Shares of Mphasis are down 4 per cent in the last five days. The stock is also down 40 per cent in 2022.

Why, you may wonder?

The stock has been under pressure for a while now due to a broader decline in IT stocks. The Russia-Ukraine war put global markets under pressure. This fall in global markets also triggered a fall in Indian IT stocks.

However, the company's shares have fallen recently after it reported lower than expected results for the September 2022 quarter.

How did it fare?

Let's find out…

Muted Quarterly Results

Mphasis reported a 16.8 per cent YoY revenue growth in constant currency terms which was lower than analyst expectations. The revenue miss was due to unexpected furlough in a specific client.

However, the impact in rupee terms got adjusted on account of a depreciation in the Indian rupee with respect to the US dollar. It reported a revenue growth of 27 per cent YoY in rupee terms.

The company's growth continued to witness adverse mortgage LOB impact from macro factors (yield volatility), affecting the BFS vertical, while the Insurance business saw a sequential decline.

Due to the increase in revenue, the company's operating profit rose 24.1 per cent YoY. But operating profit margins remained flat at 17.5 per cent as expenses rose.

The management has reiterated its operating profit guidance band of 15.25-17 per cent for the rest of the financial year 2023.

Overall, the company reported net profit growth of 22.5 per cent YoY. Net profit margins came in flat at 11.9 per cent.

Management Commentary

In the latest conference call, the company's management mentioned that it sees strength, not only in deal closures but also in origination.

Mphasis signed contracts worth $302 million taking the total contractual value to $1.3 billion with two large deals of cumulative value of $110 million.

It shared that 3 of 5 NCA (new client acquisitions) verticals have achieved a run rate of $100 million over the last 3 years, and contribute 25 per cent to the direct revenue, indicating client acquisition success.

For verticals such as Insurance, the company will work on creating a few anchor clients within each subsegments such as brokerage, and life, to scale up growth potential.

Mphasis said two-thirds of its clients believe IT services spending may increase in 2023 despite macro headwinds.

Changing deal models may influence outsourcing spends, adding that 65 per cent of customers believe vendor consolidation is a high priority.

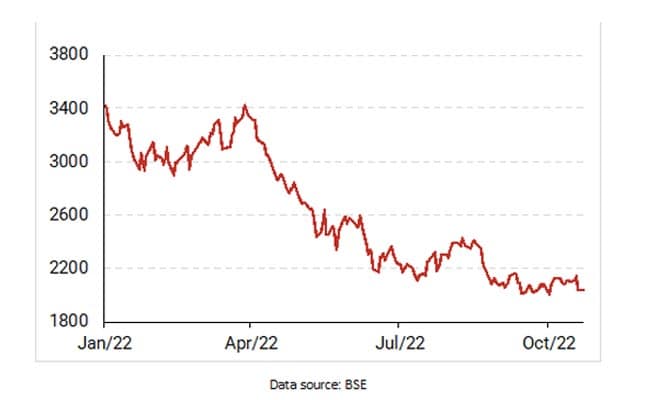

How Mphasis Shares Have Performed Lately

Mphasis shares have declined by 4 per cent in the last five days. The stock is also down 40 per cent in 2022 due to pressure in global markets.

In 2022, Indian IT stocks experienced a sharp correction, partly due to concerns about a prolonged slowdown in US IT spending.

May 2022, in particular, proved to be a bad month for IT stocks. A growing movement of economists have already predicted a global recession within the next 12 months. The Indian market is unlikely to escape these headwinds.

The stock of Mphasis touched its 52-week high of Rs 3,495 on 16 November 2021 and a 52-week low quote of Rs 1,983 on 26 September 2022.

At the current price, Mphasis trades at a PE multiple of 29.6 and a price to book value multiple of 9.2.

Mphasis Share Price In 2022

About Mphasis

Mphasis is a global information technology services company that specialises in application development and maintenance services, along with infrastructure outsourcing services, and business process outsourcing (BPOs) solutions.

The company's core servicing sectors include BFSI, technology and media, and logistics and transportation.

It was once a Hewlett Packard Enterprise subsidiary. However, 56 per cent the company's stake is now held by the global private equity major Blackstone Plc.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.