The floor seemed to have fallen out under the Adanis on November 20. A Federal court in Brooklyn, New York, unsealed an indictment brought by the United States Department of Justice against Gautam Adani, his nephew Sagar Adani and Vneet Jaain, MD & CEO of Adani Green. Five other individuals were charged – executives of US-based Azure Power and of a Canadian institutional investor CDPQ.

The allegations were on five counts:

Conspiracy to violate the US Foreign Corrupt Practices Act

Securities Fraud Conspiracy

Wire Fraud Conspiracy

Securities Fraud – the 2021 144A Bond

Conspiracy to obstruct justice

The Adani Group stocks tanked. Opposition parties began baying for blood. The Kenyan government called off two big ticket infrastructure projects won by the Adani Group. Other governments and clients began to rethink the projects in their home countries that were being implemented by the Adanis. Some investors, like GQG Partners though, dug in their heels and backed the group.

On Wednesday, Adani Green issued a press release. The worst of the charges – that of conspiracy to violate the FCPA – did not apply to Gautam Adani, Sagar Adani or to Vneet Jaain.

Neither were they facing any charges of conspiracy to obstruct justice.

The stock markets took heart and a number of Adani Group companies hit the upper circuit. The run-up has been strong for two days in a row. Senior Supreme Court advocates, large institutional investors and global funds began to reiterate their faith in the Adani Group.

The Opposition though continues to rock Parliament with demands for a discussion over the Adani issue, as they call it.

But what is the ‘Adani issue'?

The Grand Jury

The American justice system has a peculiar inheritance from the British – the notion of a Grand Jury. The British themselves got rid of it in 1948 but Americans hold on to it. In theory, a Grand Jury is a protection to ensure that an innocent person does not face unnecessary prosecution.

It is a jury selected by the Prosecution, with the government advocate presenting their case and asking that the jury allow the individual in question to be charged. There are no defendants present. Defense lawyers do not make their case – that happens only during the trial.

“Grand juries almost always indict a person,” said Jai Anant Dehadrai, Supreme Court lawyer who is also well versed in American jurisprudence. “The prosecutor presents the case. The jury returns the indictment because they are all laypersons and do not understand the laws. There is no one from the defense to rebut the prosecution's claims,” he explained.

An indictment is equivalent to a chargesheet in India. It usually contains all the key evidence unearthed by the prosecutor. More on that later.

Wire Fraud?

Let us turn our attention to the three charges that have been filed against the Adanis and Jaain.

Wire fraud, under American law, is the use of electronic or interstate communications to intentionally defraud someone or cause them harm.

According to the indictment, the Adanis and Jaain raised funds from US investors without disclosing an alleged “bribery scheme” in India. This is the sum and substance for the charge of Wire Fraud.

"This claim is fundamentally flawed for two reasons,” said lawyer Dehadrai. “The US Court of Appeals for the Eleventh Circuit, in United States v. Takhalov, provides a clear precedent for understanding the limits of Wire Fraud. A defendant cannot be convicted of Wire Fraud based solely on misrepresentations amounting to deceit. Also, for Wire Fraud to exist, there must be an intent to harm the victim in a way that fundamentally affects the nature of the bargain. If the alleged victims receive what they paid for, even in the presence of lies, a conviction cannot stand,” he explained.

What does this mean?

The judgement of the Appeals Court explains it well with an example.

“Now imagine another, more common scenario: a young woman asks a rich businessman to buy her a drink at Bob's Bar. The businessman buys the drink, and afterwards the young woman decides to leave. Did the man get what he bargained for? Yes. He received his drink, and he had the opportunity to buy a young woman a drink. Does it change things if the woman is Bob's sister and he paid her to recruit customers? No; regardless of Bob's relationship with the woman, the businessman got exactly what he bargained for. If, on the other hand, Bob promised to pour the man a glass of Pappy Van Winkle but gave him a slug of Old Crow instead, well, that would be fraud. Why? Because the misrepresentation goes to the value of the bargain.”

“There has to be a proximity between fraudulent action and loss suffered for Wire Fraud to be applicable,” said Dehadrai. “This charge is so ridiculous and remote that no jury in America will ever return a guilty verdict.”

Dehadrai gives a further example to illustrate the point. “Let us say I am a legitimately large enterprise with huge solar farms in India. I go to American investment firms and borrow money to grow my business. Can I predict that some employee may bribe a local SHO somewhere in my company? And should I disclose to my investors in the US that such an incident may happen even before the incident occurs? That is what the DoJ wants the Adanis to do. It is nothing short of ludicrous.”

At the heart of the argument is the fact that the US investors in Adani Green's $2 billion bond did not lose even a cent of the money they had invested. The allegation of fraud collapses like a house of cards.

Securities Fraud?

Securities fraud in the US refers to “accounting fraud at publicly traded companies, insider trading, false statements, market manipulation, and other schemes.”

But when no one has been defrauded, how would a section on fraud apply at all? It is a stretch of the imagination to state that an alleged bribery scheme in a foreign country (India) could amount to defrauding US investors. Especially when the US investors have lost no money in the bargain.

The Indictment

An indictment, as mentioned earlier, usually contains all the key details unearthed by the prosecution. But a simple reading of the alleged messages on the phones and emails of the Adanis and Jaain show that the prosecution is clutching at straws.

One example is that of a message allegedly sent by Sagar Adani to Gautam Adani in which he says – Azure Power “has finally submitted letter to SECI today... Will follow for next steps closely.” The indictment makes this routine message sound somehow ominous and sensational.

