Shares of Avenue Supermarts Ltd., which operates the retail chain DMart, jumped the most in over five months on Thursday after CLSA India Pvt. initiated coverage on the stock with a 'buy' rating, citing an opportunity to enter in the untapped market.

DMart is one of the leaders in India's $500-billion urban food and grocery market, which is largely dominated by small traditional retailers, the research firm said in a note. "We see (the) total addressable market growing to $2.3 trillion in 25 years, with DMart's share rising to 5% from less than 1% at present."

CLSA has the highest target price at Rs 5,107 apiece, implying a potential upside of 22.81%.

The research firm sees DMart stores increasing over three times by financial year 2034 from 341 at present as the company expands its presence in current and new states.

If the company reaches a similar store-to-population density as Walmart, which has a store per 1,00,000 people in the U.S., CLSA sees a potential for over 7,000 DMart stores in urban India in the next 25 years.

DMart is a discount retailer with the lowest operating costs, which have driven the lowest consumer prices. This, in turn, is leading to high sales velocity and better scale, reducing costs — a virtuous loop that allows the company to gain market share in a price-sensitive market. It is rapidly scaling its private-label assortment, which will drive the next leg of share gains, according to CLSA.

Lowest Consumer Prices Due To Lowest Operating Cost

DMart is one of the lowest-cost retailers globally, operating on an everyday low-cost, everyday low-price model, CLSA said.

With relatively low affordability across categories in India, DMart's low prices have been a key competitive advantage, which, along with consistent and efficient execution, has allowed the company to gain market share in overall, modern grocery retail between 2014 and 2023, it said.

Private Labels Should Drive Next Leg Of Share Gains

Historically, DMart has underplayed the private-label opportunity so as not to be seen competing with large suppliers and key brands. "However, we have seen a steady increase in DMart's private-label offerings and believe private labels can be a key differentiator, especially when compared with ecommerce and quick commerce. Private brands are offered at a 20–40% discount to popular brands," CLSA said.

"A slower-than-anticipated shift from unorganised to organised retail is a risk to our view", it said.

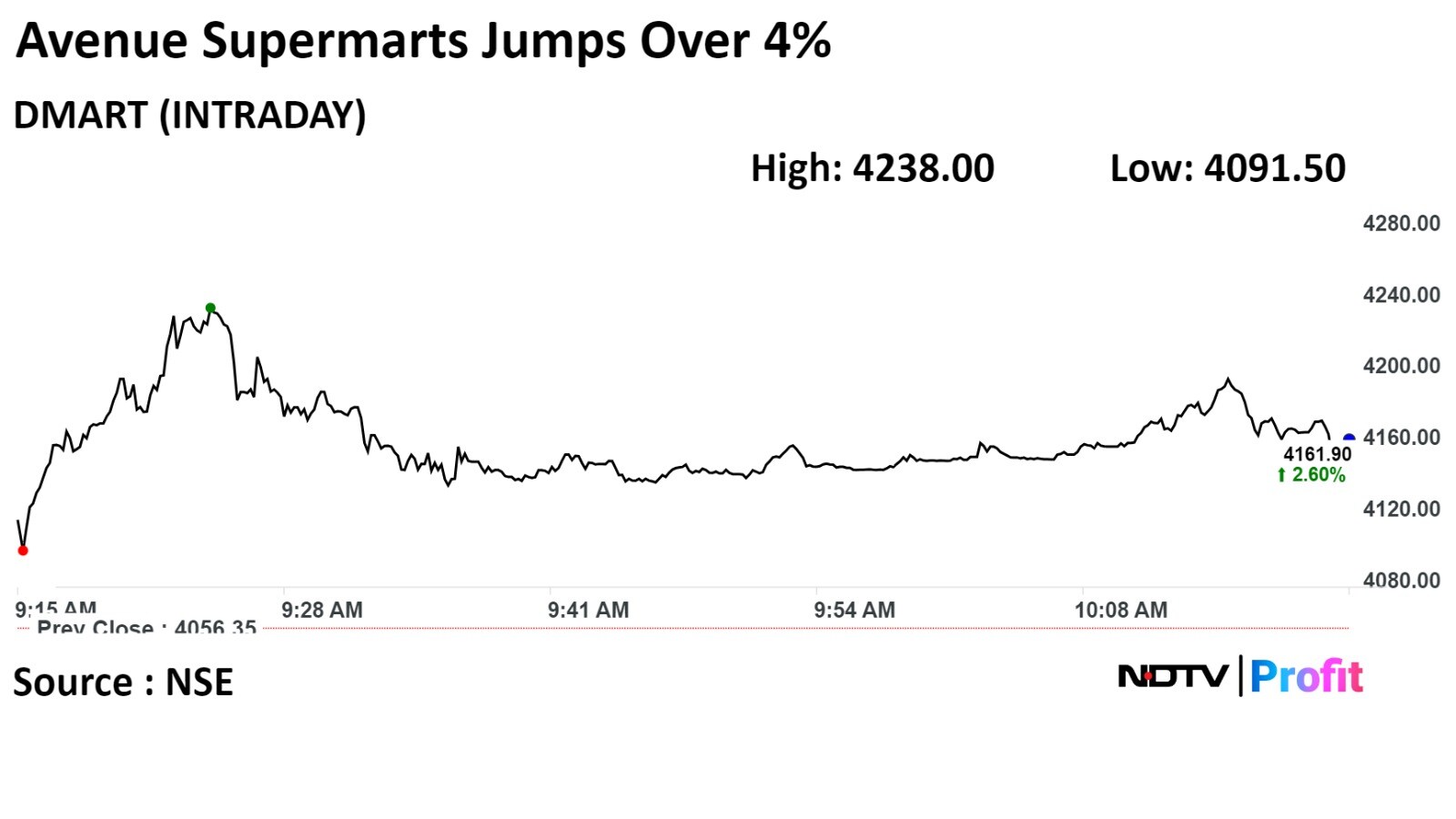

The stock rose as much as 4.48% during the day to Rs 4,238 apiece on the NSE. It was trading 3.17% higher at Rs 4,185 per share, compared to a 1.01% advance in the benchmark Nifty 50 as of 10:17 a.m.

The share price has risen 24.64% in the last 12 months. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 70, indicating an overbought position.

Eleven out of the 26 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and nine suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.