(Bloomberg Businessweek) -- In 2019, while working as a senior economist at the Federal Reserve, Claudia Sahm published a measure to show when the US has fallen into a recession.

What came to be known as the Sahm Rule is elegant in its simplicity and has been praised for its accuracy by the likes of Nobel laureate Paul Krugman.

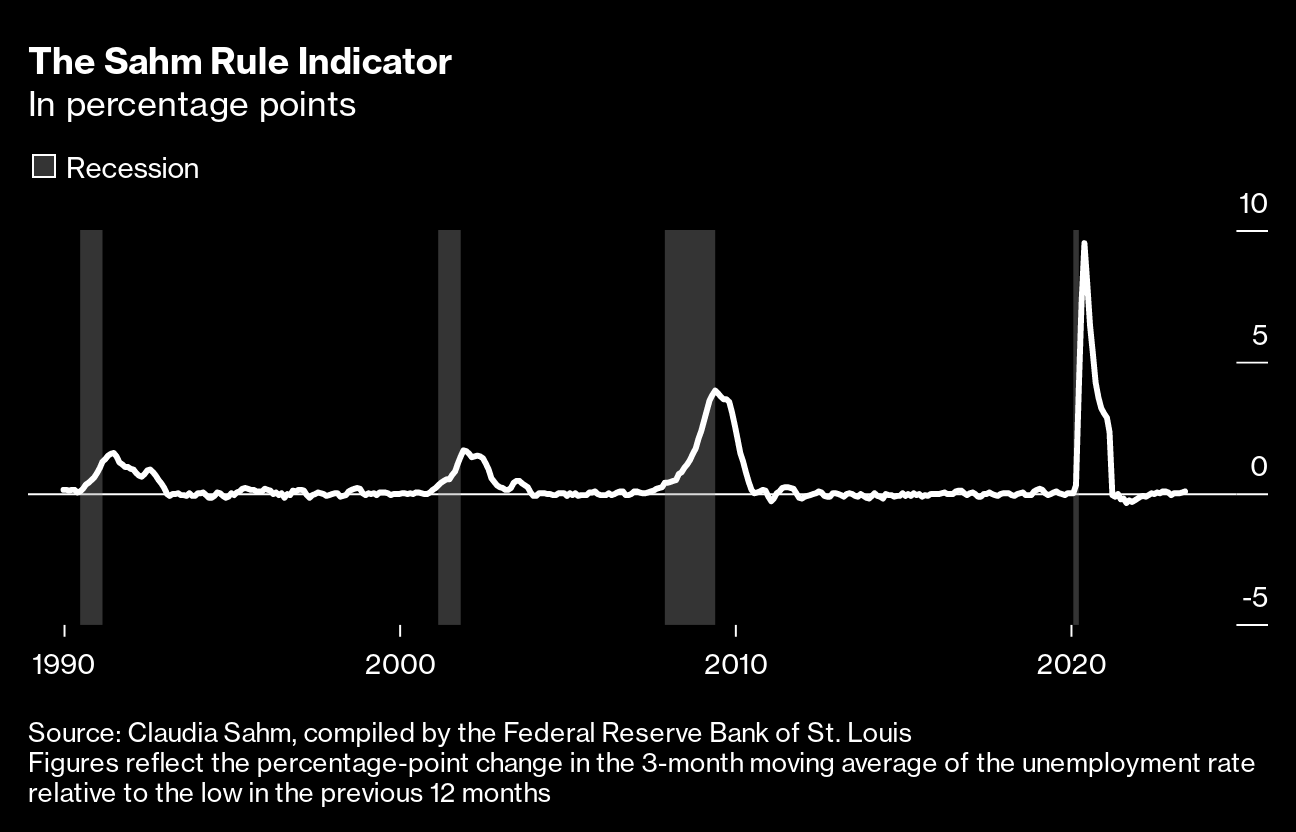

It holds that the economy is contracting when the three-month moving average of the unemployment rate rises by 0.5% relative to the low point during the previous 12 months. Sahm's single-variable formula is the closest there is to a real-time recession monitor. By comparison, the eight-person committee at the National Bureau of Economic Research that's officially in charge of determining the start and end of a downturn considers at least half a dozen indicators and typically takes about a year to make a call. (Even with scattered signs the job market is cooling, the chart below shows that as of June, Sahm's indicator was nowhere near the threshold.)

