Shares of BEML Ltd. hit a fresh record high, while those of Jupiter Wagons Ltd. surged over 4% on Thursday after both bagged contracts from the defence ministry.

BEML won a Rs 329 crore contract from the ministry to manufacture 56 mechanical minefield marking equipment mark II, the ministry said in a statement. Much like other recent orders given by the ministry, this order will also be manufactured with equipment sourced from indigenous manufacturers to help boost them and the participation of the private sector in defence production.

Jupiter Wagons Ltd. secured an order worth Rs 473 from the ministry to manufacture 697 bogie open military wagons.

Shares of BEML rose as much as 6.60% to a fresh record high, compared to a 0.14% advance in the NSE Nifty 50 at 11:37 a.m.

The stock has risen 104.55% in the last 12 months. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 73.

Of the four analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold,' and one suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 104.8%.

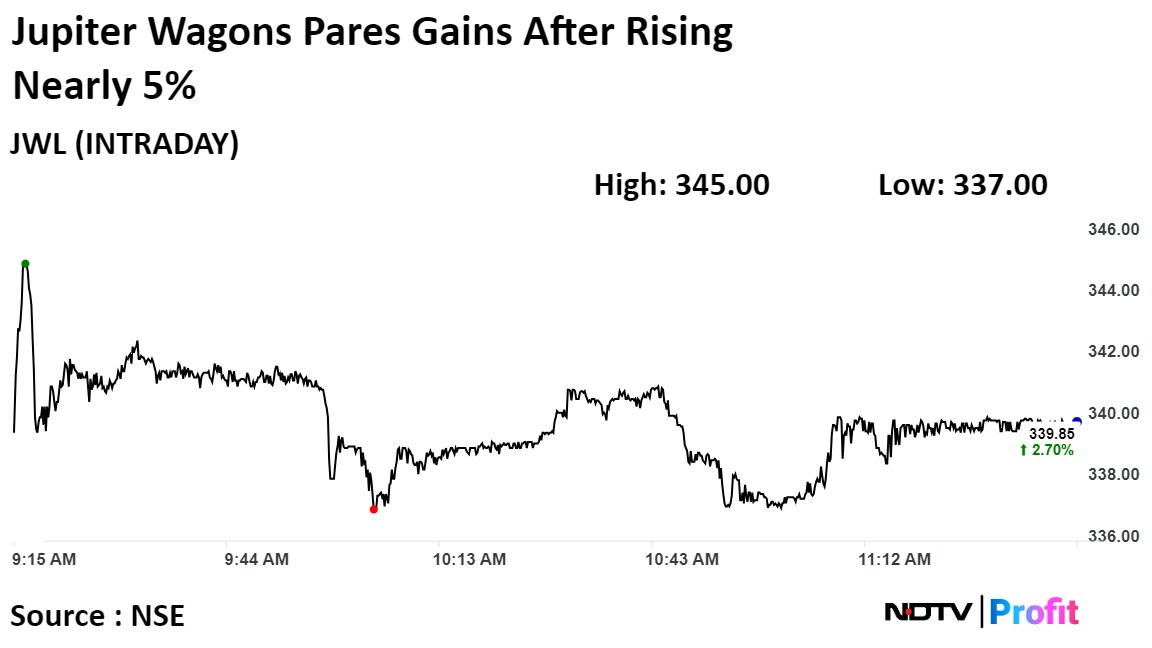

Shares of Jupiter Wagons also gained 4.26% intraday, the highest since Dec. 15. The stock pared gains to trade 2.70% higher at 11:33 a.m., compared to a 0.12% advance in the NSE Nifty 50.

It has risen 241.56% in the last 12 months. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 59.86.

Of the four analysts tracking the company, three maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 241.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.