Most brokerages raised the target price on Coal India Ltd. after its fourth-quarter profit beat analysts' estimates mostly due to new accounting method, even as concerns on e-auction premium remained.

Citi Research remained 'neutral' on the stock, and opened negative catalyst watch. Kotak Institutional Equities retained 'sell', while Emkay Global Research kept 'buy' on the stocks.

The miner's Ebitda came at Rs 11,338 crore, which is below Citi Research's estimates. Lower e-auction volumes and higher employee expenses weighed on the Ebitda, the brokerage said.

Citi Research expects e-auctions volumes to be range-bound despite rising temperatures on adequate coal inventory.

Strong growth in Coal India's net profit should be seen in two contexts, Kotak Institutional Equities said. One is wage provision of Rs 5,800 crore taken in the base quarter Q4 of fiscal 2023. Second is write-back of over burden removal provision of Rs 1,500 crore.

In past two years, Coal India has benefitted higher auction realisation, which has fallen to Rs 2,545 per ton in January-March. It has peaked at Rs 6,062 per ton in second quarter of FY23.

However, Emkay Global Research said with e-auction premiums sustaining at around 65% in fourth quarter, some alleviation to that concern is on the horizon. The brokerage's earning estimate for Coal India remained at 10%, ahead of consensus for FY25.

Coal India Q4 FY24 Results Highlights (Consolidated, YoY)

Revenue down 1.95% at Rs 37,410 crore. (Bloomberg estimate: Rs 36,909 crore).

Ebitda up 21.47% at Rs 11,338 crore. (Bloomberg estimate: Rs 10,132 crore).

Margin up 584 bps at 30.3%. (Bloomberg estimate: 27.5%).

Net profit up 25.78% at Rs 8,640 crore. (Bloomberg estimate: Rs 7,617 crore).

Board recommends final dividend of Rs 5 per share.

Brokerage Take

Citi Research

The brokerage has a 'neutral' rating on the stock, but raised the target price to Rs 460 apiece from Rs 430 apiece, implying an upside of 1.8%.

Citi Research had a 'negative catalyst watch open' on Coal India.

Ebitda seems to be below estimates on lower e-auction volumes and higher employee expenses.

The company changed the accounting policy on stripping activity.

E-auction prices may be range-bound despite rising temperatures on adequate coal inventory.

FY24 dividend is Rs 25.5 per share, in line with 43% payout.

Citi Research assumed wage inflation through FY23-26 at ~5% and FSA price CAGR at 2%.

Emkay Global

The brokerage maintained a 'buy' rating and the target price was also left unchanged at Rs 550 apiece.

E-auction premiums for Q4 are averaged at 65.7%, beating expectations of 45-50%.

Full-year employee cost came in at Rs 48,800 crore, higher than management guidance.

Emkay Global expects concerns around declining premiums alleviating to some extent.

Kotak Institutional Equities

Kotak kept a 'sell' on Coal India Ltd., but raised the target price to Rs 375 per share from Rs 335 apiece, which implied 17.4% downside potential.

Volume growth of 8% YoY was offset by decline in blended realisations by 5.8% YoY.

Headwinds on volume growth and declining realisations with e-auction premiums, the brokerage noted.

Coal India will likely benefit from 27 GW of under-construction coal-based capacities.

Benefit from absence of revision in FSA prices.

Don't see Coal India growing earnings from current base.

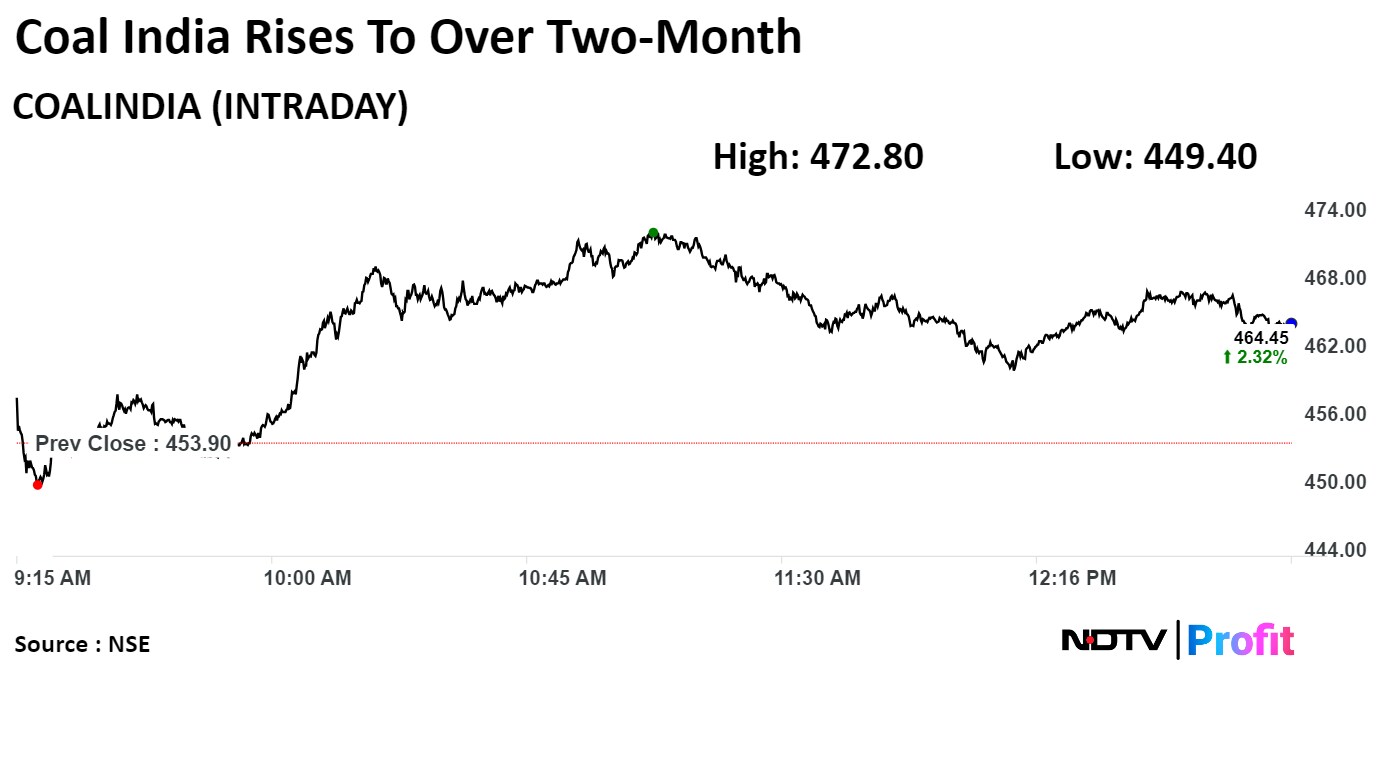

Shares of Coal India rose 4.16% intraday, the highest level since Feb. 19. They pared gains to trade 2.52% higher at 12:57 p.m., compared to 0.99% decline in the NSE Nifty 50.

The stock gained 95.86% in 12 months and 23.54% year-to-date. Total traded volume so far in the day stood at 6.3 times its 30-day average. The relative strength index was at 62.71.

Of the 26 analysts tracking the company, 20 maintain a 'buy' rating, three recommend a 'hold,' and three suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.