Now, as the US continues to defy forecasts for a steep downturn, the Sahm Rule has never seemed more relevant—yet its namesake rues all the attention. (An item she published in December as part of her newsletter was titled “I Created a Monster.”)

“If it was ever going to break it would be now, and I would be so happy to see it break,” says Sahm, 47. “I would love it to trigger and there not to be a recession.” Her point being that if unemployment was to modestly increase without a broader recession being created, Sahm would be fine with that. “I won't be sad. I would be a lot more sad if the economy goes down.”

“The whole point of it was ‘OK we need to get people help,' because if you can get in at the beginning of a recession you can do so much to soften the blow,” she says.

Sahm is among the small but growing number of economists who believe the US is headed for a soft landing—meaning the Federal Reserve's barrage of interest-rate hikes will succeed in subduing inflation without a recession that causes unemployment to spike.

Sahm says there's never been a more pressing time for economists to be humble. (One could indeed describe forecasters' incredible string of misses over the past few years as humbling.) Shocks stemming from the pandemic and Russia's invasion of Ukraine have tested decades of conventional wisdom about how economies function, she says, which is why most in the profession, including central bankers, were caught off guard when inflation reemerged after years of lying dormant.

“Everyone who is a macroeconomist, including myself, has made some very big errors thinking about the economy since the pandemic showed up,” she says. “The world is upside down and backwards, it doesn't make sense.”

Sahm, who's a contributor to Bloomberg Opinion, predicts that like the US inflation crisis of the late 1970s and early '80s, this one will spark years of introspection among economists. “I don't know what it's going to be after this, but it clearly will be a big discussion,” she says. “I would expect lots of papers and books to be written, and, in good macroeconomist style, one will say something totally different from the other.”

As debates on economic policy once confined to academic research papers or the editorial pages of major newspapers have spilled over into Twitter and Substack, views have become more polarized, the discourse more aggressive, Sahm says. That's been especially evident in sparring between those who think it's possible to douse inflation without hammering the labor market and those who think that's a fairy tale.

“It's almost as if the angry macroeconomists need their own Twitter,” says Sahm, who recently returned to the social media platform after a couple of months' hiatus, but only to share her work rather than engage in punchy debates.

It's not as if Sahm has always shied away from controversy. In 2020, some months after leaving the Fed, she published a 6,000-word-plus blog post titled “Economics Is a Disgrace.” She said her profession was rife with racism, sexism and elitism, detracting from the quality of policy advice, and called out some of the field's most prominent academics.

After 12 years at the Fed and a stint as a member of President Barack Obama's Council of Economic Advisers, Sahm landed at the Center for Equitable Growth, a left-leaning think tank in Washington where she was director of macroeconomic policy. She quit in October 2020 and now runs her own consulting firm from her home in Arlington, Virginia.

Sahm says she was drawn to economics by a desire to shape public policy. After graduating from Denison University and earning a Ph.D. from the University of Michigan, she acted on a mentor's advice and applied for a job at the Fed in Washington, where she stayed until 2019.

“Honestly, I was a little surprised that I ended up at the Fed,” she says. “I always thought of policy more in fiscal policy and that kind of space. But I very much enjoyed it. The Fed was an excellent education on how to be a macroeconomist.” While at the Fed, Sahm published research on the importance of sending direct payments to households early in a recession to mitigate its impact, an approach that was pursued by the Trump administration during the pandemic-triggered slump.

But her sojourn at the central bank wasn't always smooth, and Sahm says she experienced a culture that needed a radical shake-up both in its composition and its attitudes toward minorities.

While Sahm says the institution has come a long way, she was among the early battlers for diversity and inclusion. The appointment of Janet Yellen as Fed chair in 2014 ushered in a change of attitude and structures to ensure the Fed's staff and policymaking more closely reflected the population at large, Sahm says.

Yellen made history as the first woman to chair the Fed. Her successor, Jerome Powell, is attempting to pull off another first: tackling a cost-of-living crisis without sending unemployment soaring. (Joblessness rose to almost 11% under Paul Volcker, who became a legend by extricating the country from runaway price increases.)

Get it right, and economics textbooks will be rewritten. Get it wrong, and the credibility of the central bank will be damaged and the US economy doomed to stagflation, a combination of weak growth and high inflation.

“I absolutely disagree with the statement that we need a recession to get inflation down,” Sahm says. “We may end up with a recession because the Fed is really going at it, and a recession probably would bring down inflation, but I don't see a sufficiently good argument about why we should just expect a recession versus, you know, we might get through this.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.