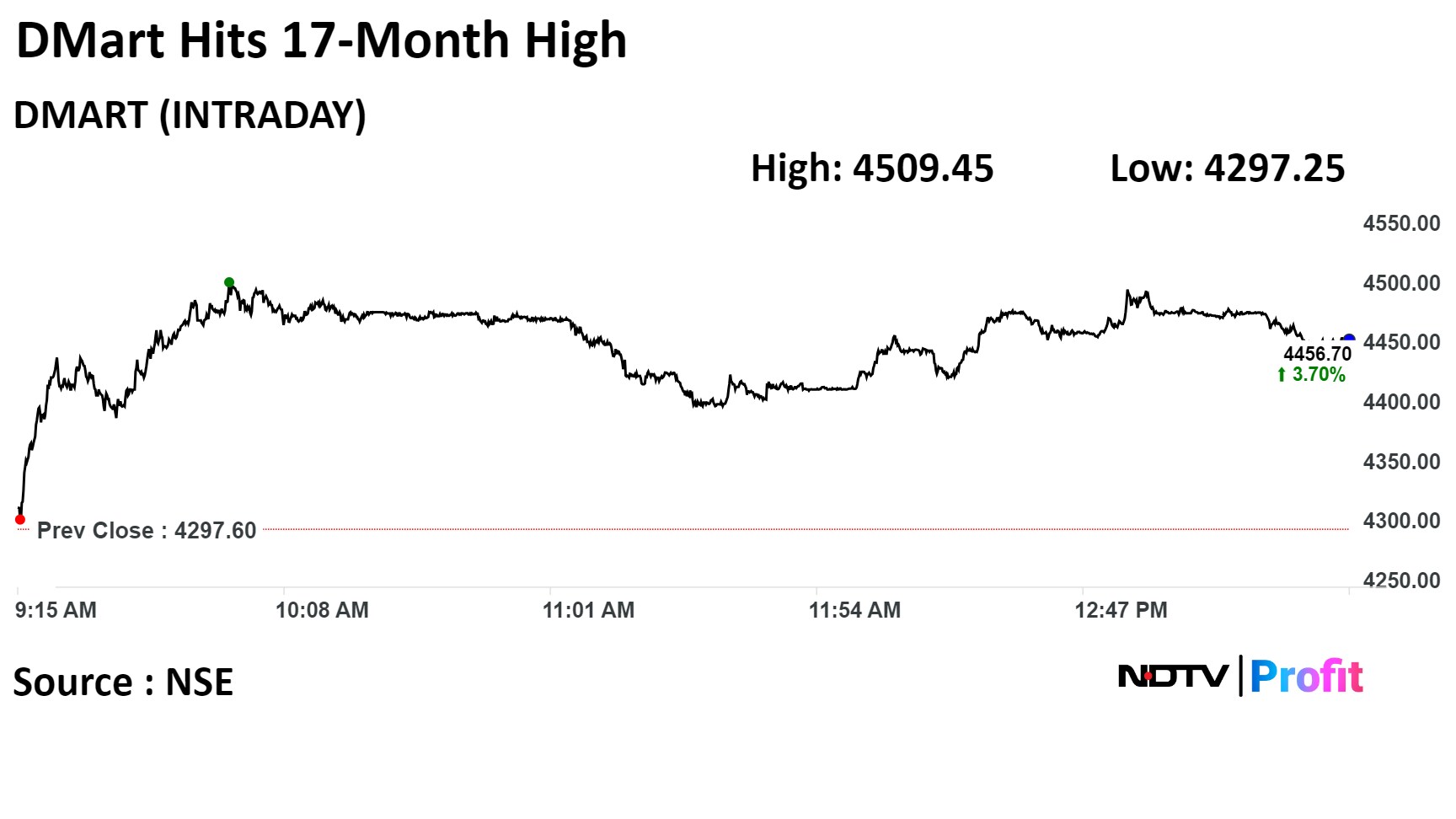

Shares of the company rose as much as 4.93%, the highest level since Oct. 6, 2022, before paring gains to trade 3.7% higher as of 1:42 p.m. This compares to a 0.25% decline in the NSE Nifty 50.

The stock has risen 31.02% year-to-date. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 80.77, indicating that the stock may be overbought.

Of the 26 analysts tracking the company, 12 maintain a 'buy' rating, five recommend a 'hold', and nine suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies a downside of 7.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.