Shares of Zomato Ltd. regained their Rs 1 lakh crore market cap after hitting a 52-week high on Monday as analysts hiked the target price, citing better revenue growth in Blinkit and an 18-fold jump in profit sequentially.

The Gurugram-based company's net profit jumped 1700% to Rs 36 crore in the quarter ended September, according to an exchange filing. Analysts polled by Bloomberg estimated net profit at Rs 13.8 crore.

Zomato Q2 FY24 Earnings Highlights (Consolidated, QoQ)

Revenue up 17.9% at Rs 2,848 crore. (Bloomberg estimate: Rs 2,559.3 crore).

Ebitda loss at Rs 47 crore vs Rs 48 crore.

Net profit up 1700% at Rs 36 crore. (Bloomberg estimate: Rs 13.8 crore).

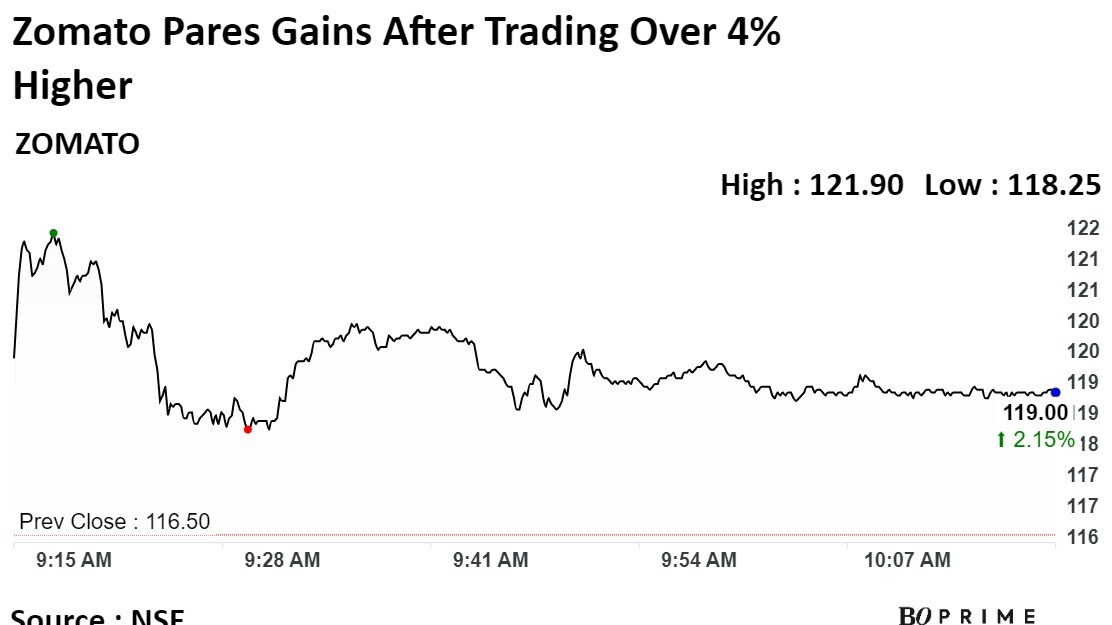

Shares of the company rose as much as 4.7% to Rs 121.95 apiece, to hit a fresh 52-week high. This compares to a 0.6% advance in the benchmark Nifty 50 at 10:30 a.m.

The stock climb also meant that Zomato has now reclaimed Rs 1 lakh crore in market capitalisation, bouncing back to levels it last reached in January 2022.

Here's what analysts made of Zomato's Q2 outing:

Morgan Stanley

Maintains 'overweight' stance, raises target price to Rs 140 from Rs 125 earlier, implying a potential upside of 20%.

Sees platform fee increasing to Rs 5 per order in near term and aid margins.

Anticipates strong revenue growth in Blinkit and better monetisation.

Positive cash generation and strong cash balance would open up possibility of capital return to shareholders.

Raised consolidated Ebitda estimates for FY24-27 by 3-5%, and FY27E multiple raised to 32 times (vs ~30 times earlier).

Nomura

Maintains 'reduce' rating, raises target price to Rs 75 from Rs 60, implying a potential downside of 36%.

Food delivery business growth driven by robust adoption of Gold program.

Estimates 24.5% CAGR for food delivery business over FY24-25.

Blinkit returns to strong growth trajectory.

Competitive intensity slowed in quick commerce.

Key risks: Stronger-than-expected gross order value growth of food delivery business; quicker breakeven in quick commerce.

CLSA

Rating upgraded from 'outperform' to 'buy', target price hiked from Rs 120 to Rs 168, with 44% upside.

Substantial growth potential in monthly transacting customers.

Forecasts food delivery monthly transacting users to rise to 2.6 crore in FY25.

Large growth runway for quick commerce segment.

Forecasts Blinkit to turn Ebitda positive in FY25.

Jefferies

Maintains 'buy' rating, raises target price to Rs 165 from Rs 130, implying a potential upside of 53%.

Blinkit achieved contribution breakeven, a key positive, on the back of increasing takerates and scale efficiencies.

Despite the growth focus, margins continued to inch-up albeit at a gradual pace.

Unit economics to steadily improve with scale, as Zomato unlocks cost efficiencies and as customer willingness to pay for convenience increases.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.