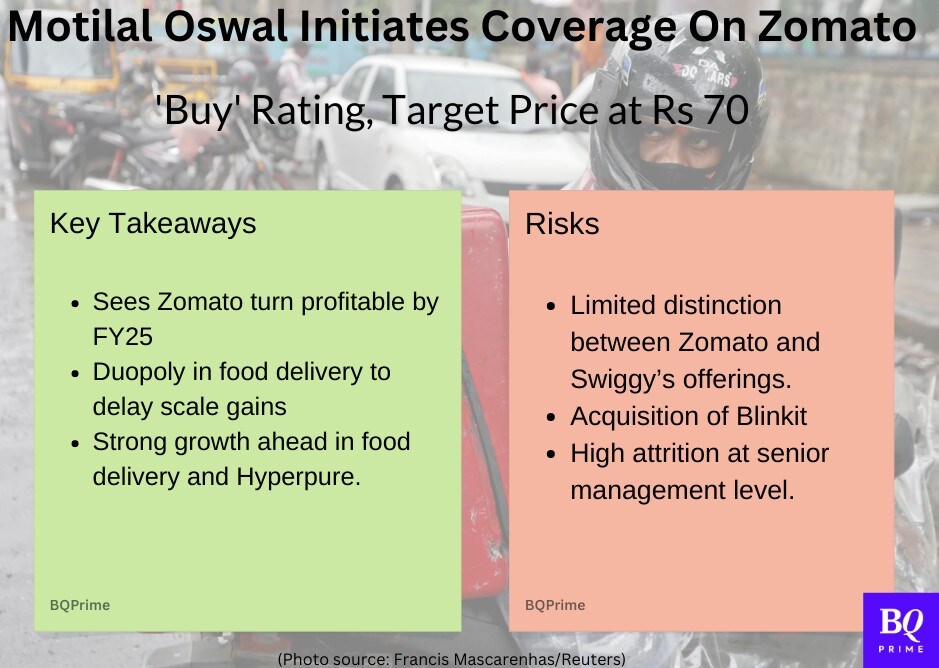

Motilal Oswal Financial Services Ltd. has initiated coverage on Zomato Ltd. with a 'buy' rating, expecting strong growth to be complemented by the company turning profitable over FY25, despite elevated competitive intensity.

According to the brokerage, India's food delivery industry is set to grow rapidly in the medium term, driven by intensifying internet penetration, rising consumption, and urbanisation. "Zomato is a dominant player in the industry, and we forecast the company to report a 29% revenue CAGR over FY23–25."

With Zomato's food business recording breakeven Ebitda in Q1 FY23, Motilal expects the company to turn profitable over FY25. "Continued spending due to elevated competitive intensity from Swiggy should weigh on Zomato's operating costs in FY24, making it difficult to breakeven."

With the exit of Amazon from food delivery, the market is now a settled duopoly with Zomato (55% market share) and Swiggy (49%). "The market has a very high moat, given the significant capital requirement to displace the incumbents," the brokerage said.

It set a target price of Rs 70 per share for the Gurugram-based food delivery app, implying a potential upside of 30% from current levels.

Among the risks, Motilal said the limited distinction between Zomato and Swiggy's offerings—both having food delivery, dine-in, and quick commerce—is a concern. "A split market without a clear leader would hit margins due to the absence of efficiency gains from order bunching. We see a contribution margin of 5.6% of GOV in FY25E for Zomato, versus its medium-term target of 8.0%."

It also said the acquisition of Blinkit is an additional risk, as India's quick commerce industry is nascent and high attrition at senior management level remains a concern.

Of the 27 analysts tracking the company, 21 maintain a 'buy,' three suggest a hold,' and three recommend a 'sell,' according to Bloomberg data. The 12-month consensus price target implies an upside of 40.2%.

Shares of the company traded about 1.1% lower at Rs 53.24 apiece, around 10 a.m. on Monday, compared to a 1.5% decline in the S&P BSE Sensex.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.