Even though it is more than two years since the Reserve Bank of India deregulated interest rates on savings deposits, most banks still offer around 4 per cent. Some banks offer higher interest rates on savings accounts but ask for a higher minimum deposit.

Still, we park a significant proportion of our spare cash in these low-yielding savings accounts, earning much lower rates than the inflation rate.

Liquid funds can help us earn much higher rates than what the savings deposits offer without compromising too much on how quickly we can get our hands on the cash.

What is a liquid fund

Liquid fund is a category of mutual fund which invests primarily in money market instruments like certificate of deposits, treasury bills, commercial papers and term deposits. Lower maturity period of these underlying assets helps a fund manager in meeting the redemption demand from investors.

Benefits of liquid funds

These mutual funds have no lock-in period.

Withdrawals from liquid funds are processed within 24 hours on business days. The cut-off time on withdrawal is generally 2 p.m. on business days. It means if you place a redemption request by 2 p.m. on a business day, then the funds will be credited to your bank account on the next business day by 10 a.m.

Liquid funds have the lowest interest rate risk among debt funds as they primarily invest in fixed income securities with short maturity.

Liquid funds have no entry load and exit loads.

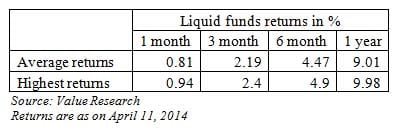

Returns from liquid funds

Liquid funds are among the best investment options for the short term during a high inflation environment. During high inflationary period, the Reserve Bank typically keeps interest rates high and tightens liquidity, helping liquid funds to earn good returns.

During the past year, some liquid funds have even offered higher returns than bank fixed deposits, which levy a penalty on premature withdrawal.

How to choose a liquid fund

The returns from liquid funds don't vary much as they invest in similar underlying securities. However, when looking for a liquid fund, the past return should not be the only factor for consideration. Other factors like size of the fund, credit quality of underlying securities and track record of the fund house should also be kept in mind.

Different plans

Liquid funds come with different plans like growth plans, daily dividend plan, weekly dividend plans and monthly dividend plans. Growth plans don't declare any dividend, and appreciation of fund is reflected in higher unit value.

Investors can choose their plan as per their convenience and liquidity needs. Retail investors can also invest in direct plans as they have a lower expense ratio which helps in getting a higher return.

Taxation

Dividends received under liquid plans are not taxed at the hands of resident individual investors but fund houses pay dividend distribution tax @28.325 per cent (including surcharge and cess).

Individual investors who books gains before a year on their investment in liquid funds are taxed at the same rate as per their income slabs. Interest earned from savings accounts are also taxed at this same rate.

If investors redeem liquid fund units after a year, they have to pay a long-term capital gains tax of 11.33 per cent (including cess and surcharge) or 22.66 per cent with indexation benefit, whichever is lower. This helps in reducing tax outgo for those in higher income tax slabs. Earnings from savings accounts or banks fixed deposits are clubbed to one's income and are taxed at respective slabs.

Disclaimer: The opinions expressed here are the personal opinions of the author. NDTV is not responsible for the accuracy, completeness, suitability or validity of any information given here. All information is provided on an as-is basis. Investors are advised to make their own assessment before acting on the information.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.