Shares of the Anup Engineering Ltd. surged nearly 15% to a one-month high on Monday after it entered into a definitive share purchase agreement to fully acquire Mabel Engineering Pvt.

The aim is to expand product portfolio, capacity and geographical spread, according to an exchange filing. The company will also consider a bonus issue on Wednesday, adding to the positive sentiment for the stock.

The Mabel acquisition is expected to be completed by May 31 and the purchase consideration is Rs 33 crore. Mabel reported a turnover of Rs 27.1 crore in the last financial year, it said.

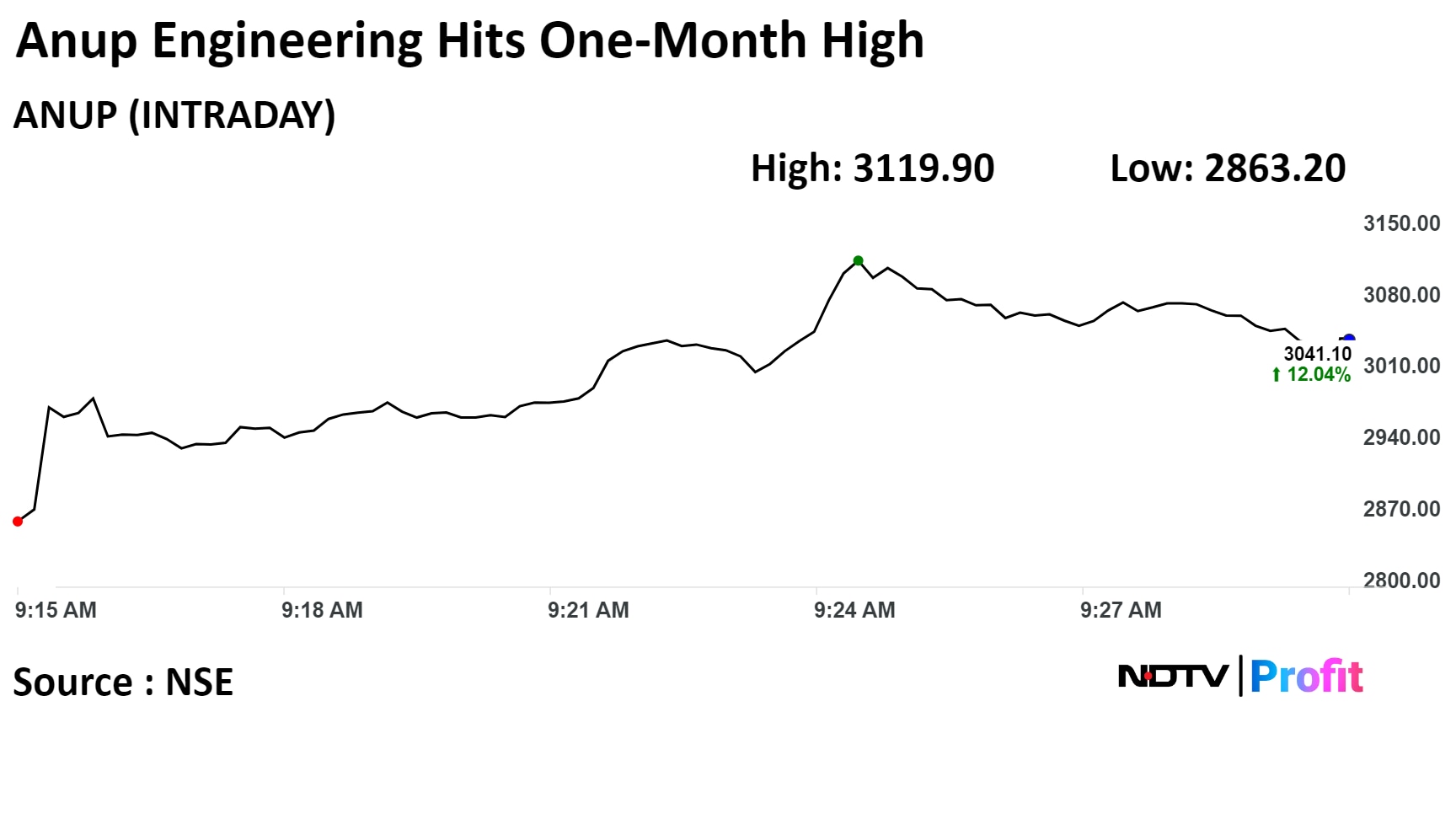

On the NSE, Anup's stock rose as much as 14.95% during the day to Rs 3,119.90 apiece, the highest since Feb. 9. It was trading 10.35% higher at Rs 2,998.90 per share, compared to a 0.2% decline in the benchmark Nifty 50 at 09:42 a.m.

The share price has risen 198.6% in the last 12 months. The total traded volume so far in the day stood at 31 times its 30-day average. The relative strength index was at 60.71.

Two analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.