The indictment does not provide any proof of any bribe having been paid to any official or individual. The allegations are that of agreeing to pay a bribe.

The question of a bribe being paid for this particular project is, in itself, suspect. The financials simply do not make sense.

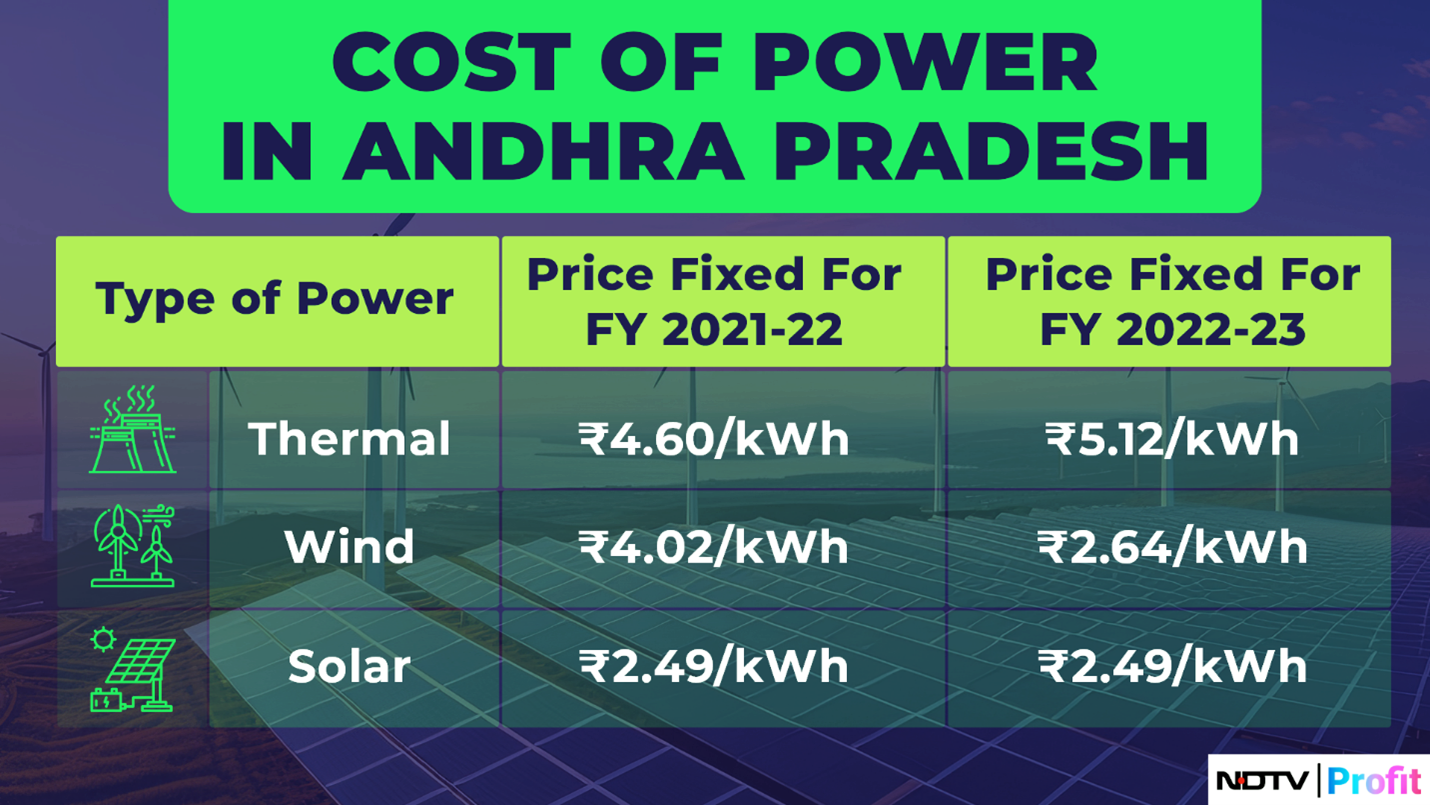

Take Andhra Pradesh for instance. In fiscal 2021-22, when the alleged bribe was offered, the Andhra state power regulator had fixed the price of thermal power purchased by the government at Rs 4.60 per kWh (kilowatt hours). For fiscal 2022-23, the price was fixed at Rs 5.12/kwH.

Wind power was fixed at Rs 4.02/kWh for fiscal 2021-22 and Rs 2.64/kWh for the fiscal 2022-23.

Solar power offered by the Solar Energy Corporation of India (SECI) was the cheapest at Rs 2.49/kWh. It was, in fact, 2 paise less than what Adani Green had quoted to the SECI.

Cost of power in Andhra Pradesh.

Corruption in power deals usually enters the fray when the cost of power is high. In this case, why bribe an official to buy the cheapest power which came with battery installations to store it too? Logic takes a backseat in this case.

The final word comes from the Vice President-elect of the United States JD Vance himself. In February, Vance had written to the SEC, the American equivalent of SEBI, calling them out on an enforcement case in which false statements were used as the basis to freeze bank accounts and assets of a cryptocurrency platform. “It is unconscionable that any federal agency… could operate in such an unethical and unprofessional manner,” Vance wrote in that letter.

The US DoJ under the Biden administration has been under a cloud for some time now. Their latest salvo at the Adanis has all the hallmarks of agenda-driven persecution.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.